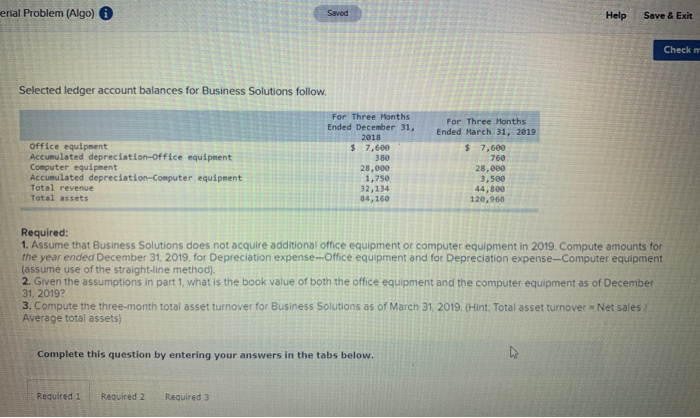

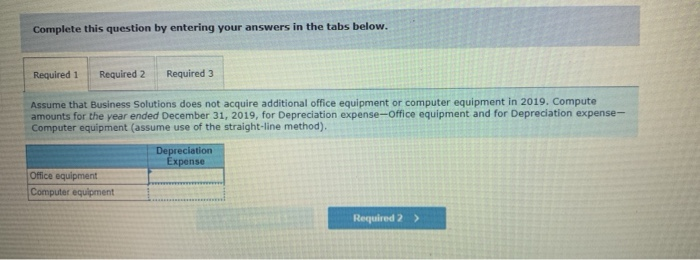

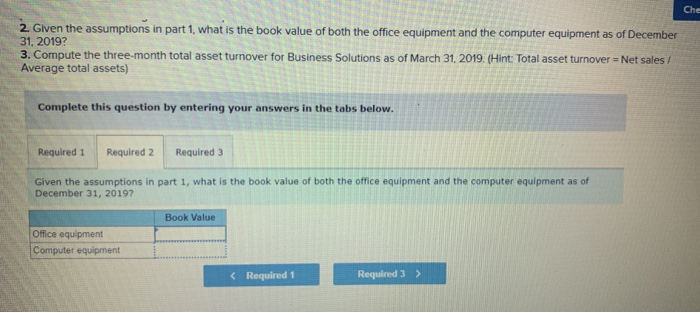

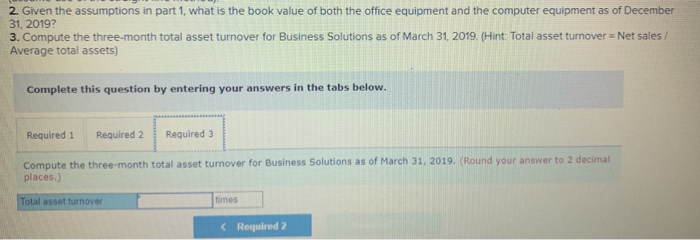

erial Problem (Algo) Help Save & Exit Check Selected ledger account balances for Business Solutions follow. office equipment Accumulated depreciation office equipment Computer equipment Accumulated depreciation-Computer equipment Total revenue Tatal assets For Three Months Ended December 31, 2018 $ 7.600 380 28.000 1,750 32. 134 34,160 For Three Months Ended March 31, 2019 $ 7.600 760 28,000 3.500 44,800 120,960 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2019. Compute amounts for the year ended December 31, 2019, for Depreciation expense-Office equipment and for Depreciation expense-Computer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2019? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2019. (Hint: Total asset turnover Net sales Average total assets) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2019. Compute amounts for the year ended December 31, 2019, for Depreciation expense-Office equipment and for Depreciation expense- Computer equipment (assume use of the straight-line method). Depreciation Expense Office equipment Computer equipment Required 2 > Che 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2019? 3. Compute the three month total asset turnover for Business Solutions as of March 31, 2019. (Hint: Total asset turnover = Net sales/ Average total assets) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2019? Book Value Office equipment Computer equipment 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31. 2019? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2019. (Hint: Total asset turnover = Net sales / Average total assets) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the three-month total asset turnover for Business Solutions as of March 31, 2019. (Round your answer to 2 decimal places.) Total asset turnover times