Note: Today's fictional case takes place during financial statement preparation for the year ended December 31, 2016. For the three years following our prior

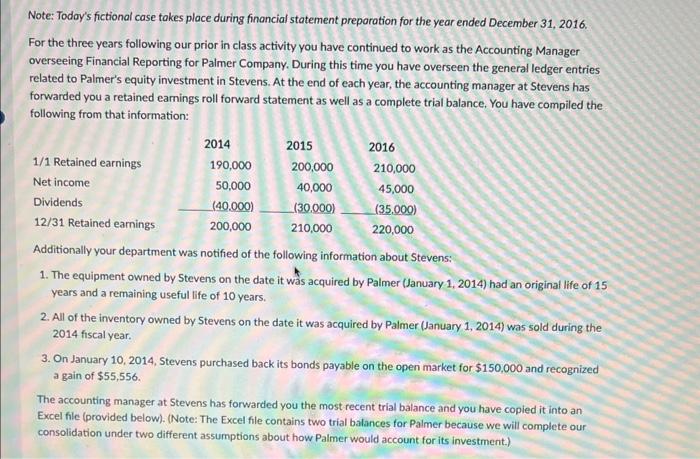

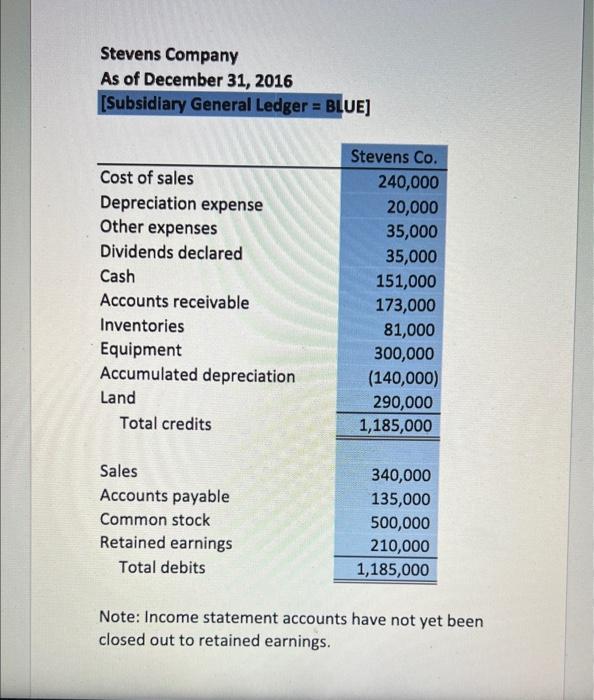

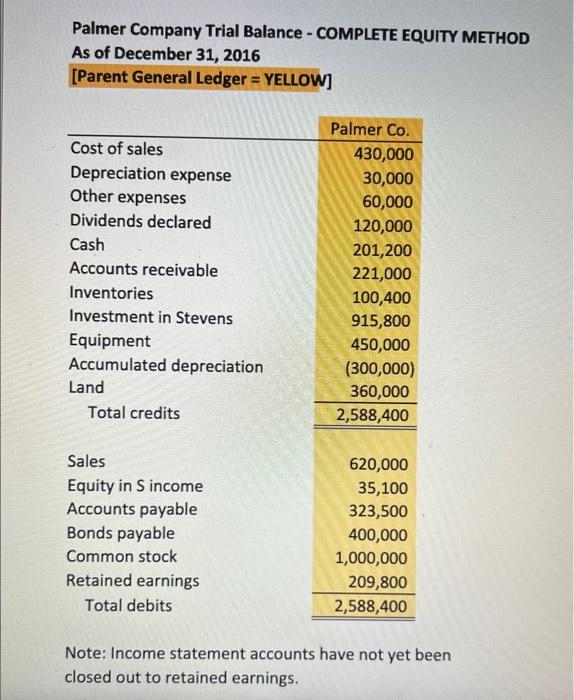

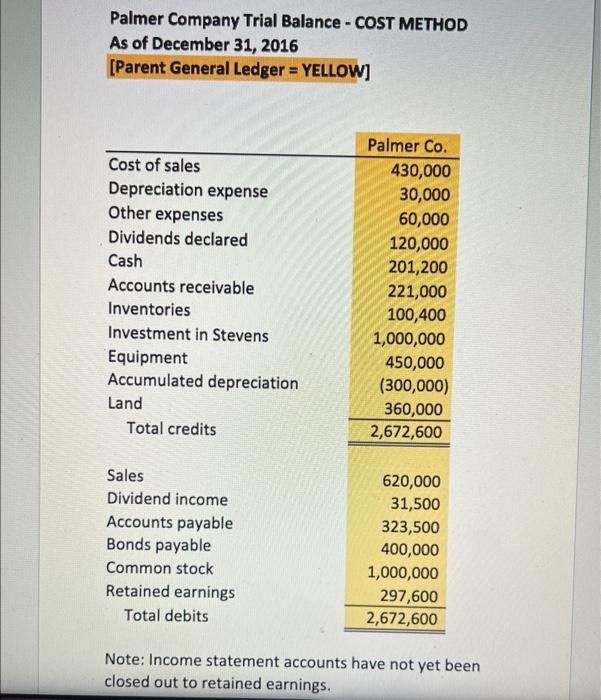

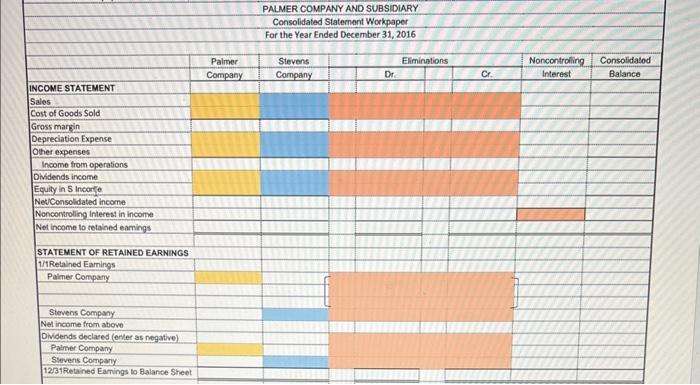

Note: Today's fictional case takes place during financial statement preparation for the year ended December 31, 2016. For the three years following our prior in class activity you have continued to work as the Accounting Manager overseeing Financial Reporting for Palmer Company. During this time you have overseen the general ledger entries related to Palmer's equity investment in Stevens. At the end of each year, the accounting manager at Stevens has forwarded you a retained earnings roll forward statement as well as a complete trial balance. You have compiled the following from that information: 1/1 Retained earnings Net income Dividends 12/31 Retained earnings 2014 190,000 2015 2016 200,000 210,000 50,000 40,000 45,000 (40,000) (30.000) (35.000) 200,000 210,000 220,000 Additionally your department was notified of the following information about Stevens: 1. The equipment owned by Stevens on the date it was acquired by Palmer (January 1, 2014) had an original life of 15 years and a remaining useful life of 10 years. 2. All of the inventory owned by Stevens on the date it was acquired by Palmer (January 1, 2014) was sold during the 2014 fiscal year. 3. On January 10, 2014, Stevens purchased back its bonds payable on the open market for $150,000 and recognized a gain of $55,556. The accounting manager at Stevens has forwarded you the most recent trial balance and you have copied it into an Excel file (provided below). (Note: The Excel file contains two trial balances for Palmer because we will complete our consolidation under two different assumptions about how Palmer would account for its investment.) Stevens Company As of December 31, 2016 [Subsidiary General Ledger = BLUE] Stevens Co. Cost of sales Depreciation expense Other expenses 240,000 20,000 35,000 Dividends declared 35,000 Cash 151,000 Accounts receivable 173,000 Inventories 81,000 Equipment 300,000 Accumulated depreciation (140,000) Land 290,000 Total credits 1,185,000 Sales 340,000 Accounts payable 135,000 Common stock 500,000 Retained earnings 210,000 Total debits 1,185,000 Note: Income statement accounts have not yet been closed out to retained earnings. Palmer Company Trial Balance - COMPLETE EQUITY METHOD As of December 31, 2016 [Parent General