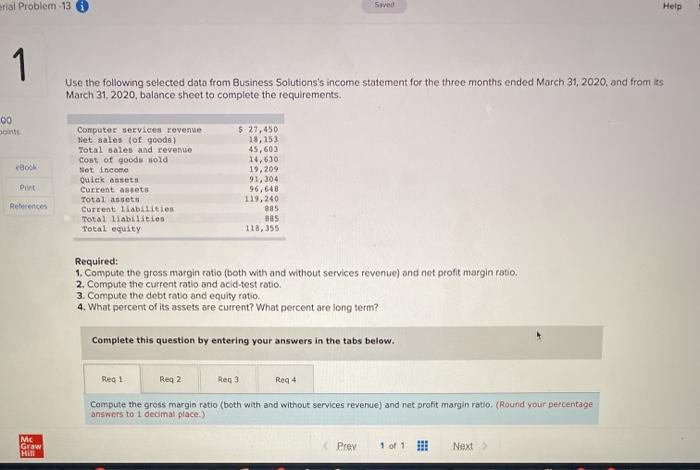

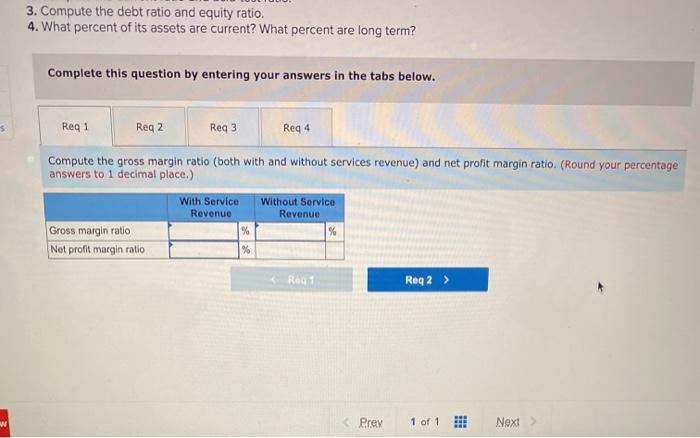

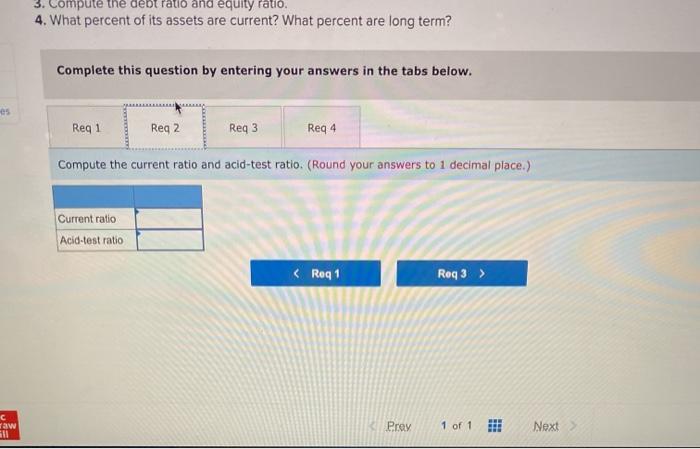

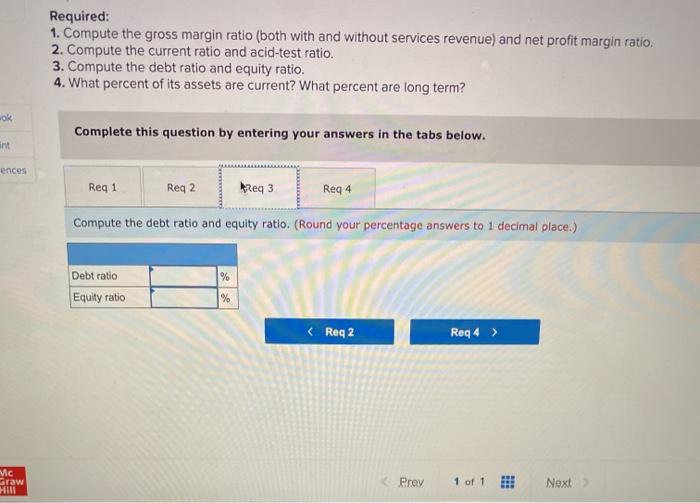

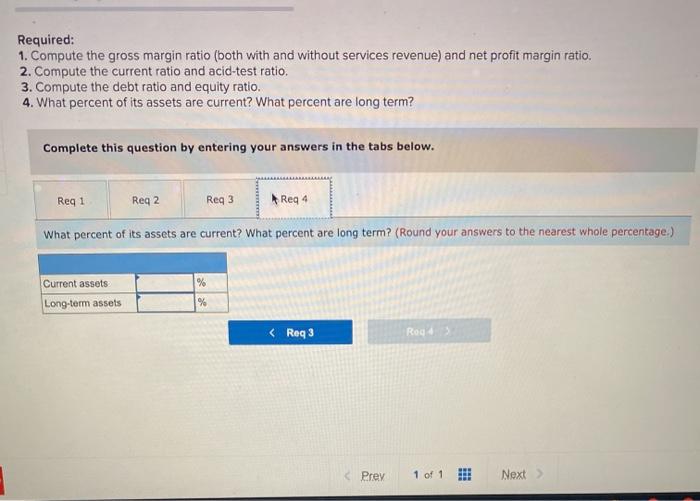

erial Problem -13 Seved Help 1 Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2020, and from its March 31, 2020, balance sheet to complete the requirements. 00 Book Computer services revenue Net sales (of goods) Total sales and revenue cost of goods sold Set income Quick assets Current assets Total assets Current liabilities Total liabilities Total equity $ 27,450 18,153 45,602 14,630 19,209 91,304 96,648 119,240 Pint References 885 118,355 Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Reg 4 Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. (Round your percentage answers to 1 decimal place) Mc Graw Prev 1 of 1 !!! Next HI 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. 5 Req1 Reg 2 Reg 3 Reg 4 Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. (Round your percentage answers to 1 decimal place.) With Service Without Service Revenue Gross margin ratio % Net profit margin ratio % Revenue R01 Req2 > w Prey 1 of 1 !!! Next 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. es Reg 1 Reg 2 Reg 3 Reg 4 Compute the current ratio and acid-test ratio. (Round your answers to 1 decimal place.) Current ratio Acid-test ratio raw sil Prey 1 of 1 Next Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? ok Complete this question by entering your answers in the tabs below. int ences Reg 1 Req 2 Breg 3 Req 4 Compute the debt ratio and equity ratio. (Round your percentage answers to 1 decimal place.) % Debt ratio Equity ratio Mc Graw Hill Prey 1 of 1 HH! Next Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3 Reg 4 What percent of its assets are current? What percent are long term? (Round your answers to the nearest whole percentage.) Current assets Long-term assets %