Answered step by step

Verified Expert Solution

Question

1 Approved Answer

es Prepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. (If no entry is required for a transaction/event, select No

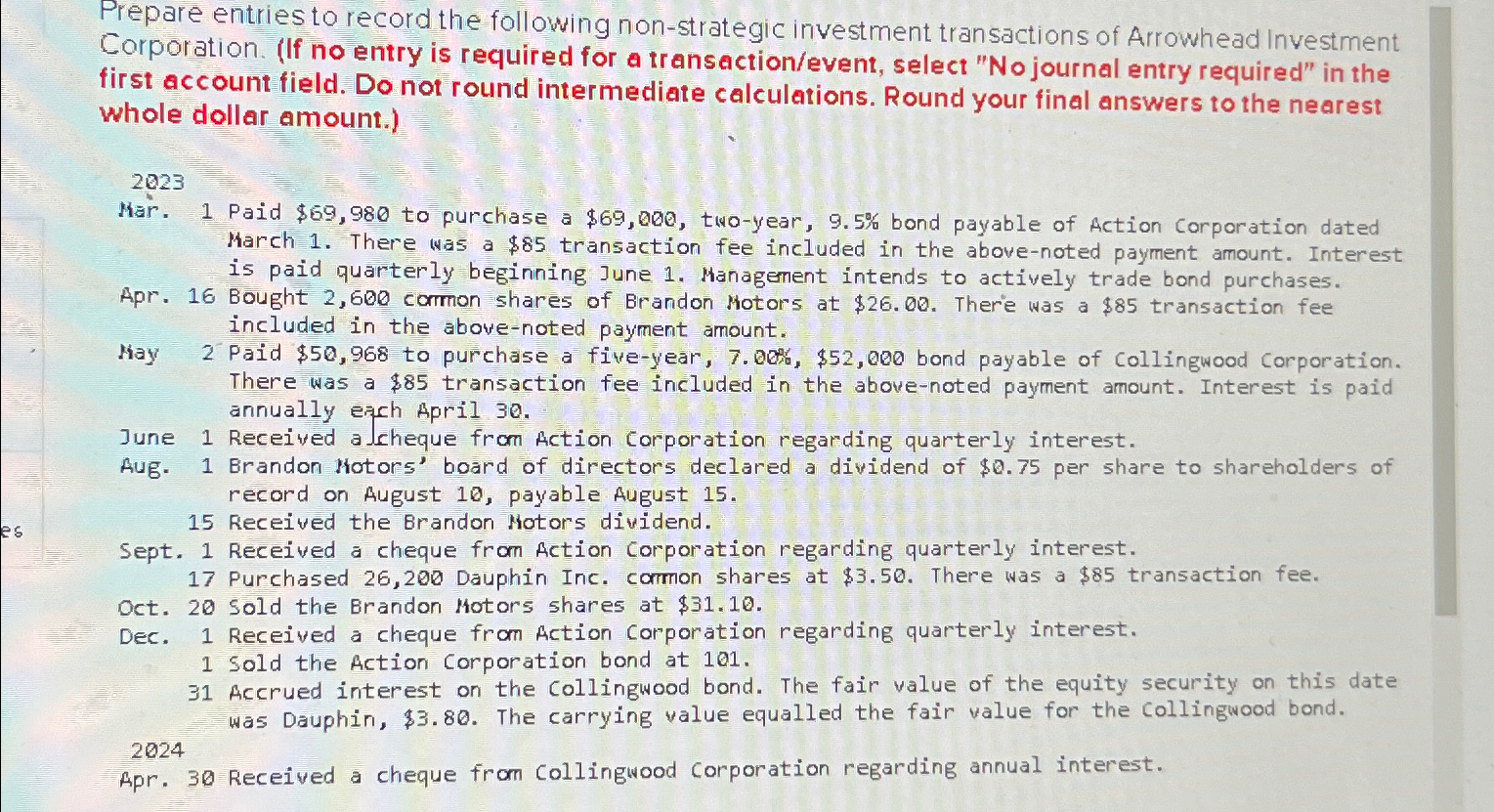

es Prepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) 2023 Mar. 1 Paid $69,980 to purchase a $69,000, two-year, 9.5% bond payable of Action Corporation dated March 1. There was a $85 transaction fee included in the above-noted payment amount. Interest is paid quarterly beginning June 1. Management intends to actively trade bond purchases. Apr. 16 Bought 2,600 common shares of Brandon Motors at $26.00. There was a $85 transaction fee included in the above-noted payment amount. May June Aug. 2 Paid $50,968 to purchase a five-year, 7.00%, $52,000 bond payable of Collingwood Corporation. There was a $85 transaction fee included in the above-noted payment amount. Interest is paid annually each April 30. 1 Received a cheque from Action Corporation regarding quarterly interest. 1 Brandon Motors' board of directors declared a dividend of $0.75 per share to shareholders of record on August 10, payable August 15. 15 Received the Brandon Motors dividend. Sept. 1 Received a cheque from Action Corporation regarding quarterly interest. 17 Purchased 26,200 Dauphin Inc. common shares at $3.50. There was a $85 transaction fee. Oct. 20 Sold the Brandon Motors shares at $31.10. Dec. 2024 1 Received a cheque from Action Corporation regarding quarterly interest. 1 Sold the Action Corporation bond at 101. 31 Accrued interest on the Collingwood bond. The fair value of the equity security on this date was Dauphin, $3.80. The carrying value equalled the fair value for the Collingwood bond. Apr. 30 Received a cheque from Collingwood Corporation regarding annual interest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started