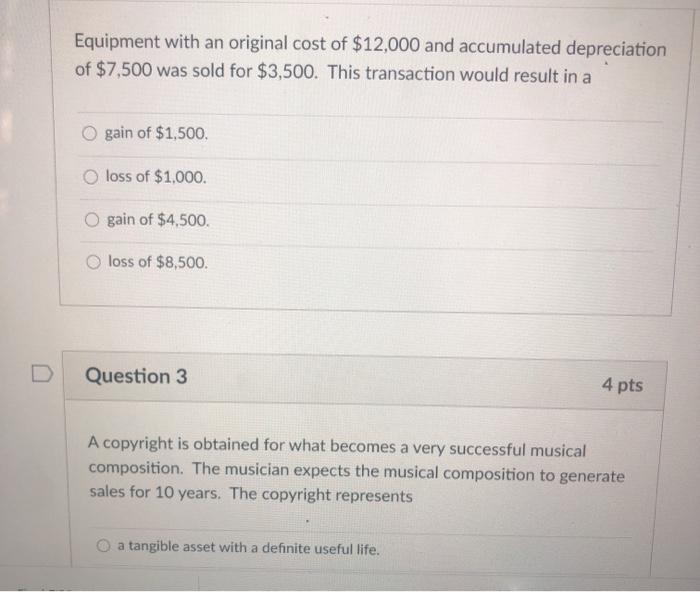

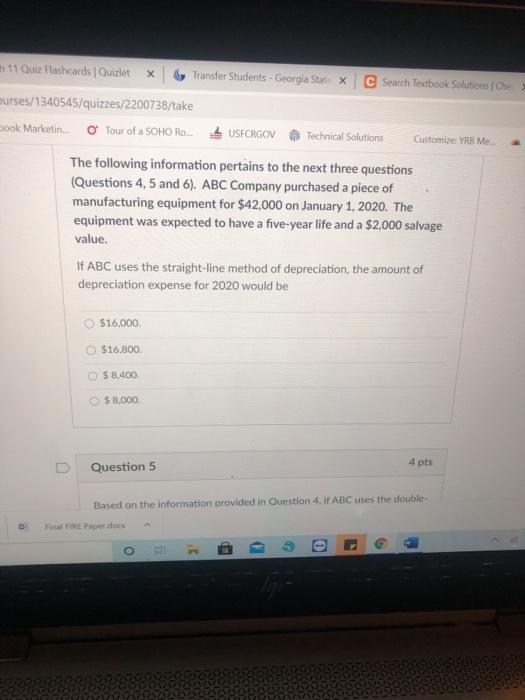

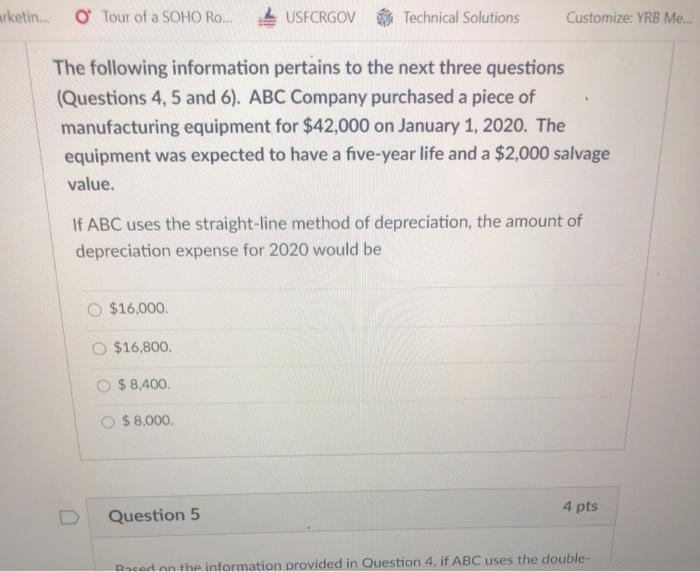

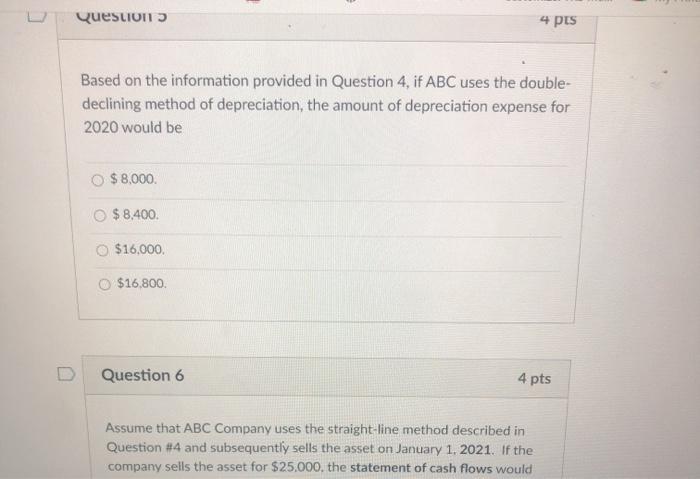

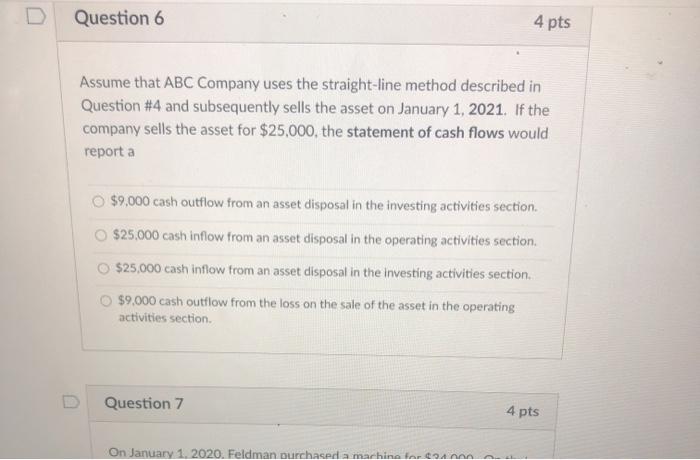

Equipment with an original cost of $12,000 and accumulated depreciation of $7,500 was sold for $3,500. This transaction would result in a gain of $1,500 loss of $1,000 O gain of $4,500 loss of $8,500 Question 3 4 pts A copyright is obtained for what becomes a very successful musical composition. The musician expects the musical composition to generate sales for 10 years. The copyright represents a tangible asset with a definite useful life. 11 Quiz Flashcards | Quizlet X Transfer Students - Georgia Statx Search Textbook Solutions ourses/1340545/quizzes/2200738/take book Marketin. O Tour of a SOHO RO... USECRGOV Technical Solutions Customized: YRB Me The following information pertains to the next three questions (Questions 4, 5 and 6). ABC Company purchased a piece of manufacturing equipment for $42,000 on January 1, 2020. The equipment was expected to have a five-year life and a $2,000 salvage value. If ABC uses the straight-line method of depreciation, the amount of depreciation expense for 2020 would be $16,000 $16,800. $ 8,400 $ 8.000 4 pts Question 5 Based on the information provided in Question 4. If ABC uses the double Fina Rodos - C arketin. O Tour of a SOHO Ro... USECRGOV Technical Solutions Customize: YRB Me... The following information pertains to the next three