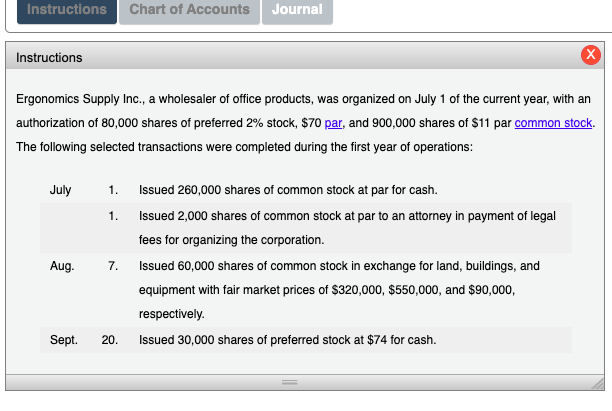

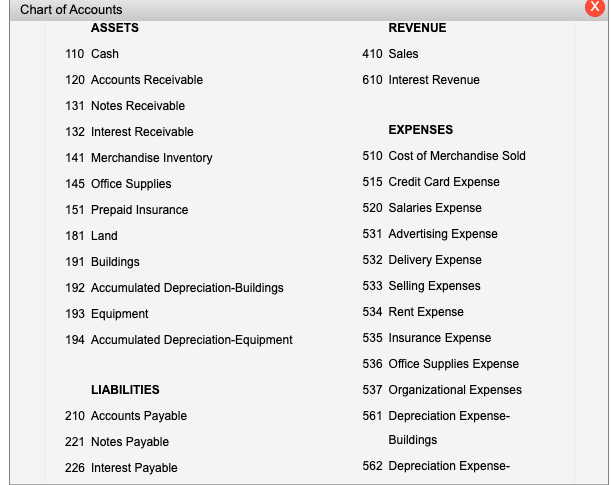

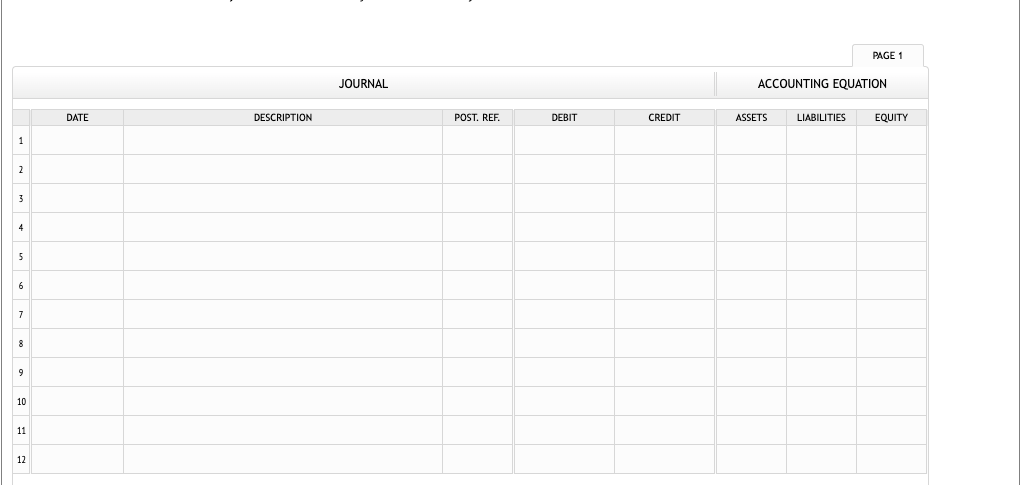

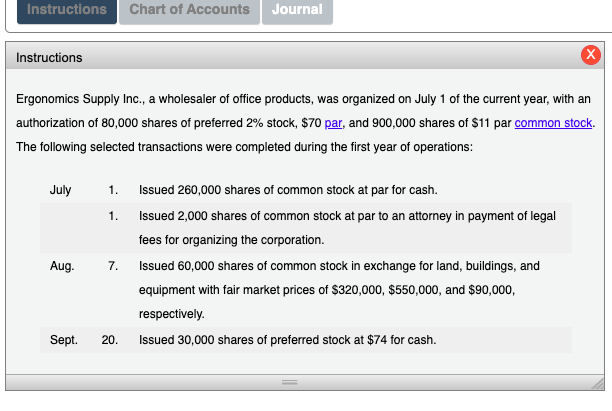

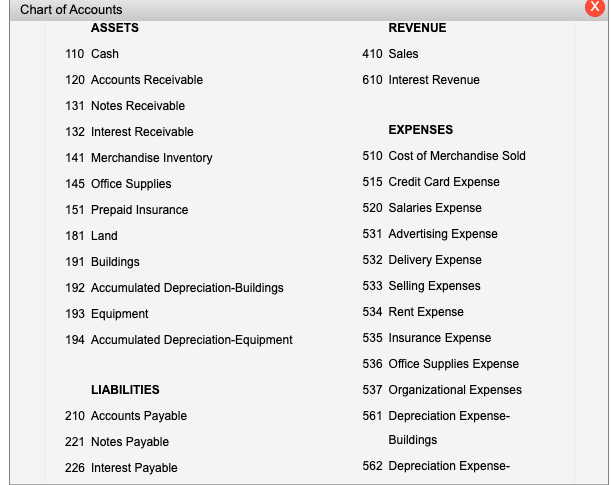

Ergonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an athorization of 80,000 shares of preferred 2% stock, $70 par, and 900,000 shares of $11 par common stock. The following selected transactions were completed during the first year of operations: July 1. Issued 260,000 shares of common stock at par for cash. 1. Issued 2,000 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Aug. 7. Issued 60,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $320,000, $550,000, and $90,000, respectively. Sept. 20. Issued 30,000 shares of preferred stock at $74 for cash. Chart of Accounts ASSETS REVENUE 110 Cash 410 Sales 120 Accounts Receivable 610 Interest Revenue 131 Notes Receivable 132 Interest Receivable EXPENSES 141 Merchandise Inventory 510 Cost of Merchandise Sold 145 Office Supplies 515 Credit Card Expense 151 Prepaid Insurance 520 Salaries Expense 181 Land 531 Advertising Expense 191 Buildings 532 Delivery Expense 192 Accumulated Depreciation-Buildings 533 Selling Expenses 193 Equipment 534 Rent Expense 194 Accumulated Depreciation-Equipment 535 Insurance Expense 536 Office Supplies Expense LIABILITIES 537 Organizational Expenses 210 Accounts