Answered step by step

Verified Expert Solution

Question

1 Approved Answer

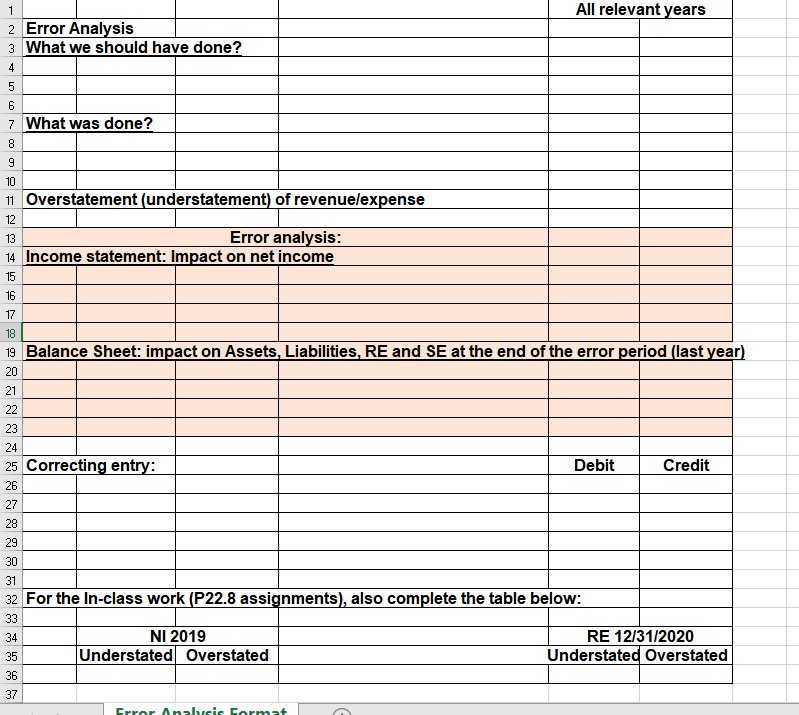

Error 1: Wolochuck purchased a new piece of equipment on June 30, 2016, at a cost of $45,000. The equipment has an expected salvage value

Error 1: Wolochuck purchased a new piece of equipment on June 30, 2016, at a cost of $45,000. The equipment has an expected salvage value of $3,000 and a useful life of 6 years. The company bookkeeper recorded depreciation each year but failed to consider the salvage value in depreciation computations through 2019 (current year). The books are still open for 2019 but all other years are closed. Prepare the analytics for 2016-2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started