Ledger = YELLOW] Palmer Co. Cost of sales 430,000 Depreciation expense 30,000 Other expenses 60,000 Dividends declared 120,000 Cash 201,200 Accounts receivable 221,000 Inventories 100,400 Investment in Stevens 915,800 Equipment 450,000 Accumulated depreciation (300,000) Land 360,000 Total credits 2,588,400 Sales 620,000 Equity in S income 35,100 Accounts payable 323,500 Bonds payable 400,000 Common stock 1,000,000 Retained earnings 209,800 Total debits 2,588,400 Note: Income statement accounts have not yet been closed out to retained earnings. Palmer Company Trial Balance - COST METHOD As of December 31, 2016 [Parent General Ledger = YELLOW] Palmer Co. Cost of sales 430,000 Depreciation expense 30,000 Other expenses 60,000 Dividends declared 120,000 Cash 201,200 Accounts receivable 221,000 Inventories 100,400 Investment in Stevens 1,000,000 Equipment 450,000 Accumulated depreciation (300,000) Land 360,000 Total credits 2,672,600 Sales 620,000 Dividend income 31,500 Accounts payable 323,500 Bonds payable 400,000 Common stock 1,000,000 Retained earnings 297,600 Total debits 2,672,600 Note: Income statement accounts have not yet been closed out to retained earnings. Eliminating Entries - Equity Entry Entry Date Account Name Debit Credit PALMER COMPANY AND SUBSIDIARY Consolidated Statement Workpaper For the Year Ended December 31, 2016 Palmer Stevens Company Company INCOME STATEMENT Sales Cost of Goods Sold Gross margin Depreciation Expense Other expenses Income from operations Dividends income Equity in S Incone Net/Consolidated income Noncontrolling Interest in income Net income to retained eamings STATEMENT OF RETAINED EARNINGS 1/1Retained Eamings Palmer Company Stevens Company Net income from above Dividends declared (enter as negative) Palmer Company Stevens Company 12/31Retained Eamings to Balance Sheet Eliminations Noncontrolling Consolidated Dr. Cr. Interest Balance BALANCE SHEET Cash Accounts Receivable Inventory Investment in Stevens Company Equipment Accumulated depreciation Land Total assets Accounts Payable Bonds Payable Capital Stock Palmer Company Stevens Company Retained Earnings from above 1/1 Noncontrolling Interest 12/31 Noncontrolling Interest Total liabilities & equity Palmer Stevens Eliminations Noncontrolling Consolidated Company Company Dr. Cr. Interest Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address your request comprehensively lets create detailed tables for each calculation required following the financial data and tasks given 1 Retained Earnings Roll Forward for Stevens Company From ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started