Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AMERCO, the holding company for U-Haul International, Inc., included the following note in its annual report for the fiscal year ended on March 31,

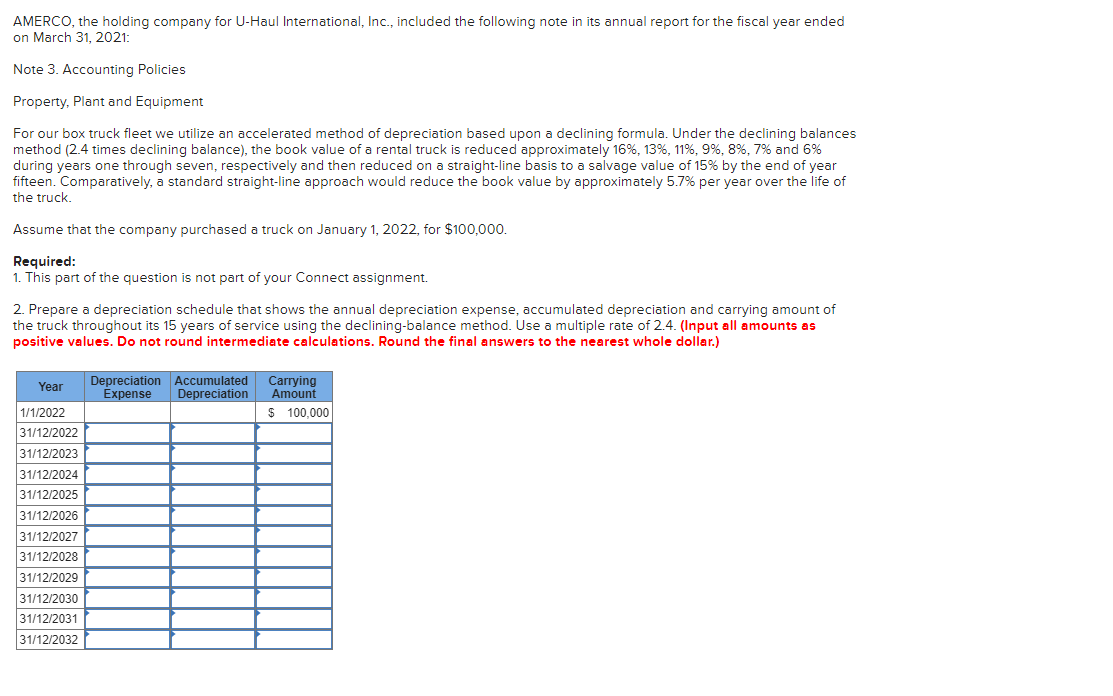

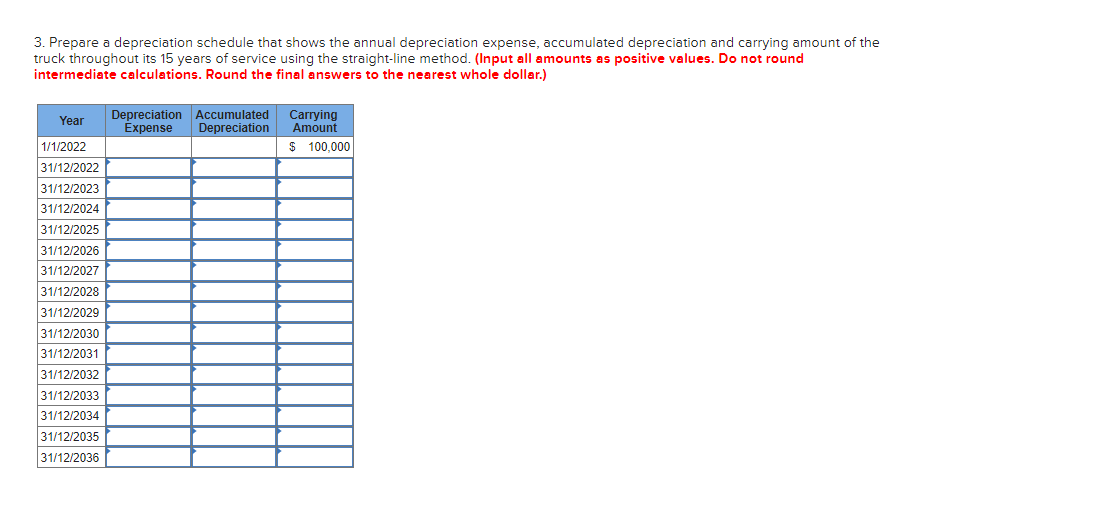

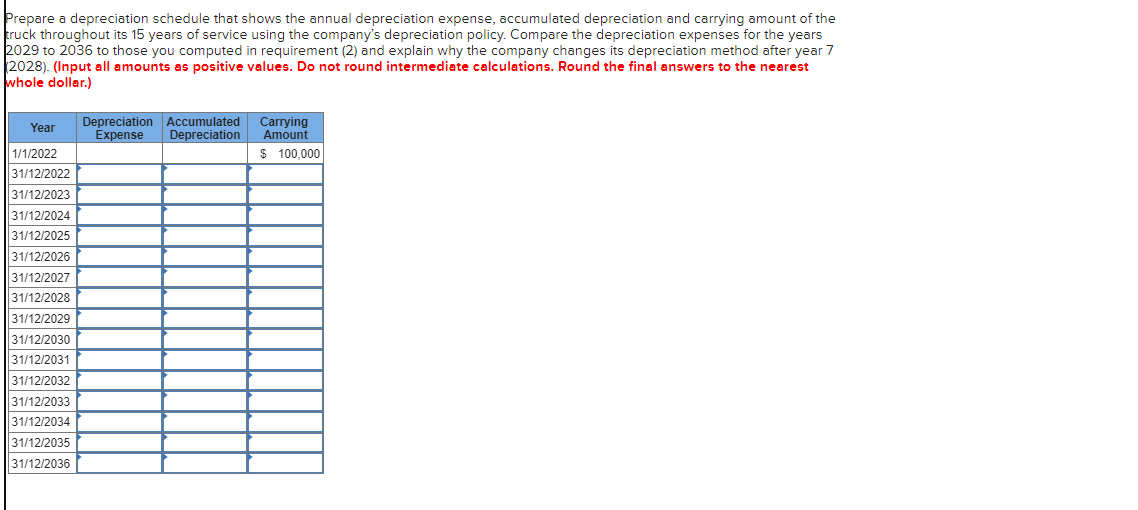

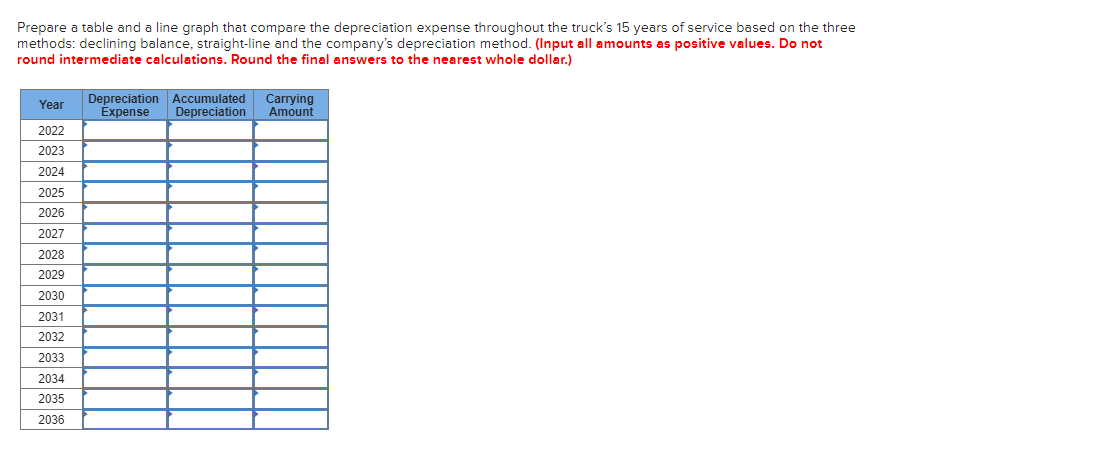

AMERCO, the holding company for U-Haul International, Inc., included the following note in its annual report for the fiscal year ended on March 31, 2021: Note 3. Accounting Policies Property, Plant and Equipment For our box truck fleet we utilize an accelerated method of depreciation based upon a declining formula. Under the declining balances method (2.4 times declining balance), the book value of a rental truck is reduced approximately 16%, 13 % , 11%, 9%, 8%, 7% and 6% during years one through seven, respectively and then reduced on a straight-line basis to a salvage value of 15% by the end of year fifteen. Comparatively, a standard straight-line approach would reduce the book value by approximately 5.7% per year over the life of the truck. Assume that the company purchased a truck on January 1, 2022, for $100,000. Required: 1. This part of the question is not part of your Connect assignment. 2. Prepare a depreciation schedule that shows the annual depreciation expense, accumulated depreciation and carrying amount of the truck throughout its 15 years of service using the declining-balance method. Use a multiple rate of 2.4. (Input all amounts as positive values. Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Year 1/1/2022 31/12/2022 31/12/2023 31/12/2024 31/12/2025 31/12/2026 31/12/2027 31/12/2028 31/12/2029 31/12/2030 31/12/2031 31/12/2032 Depreciation Accumulated Carrying Expense Depreciation Amount $ 100,000 3. Prepare a depreciation schedule that shows the annual depreciation expense, accumulated depreciation and carrying amount of the truck throughout its 15 years of service using the straight-line method. (Input all amounts as positive values. Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Year Depreciation Accumulated Carrying Expense Depreciation Amount $ 100,000 1/1/2022 31/12/2022 31/12/2023 31/12/2024 31/12/2025 31/12/2026 31/12/2027 31/12/2028 31/12/2029 31/12/2030 31/12/2031 31/12/2032 31/12/2033 31/12/2034 31/12/2035 31/12/2036 Prepare a depreciation schedule that shows the annual depreciation expense, accumulated depreciation and carrying amount of the truck throughout its 15 years of service using the company's depreciation policy. Compare the depreciation expenses for the years 2029 to 2036 to those you computed in requirement (2) and explain why the company changes its depreciation method after year 7 (2028). (Input all amounts as positive values. Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Year 1/1/2022 31/12/2022 31/12/2023 31/12/2024 31/12/2025 31/12/2026 31/12/2027 31/12/2028 31/12/2029 31/12/2030 31/12/2031 31/12/2032 31/12/2033 31/12/2034 31/12/2035 31/12/2036 Depreciation Accumulated Carrying Expense Depreciation Amount $ 100,000 Prepare a table and a line graph that compare the depreciation expense throughout the truck's 15 years of service based on the three methods: declining balance, straight-line and the company's depreciation method. (Input all amounts as positive values. Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Year Depreciation Accumulated Expense Depreciation 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 Carrying Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the depreciation schedule using the decliningbalance method with a multiple rate of 24 we will calculate the annual depreciation expense accumulated depreciation and carrying amount for eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started