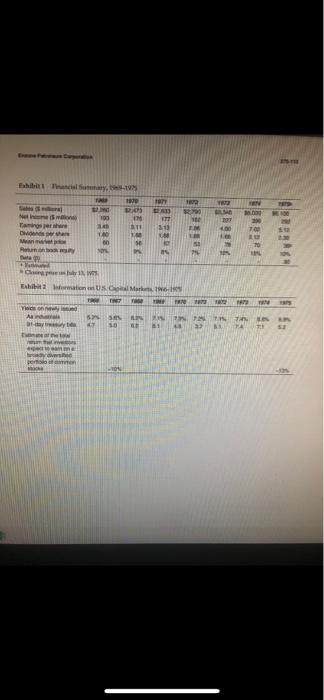

Enzone Petroleum Corporation One of the cetical problema confronting management and the hay 1975 was determining a ninamum eptable te of hum this question hed bom onder dacusion within the company for s involved had been unable to age even on what emeral conop should be adopted. They were about evenly dividest between ing company's overal weighted average cost of capital or uning reflect the sk-prolit dhuracteristics of the several business company te In early 1975 was asked of single follow in the future. The eonell i hadi growie and to recommend which approach to extend the use of the management planned to evaluate deduction of a charge bor capital s Company Background En fiome operating in the Following 50 years, the and marketing refined petroleum este developesest The city operating sidiaries working in each de production capasty with the need teen poe Titel pendan susiy prot of Enn P corpuste porning and Y prochemicals. Everybody Marghery p romic sectos the hoend med inovased importance the evaluation of ing bional managers on the h by the divis fts when the tiem wamed in 1934 with the merger of seva formerly independent refing, popeline transportation, and trial chemical fele Othe plation and production t Agricheals tally way deberaten and stewion among dampen o ating meded $6 bin in 1974 and abos 500 millam a your in sector de Ed operation) hefteding had leerd hand that masser ped sit by chemical that, so the vening the de Enomes dimenticce 100% Although managment was snible to decide whether the company should ile to at the company had tentatively worked with a single opt 10 years. The company's he capital bulging apprend during the pidh proposed investors with a prave ret g weighted average of capital at the company Past Experience with Discounting Cost of Capital The mat had be fund proport fapital discount ate and in the above e pe vale 10% in 1966 Fist fatur funds suces Second, on had! signed wwighted average cost of capital had been calis Finally, this weighted average had been added t earned on a sustantial proportion of the company Tablea Management had reached a com been add that funded des should funded det phas book nuity) in markets. This policy had been or fencing pins yicha cual shale Argus had developed on the ghti aigh benkerhal kenant early in 1966 that ng tinata fin dute e equity debate decided to tandings Advocates pils at least this refere and market price a Table A C Capd dou 196 De ch hand Propuntione ma pi management h First, they stined the spent bades spoke a les had wh expany ty sos Klaskan priguatin P PAT C ng p Weight Col Proposing a Multiple Cutoff Rate angle in the The specific alemathe peopoend by the sporters of multiple cutoff rates in l company wide rate involved determining several as besed on the end of capital in each of the economic sectors or industries i e company's principal operating worked Weighted average cost of capital cat s would be desemined for the compar and marketing chemicals, and real 18%, 18%, 10% estale, The sun was that these ma on proposed capitalistments in present industry, as well as for its plastics industrial chemicals, agricultura dari apating outside the nday. For example of a respectively, were proposed t aportation par All c the production exploration, chem, ther rates proposed tell within this cutoff at denne the minimum acceptable main operating at the company, an well as capital imped It was proposed that the weighdeacost I capital in much persing be developed as follows First an estimate wedd male al debt and equity prop independently fenced fi operating in each sector Seveal sach independers competed again each the affilates wold etimal code with the capital in the past Thind the co would be cool determine the weighted average cod ating purposes These le handle. chad been calculated to several penods in s ariably turned - that the wande weighted according to s relative diferential described a fact that the sa dvendication benefits of any dectie Trame imprie setting lygtede end some a well as important cap market of de vertically grated parts e emple, the k m were d identical be that the indard fo davus) selallindii betw mpact d wattle We help of Reaching a Deci In es began meiteneats, aceptab the Tow 15-112 need that whest option the compre effectively capital Fetherma fonds in the highest retam projects available. They hacking mille rate wem those that were unabl measured against the corporate group's acad.com the categories suggested by the advocates of multiple rates aconding to their riskiress. For example, experience with companies and yet tarker investments would inituted by therefore he seed to tomportation turalistically low hurdle nate Agint this, the proponents poined out again that if the prent company was serion about o run in industries with such disparate tak poolt character essential to relate internal target cates of return to these cecumstan that the final chce between single veras multiple cotoff exten har orging prisch JIC Ex Copert Exhibit Fancial Suary, 15 TAIP 1970 20 12425 Saraj Net nem Tamings per share 103 340 311 PHOT 1 hun 13 Exhibit Information on US Capital Markets 16-18 Yids on newly 5.24 SAS RP 55 47 50 81 ** 1977 1802 1872 Ju NA NA 1970 7873 1872 1979 75 75 75 in in AR 32 B.A. 53 789 *YA AGBERS P.A.E. Temal Enzone Petroleum Case 1. In 1975, what single corporate-wide WACC did Enzone plan to use? Is this number correct? Criticize (a) the numbers, and, (b) any wrong valuation models that were used for finding the costs of debt and equity in the calculation of this number You will, of course, need to calculate the CORRECT WACC spuit of your answer 2. How would the continued use of a single corporate-wide WACC hurt Enzone's profitability and its competitiveness Discuss this fully, wroiding jargon as much as possible and using a graph to make your cane 3. Carefully explain why there is resistance from some divisions to the proposal to shift to a multiple hundle rate system? Explain this resistance in terms of agency conflicts between the managers and stockholders 4. Critically evaluate the arguments posed by the officers of the competing operating subsidiaries that are contained in the two text paragraphs that end the cate. Use your knowledge of finance as well as basic logic (informal fallacies in reasoning) in this