Answered step by step

Verified Expert Solution

Question

1 Approved Answer

eote b) c) d) e) 4) a) b) c) d) e) A client has given you the following financial information for their company XYZ

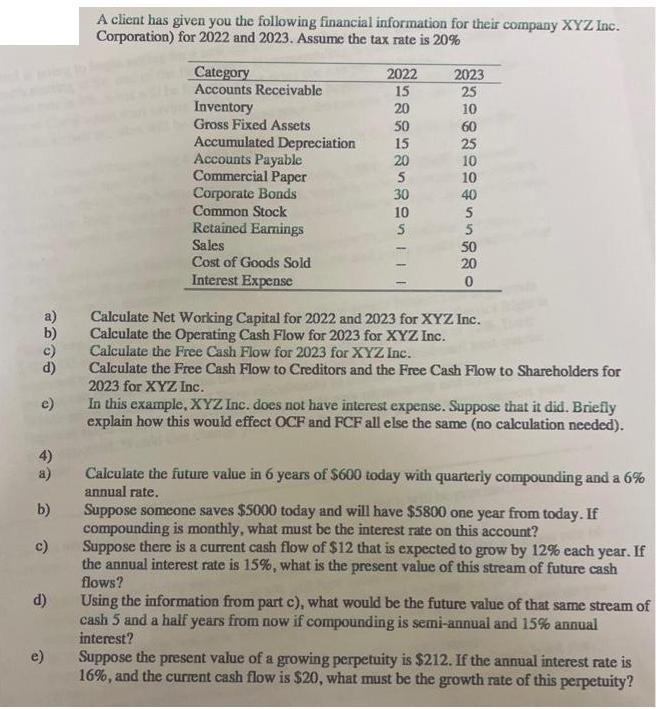

eote b) c) d) e) 4) a) b) c) d) e) A client has given you the following financial information for their company XYZ Inc. Corporation) for 2022 and 2023. Assume the tax rate is 20% Category Accounts Receivable Inventory Gross Fixed Assets Accumulated Depreciation Accounts Payable Commercial Paper Corporate Bonds Common Stock Retained Earnings Sales Cost of Goods Sold Interest Expense 2022 15 20 50 15 20 5 30 10 5 2023 25 10 60 25 10 10 40 5 5 50 20 0 Calculate Net Working Capital for 2022 and 2023 for XYZ Inc. Calculate the Operating Cash Flow for 2023 for XYZ Inc. Calculate the Free Cash Flow for 2023 for XYZ Inc. Calculate the Free Cash Flow to Creditors and the Free Cash Flow to Shareholders for 2023 for XYZ Inc. In this example, XYZ Inc. does not have interest expense. Suppose that it did. Briefly explain how this would effect OCF and FCF all else the same (no calculation needed). Calculate the future value in 6 years of $600 today with quarterly compounding and a 6% annual rate. Suppose someone saves $5000 today and will have $5800 one year from today. If compounding is monthly, what must be the interest rate on this account? Suppose there is a current cash flow of $12 that is expected to grow by 12% each year. If the annual interest rate is 15%, what is the present value of this stream of future cash flows? Using the information from part c), what would be the future value of that same stream of cash 5 and a half years from now if compounding is semi-annual and 15% annual interest? Suppose the present value of a growing perpetuity is $212. If the annual interest rate is 16%, and the current cash flow is $20, what must be the growth rate of this perpetuity?

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 2 a XYZ Incs Net Working Capital for the years 2022 and 2023 is calculated as Current Assets Current Liabilities Net Working Capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started