Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Erank and Dale Cumack are married and filing a joint 2022 income tax return. During 2022, Frank, age 63, was retired from yovernment service and

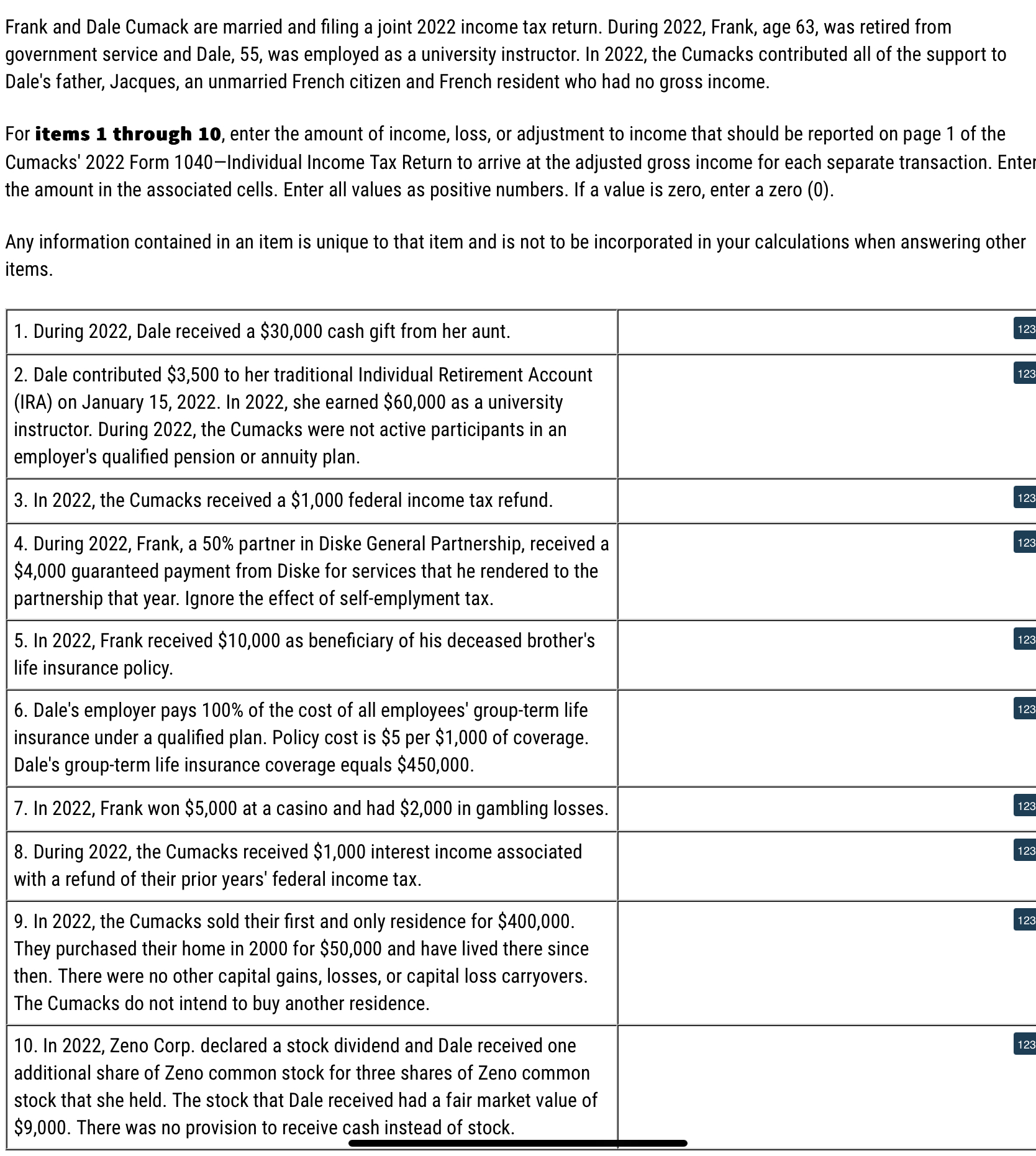

Erank and Dale Cumack are married and filing a joint 2022 income tax return. During 2022, Frank, age 63, was retired from yovernment service and Dale, 55, was employed as a university instructor. In 2022, the Cumacks contributed all of the support to Jale's father, Jacques, an unmarried French citizen and French resident who had no gross income. For items 1 through 10, enter the amount of income, loss, or adjustment to income that should be reported on page 1 of the Cumacks' 2022 Form 1040-Individual Income Tax Return to arrive at the adjusted gross income for each separate transaction. Ent he amount in the associated cells. Enter all values as positive numbers. If a value is zero, enter a zero (0). Any information contained in an item is unique to that item and is not to be incorporated in your calculations when answering other tems

Erank and Dale Cumack are married and filing a joint 2022 income tax return. During 2022, Frank, age 63, was retired from yovernment service and Dale, 55, was employed as a university instructor. In 2022, the Cumacks contributed all of the support to Jale's father, Jacques, an unmarried French citizen and French resident who had no gross income. For items 1 through 10, enter the amount of income, loss, or adjustment to income that should be reported on page 1 of the Cumacks' 2022 Form 1040-Individual Income Tax Return to arrive at the adjusted gross income for each separate transaction. Ent he amount in the associated cells. Enter all values as positive numbers. If a value is zero, enter a zero (0). Any information contained in an item is unique to that item and is not to be incorporated in your calculations when answering other tems Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started