Answered step by step

Verified Expert Solution

Question

1 Approved Answer

equations help out a lot! thanks I need to calculate the project DCFROR and NPV for a minimum DCFROR of 20% to determine if the

equations help out a lot! thanks

equations help out a lot! thanks

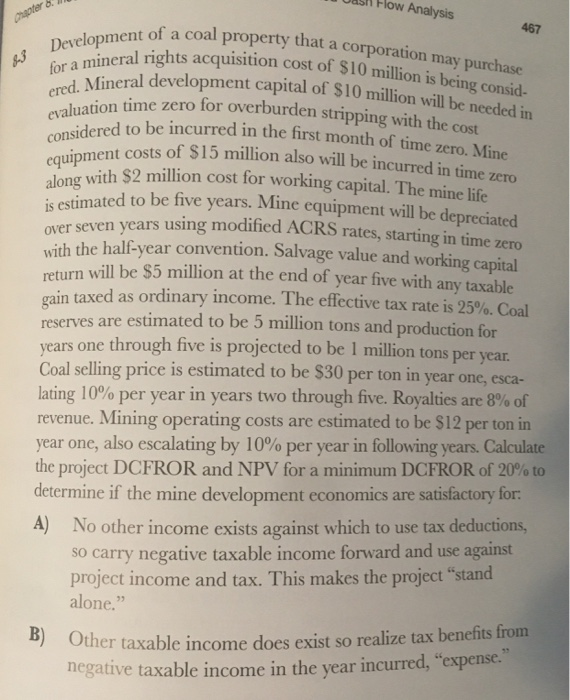

I need to calculate the project DCFROR and NPV for a minimum DCFROR of 20% to determine if the mine development economics are satisfactory for: a) No other income exists against which to use tax deductions, making the project "stand-alone" and b) other taxable income does exist so realize tax benefits from negative taxable income in the year incurred, "expense"

ASA How Analysis ter 8. ll. Development of a coal for a mineral rights acqui ered. Mineral development considered to be incurred in equipment costs of $15 m 467 ot of a coal property that a corporation may al rights acquisition cost of $10 million is being consid. development capital of $10 million will be needed in Wation time zero for overburden stripping with the cost to be incurred in the first month of time zero. Mine ent costs of $15 million also will be incurred in time llion cost for working capital. The mine life along with $2 million cost for working cani mated to be five years. Mine equipment will be depreciated on years using modified ACRS rates, starting in time zero ith the half-year convention. Salvage value and working capital turn will be $5 million at the end of year five with any taxable gain taxed as ordinary income. The effective tax rate is 25%. Coal reserves are estimated to be 5 million tons and production for vears one through five is projected to be 1 million tons per year. Coal selling price is estimated to be $30 per ton in year one, esca- lating 10% per year in years two through five. Royalties are 8% of revenue. Mining operating costs are estimated to be S12 per ton in year one, also escalating by 10% per year in following years. Calculate the project DCFROR and NPV for a minimum DCFROR of 20% to determine if the mine development economics are satisfactory for: A) No other income exists against which to use tax deductions, so carry negative taxable income forward and use against project income and tax. This makes the project "stand alone. B) Other taxable income a er taxable income does exist so realize tax benefits from negative taxable income in the year incurred, "expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started