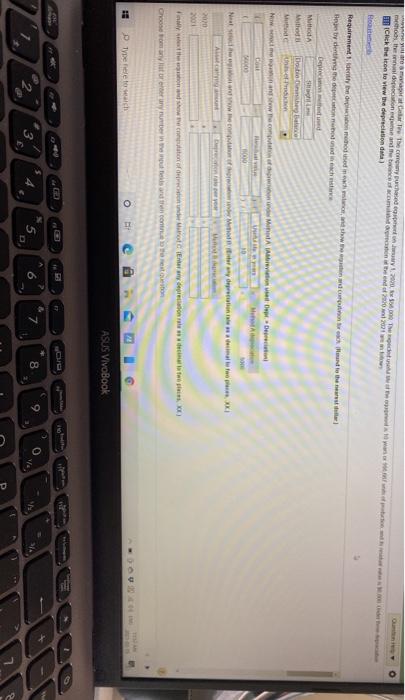

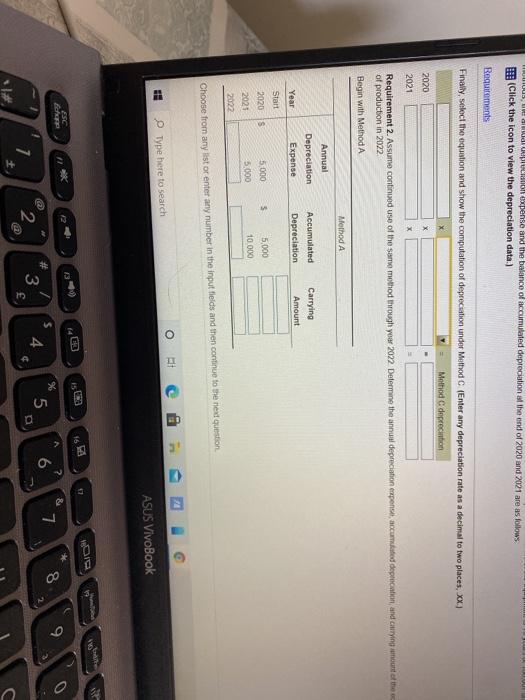

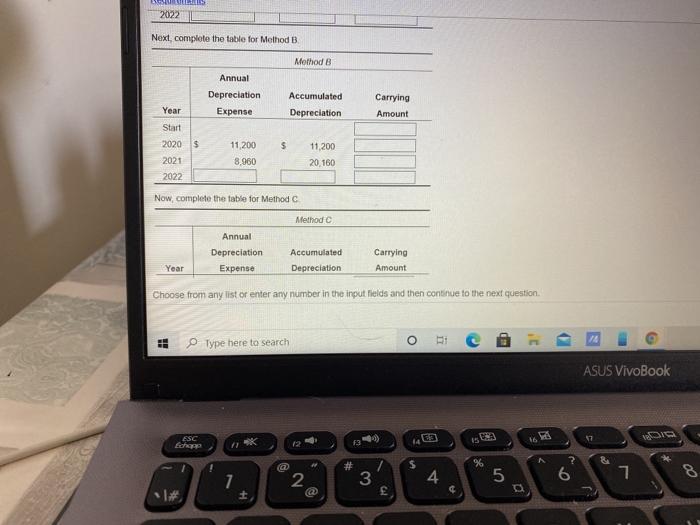

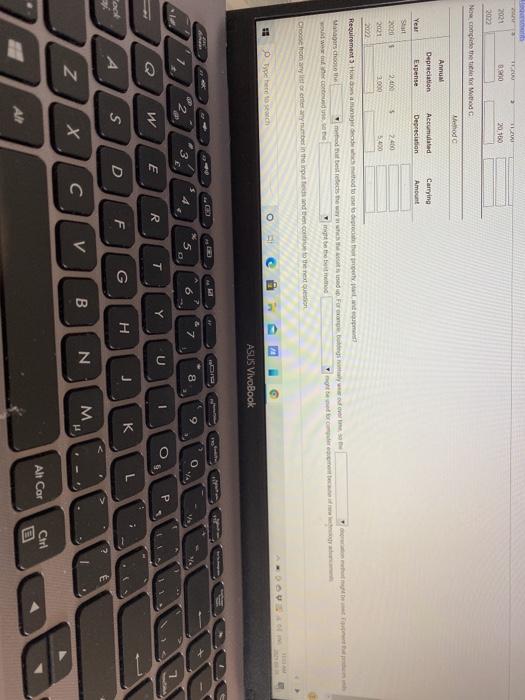

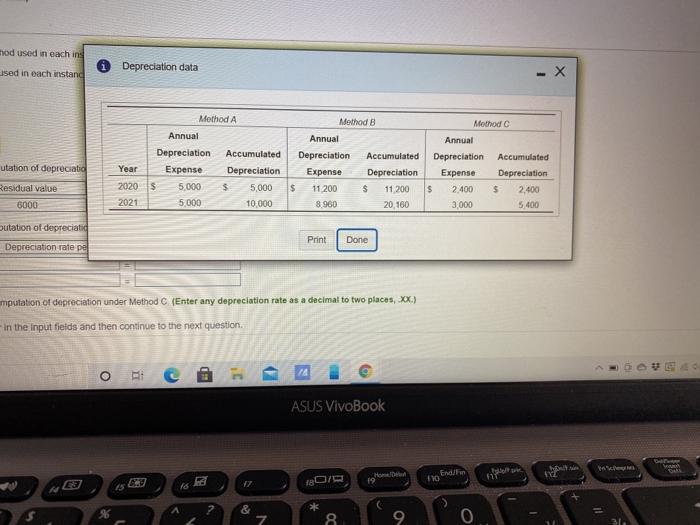

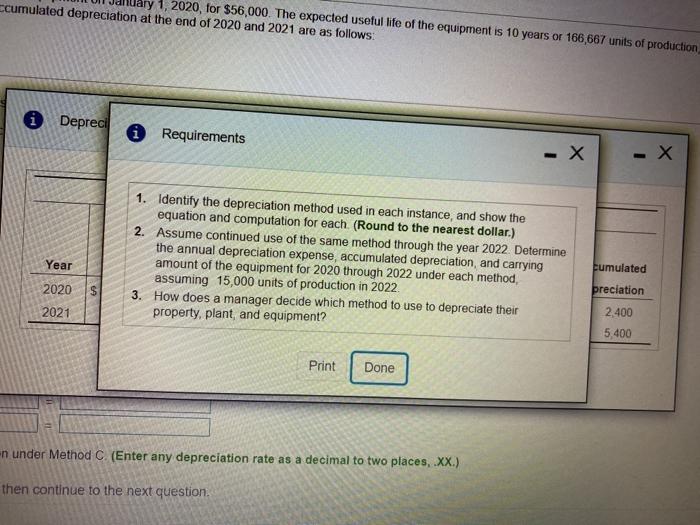

es To the company. The model mes the directions and become and of 2001 Click the icon to view the depreciation data) Requirements. Identity the most head to the By denting the dependence Deprecated Method Dosti B th www.coin Mint Det Coat 1000 werden alle A. 070 2001 www.econo de contro in polie Choose turnyres and the most outon De hele to watch As VivoBook A 7 6 8 0 9 5 D We 2 SA JUS WILLISION Xpense and the balance of accumulated depreciation at the end of 2020 and 2021 are as follows Click the icon to view the depreciation data.) Requirements Finally, select the equation and show the computation of depreciation under Method C (Enter any depreciation rate as a decimal to two places, XX Method depreciation 2020 2021 Requirement 2. Assumo continued use of the same method through year 2022 Determine the annual depreciation expense, accumulated depreciation and carrying amount of the of production in 2022 Begin with MethodA Method A Annual Depreciation Expense Carrying Accumulated Depreciation Year Amount 3 Start 2020 S 2025 2022 5.000 -5.000 5,000 10 000 Choose from any list or enter any number in the input fields and then continue to the next question O 11 C ED C 2 Type here to search ASUS VivoBook a FRP & 0 S ? 