critical evaluation O Enzone Petroleum Corporation One of the cetical problema confronting management and the hay 1975 was determining a ninamum eptable te of hum this question hed bom onder dacusion within the company for s involved had been unable to age even on what emeral conop should be adopted. They were about evenly dividest between ing company's overal weighted average cost of capital or uning reflect the sk-prolit dhuracteristics of the several business company te In early 1975 was asked of single follow in the future. The eonell i hadi growie and to recommend which approach to extend the use of the management planned to evaluate deduction of a charge bor capital s Company Background En fiome operating in the Following 50 years, the and marketing refined petroleum este developesest The city operating sidiaries working in each de production capasty with the need teen poe Titel pendan susiy prot of Enn P corpuste porning and Y prochemicals. Everybody Marghery p romic sectos the hoend med inovased importance the evaluation of ing bional managers on the h by the divis fts when the tiem wamed in 1934 with the merger of seva formerly independent refing, popeline transportation, and trial chemical fele Othe plation and production t Agricheals tally way deberaten and stewion among dampen o ating meded $6 bin in 1974 and abos 500 millam a your in sector de Ed operation) hefteding had leerd hand that masser ped sit by chemical that, so the vening the de Enomes dimenticce 100% Although managment was snible to decide whether the company should ile to at the company had tentatively worked with a single opt 10 years. The company's he capital bulging apprend during the pidh proposed investors with a prave ret g weighted average of capital at the company Past Experience with Discounting Cost of Capital The mat had be fund proport fapital discount ate and in the above e pe vale 10% in 1966 Fist fatur funds suces Second, on had! signed wwighted average cost of capital had been calis Finally, this weighted average had been added t earned on a sustantial proportion of the company Tablea Management had reached a com been add that funded des should funded det phas book nuity) in markets. This policy had been or fencing pins yicha cual shale Argus had developed on the ghti aigh benkerhal kenant early in 1966 that ng tinata fin dute e equity debate decided to tandings Advocates pils at least this refere and market price a Table A C Capd dou 196 De ch hand Propuntione ma pi management h First, they stined the spent bades spoke a les had wh expany ty sos Klaskan priguatin P PAT C ng p Weight Col Proposing a Multiple Cutoff Rate angle in the The specific alemathe peopoend by the sporters of multiple cutoff rates in l company wide rate involved determining several as besed on the end of capital in each of the economic sectors or industries i e company's principal operating worked Weighted average cost of capital cat s would be desemined for the compar and marketing chemicals, and real 18%, 18%, 10% estale, The sun was that these ma on proposed capitalistments in present industry, as well as for its plastics industrial chemicals, agricultura dari apating outside the nday. For example of a respectively, were proposed t aportation par All c the production exploration, chem, ther rates proposed tell within this cutoff at denne the minimum acceptable main operating at the company, an well as capital imped It was proposed that the weighdeacost I capital in much persing be developed as follows First an estimate wedd male al debt and equity prop independently fenced fi operating in each sector Seveal sach independers competed again each the affilates wold etimal code with the capital in the past Thind the co would be cool determine the weighted average cod ating purposes These le handle. chad been calculated to several penods in s ariably turned - that the wande weighted according to s relative diferential described a fact that the sa dvendication benefits of any dectie Trame imprie setting lygtede end some a well as important cap market of de vertically grated parts e emple, the k m were d identical be that the indard fo davus) selallindii betw mpact d wattle We help of Reaching a Deci In es began meiteneats, aceptab the Tow 15-112 need that whest option the compre effectively capital Fetherma fonds in the highest retam projects available. They hacking mille rate wem those that were unabl measured against the corporate group's acad.com the categories suggested by the advocates of multiple rates aconding to their riskiress. For example, experience with companies and yet tarker investments would inituted by therefore he seed to tomportation turalistically low hurdle nate Agint this, the proponents poined out again that if the prent company was serion about o run in industries with such disparate tak poolt character essential to relate internal target cates of return to these cecumstan that the final chce between single veras multiple cotoff exten har orging prisch JIC Ex Copert Exhibit Fancial Suary, 15 TAIP 1970 20 12425 Saraj Net nem Tamings per share 103 340 311 PHOT 1 hun 13 Exhibit Information on US Capital Markets 16-18 Yids on newly 5.24 SAS RP 55 47 50 81 ** 1977 1802 1872 Ju NA NA 1970 7873 1872 1979 75 75 75 in in AR 32 B.A. 53 789 *YA AGBERS P.A.E. Temal Enzone Petroleum Case 1. In 1975, what single corporate-wide WACC did Enzone plan to use? Is this number correct? Criticize (a) the numbers, and, (b) any wrong valuation models that were used for finding the costs of debt and equity in the calculation of this number You will, of course, need to calculate the CORRECT WACC spuit of your answer 2. How would the continued use of a single corporate-wide WACC hurt Enzone's profitability and its competitiveness Discuss this fully, wroiding jargon as much as possible and using a graph to make your cane 3. Carefully explain why there is resistance from some divisions to the proposal to shift to a multiple hundle rate system? Explain this resistance in terms of agency conflicts between the managers and stockholders 4. Critically evaluate the arguments posed by the officers of the competing operating subsidiaries that are contained in the two text paragraphs that end the cate. Use your knowledge of finance as well as basic logic (informal fallacies in reasoning) in this critical evaluation O