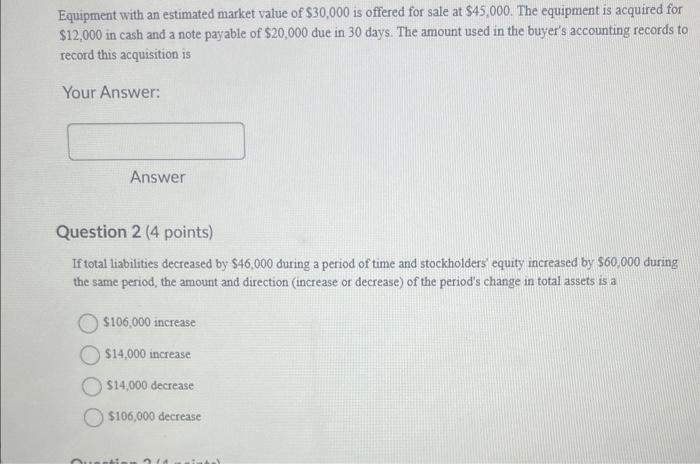

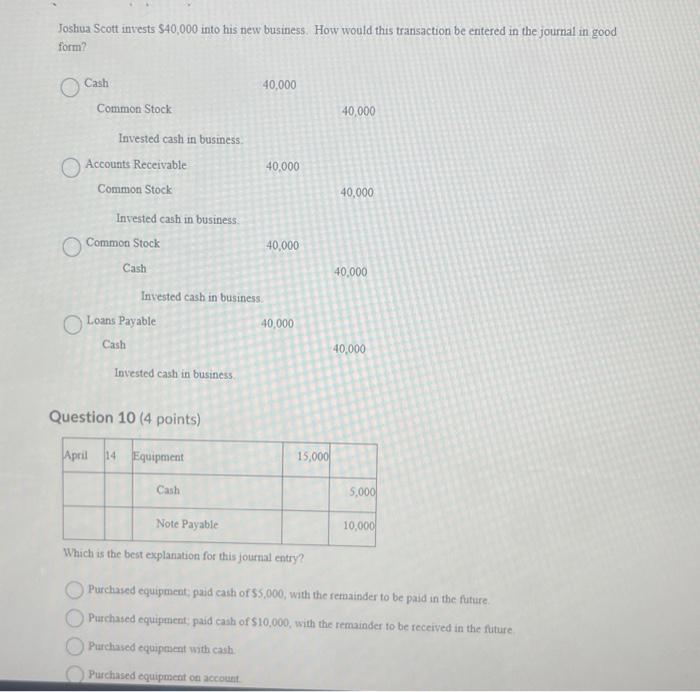

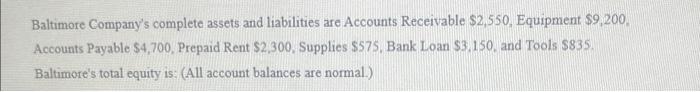

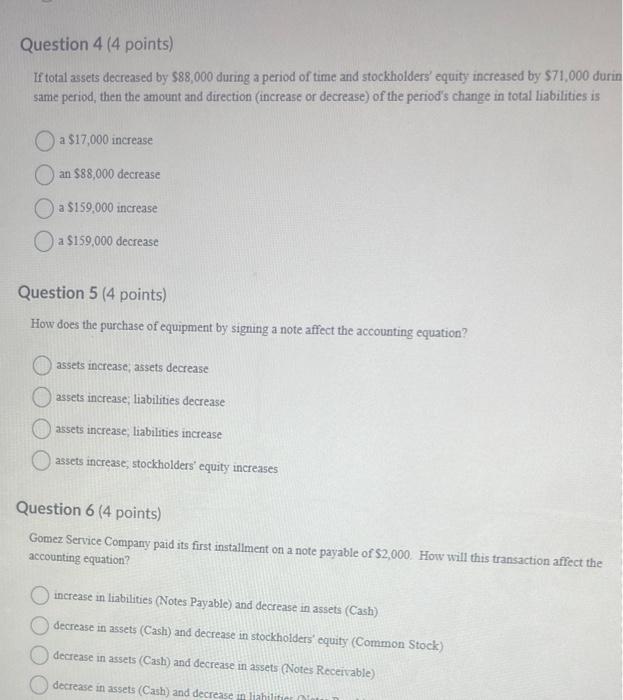

Equipment with an estimated market value of $30,000 is offered for sale at $45,000. The equipment is acquired for $12,000 in cash and a note payable of $20,000 due in 30 days. The amount used in the buyer's accounting records to record this acquisition is Your Answer: Answer Question 2 (4 points) If total liabilities decreased by $46,000 during a period of time and stockholders equity increased by $60,000 during the same period, the amount and direction (increase or decrease) of the period's change in total assets is a $106,000 increase $14,000 increase $14,000 decrease $106,000 decrease Joshua Scott invests $40,000 into his new business. How would this transaction be entered in the journal in good form? Cash Common Stock Invested cash in business. Accounts Receivable Common Stock Invested cash in business: Common Stock 40,000 Cash 40,000 Invested cash in business: Loans Payable 40,000 Cash 40,000 Invested cash in busincss. Question 10 (4 points) Which is the best explanation for this journal entry? Purchased equipment; paid cash of 55,000 , with the remainder to be paid in the future. Purchased equipment; paid cash of $10,000, with the remainder to be received in the future Purchased equipment with cash: Purchased equipmeat on account. Baltimore Company's complete assets and liabilities are Accounts Receivable \$2,550, Equipment \$9,200. Accounts Payable \$4, 700, Prepaid Rent \$2,300, Supplies \$575, Bank Loan \$3, 150, and Tools \$835. Baltimore's total equity is: (All account balances are normal.) If total assets decreased by $88,000 during a period of time and stockholders' equity increased by $71,000 durin same period, then the amount and direction (increase or decrease) of the period's change in total liabilities is a $17,000 increase an $88,000 decrease a $159,000 increase a $159,000 decrease Question 5 (4 points) How does the purchase of equipment by signing a note affect the accounting equation? assets increase; assets decrease assets increase; liabilities decrease assets increase, liabilities increase assets increase; stockholders' equity increases Question 6 (4 points) Gomez Service Company paid its first installment on a note payable of $2,000. How will this transaction affect the accounting equation? increase in liabilities (Notes Payable) and decrease in assets (Cash) decrease in assets (Cash) and decrease in stockholders' equity (Common Stock) decrease in assets (Cash) and decrease in assets (Notes Receivable)