questions (Questions 4, 5 and 6). ABC Company purchased a piece of manufacturing equipment for $42,000 on January 1, 2020. The equipment was expected to have a five-year life and a $2,000 salvage value. If ABC uses the straight-line method of depreciation, the amount of depreciation expense for 2020 would be $16,000 O $16,800 $ 8,400. $ 8,000. 4 pts Question 5 Recor an the information provided in Ouestion 4. if ABC uses the double- Questions 4 pts Based on the information provided in Question 4, if ABC uses the double- declining method of depreciation, the amount of depreciation expense for 2020 would be $ 8.000 $ 8,400. $16.000 $16,800 Question 6 4 pts Assume that ABC Company uses the straight-line method described in Question #4 and subsequently sells the asset on January 1, 2021. If the company sells the asset for $25.000. the statement of cash flows would Question 6 4 pts Assume that ABC Company uses the straight-line method described in Question #4 and subsequently sells the asset on January 1, 2021. If the company sells the asset for $25,000, the statement of cash flows would report a $9,000 cash outflow from an asset disposal in the investing activities section. $25,000 cash inflow from an asset disposal in the operating activities section $25,000 cash inflow from an asset disposal in the investing activities section. $9,000 cash outflow from the loss on the sale of the asset in the operating activities section Question 7 4 pts On January 1.2020. Feldman purchaedia machine la conna