Payable 561 Depreciation Expense- 221 Notes Payable Buildings 226 Interest Payable 562 Depreciation Expense- Ergonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an athorization of 80,000 shares of preferred 2% stock, $70 par, and 900,000 shares of $11 par common stock. The following selected transactions were completed during the first year of operations: July 1. Issued 260,000 shares of common stock at par for cash. 1. Issued 2,000 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Aug. 7. Issued 60,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $320,000, $550,000, and $90,000, respectively. Sept. 20. Issued 30,000 shares of preferred stock at $74 for cash. Chart of Accounts ASSETS REVENUE 110 Cash 410 Sales 120 Accounts Receivable 610 Interest Revenue 131 Notes Receivable 132 Interest Receivable EXPENSES 141 Merchandise Inventory 510 Cost of Merchandise Sold 145 Office Supplies 515 Credit Card Expense 151 Prepaid Insurance 520 Salaries Expense 181 Land 531 Advertising Expense 191 Buildings 532 Delivery Expense 192 Accumulated Depreciation-Buildings 533 Selling Expenses 193 Equipment 534 Rent Expense 194 Accumulated Depreciation-Equipment 535 Insurance Expense 536 Office Supplies Expense LIABILITIES 537 Organizational Expenses 210 Accounts Payable 561 Depreciation Expense- 221 Notes Payable Buildings 226 Interest Payable 562 Depreciation Expense