Answered step by step

Verified Expert Solution

Question

1 Approved Answer

equipment is worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. a. What is the

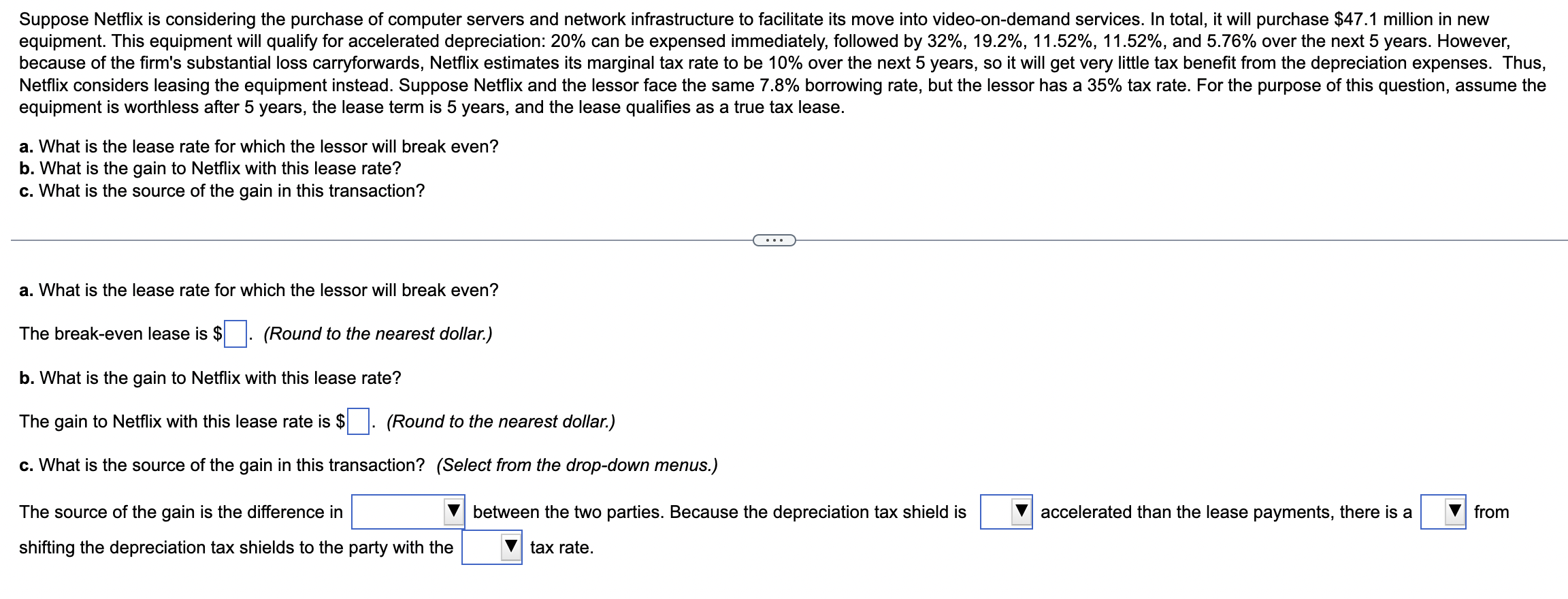

equipment is worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. a. What is the lease rate for which the lessor will break even? b. What is the gain to Netflix with this lease rate? c. What is the source of the gain in this transaction? a. What is the lease rate for which the lessor will break even? The break-even lease is $ (Round to the nearest dollar.) b. What is the gain to Netflix with this lease rate? The gain to Netflix with this lease rate is $. (Round to the nearest dollar.) c. What is the source of the gain in this transaction? (Select from the drop-down menus.) The source of the gain is the difference in shifting the depreciation tax shields to the party with the between the two parties. Because the depreciation tax shield is tax rate. accelerated than the lease payments, there is a from equipment is worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. a. What is the lease rate for which the lessor will break even? b. What is the gain to Netflix with this lease rate? c. What is the source of the gain in this transaction? a. What is the lease rate for which the lessor will break even? The break-even lease is $ (Round to the nearest dollar.) b. What is the gain to Netflix with this lease rate? The gain to Netflix with this lease rate is $. (Round to the nearest dollar.) c. What is the source of the gain in this transaction? (Select from the drop-down menus.) The source of the gain is the difference in shifting the depreciation tax shields to the party with the between the two parties. Because the depreciation tax shield is tax rate. accelerated than the lease payments, there is a from

equipment is worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. a. What is the lease rate for which the lessor will break even? b. What is the gain to Netflix with this lease rate? c. What is the source of the gain in this transaction? a. What is the lease rate for which the lessor will break even? The break-even lease is $ (Round to the nearest dollar.) b. What is the gain to Netflix with this lease rate? The gain to Netflix with this lease rate is $. (Round to the nearest dollar.) c. What is the source of the gain in this transaction? (Select from the drop-down menus.) The source of the gain is the difference in shifting the depreciation tax shields to the party with the between the two parties. Because the depreciation tax shield is tax rate. accelerated than the lease payments, there is a from equipment is worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. a. What is the lease rate for which the lessor will break even? b. What is the gain to Netflix with this lease rate? c. What is the source of the gain in this transaction? a. What is the lease rate for which the lessor will break even? The break-even lease is $ (Round to the nearest dollar.) b. What is the gain to Netflix with this lease rate? The gain to Netflix with this lease rate is $. (Round to the nearest dollar.) c. What is the source of the gain in this transaction? (Select from the drop-down menus.) The source of the gain is the difference in shifting the depreciation tax shields to the party with the between the two parties. Because the depreciation tax shield is tax rate. accelerated than the lease payments, there is a from Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started