6 9 7 8 % 5 # 3 4 2 7 . C 2022 Next, complete the table for Method B Method B Annual Depreciation Expense Accumulated Depreciation Carrying Amount Year Start 2020 $ 2021 2022 $ 11.200 8.960 11,200 20.160 Now, complete the table for Method C Method Annual Depreciation Expense Accumulated Depreciation Carrying Amount Year Choose from any list or enter any number in the input fields and then continue to the next question HR Type here to search ASUS VivoBook 17 ESC Ech 13 14 $ # 3 % 5 ? 6 2 7 4 7 19 A 2021 202 8.800 20.00 No complete the title for the Nehoda Annun Depreciation Expense Accumulated Depreciation Carrying Amount Year S $ 2020 2001 2.4 2.000 2.400 5.400 Requirement Hommage de ched to the top Managers choose the mit besteeds wowowe God the Choose from any store any number in the notes and then to the next Type here to sech ASUS VivoBook 0 9 5 8 7 6 3 se 0 o P $ R > E T J L H G D A s F V B N M V C x Z 21 7. Alt Cor Cir All rod used in eaching ised in each instand Depreciation data Method utation of depreciatio Method A Annual Depreciation Accumulated Year Expense Depreciation 2020 s 5,000 $ 5,000 2021 5.000 10.000 Annual Depreciation Expense $ 11.200 8.960 Accumulated Depreciation $ 11.200 Method Annual Depreciation Accumulated Expense Depreciation $ 2.400 $ 2.400 3,000 5.400 Residual value 6000 20.160 putation of depreciatid Print Done Depreciation rate per mputation of depreciation under Method C (Enter any depreciation rate as a decimal to two places, xx.) in the input fields and then continue to the next question P o te 3 ASUS VivoBook OIR 19 E3 10 End 15 2 & 7 8 9 0 31 ary 1, 2020, for $56,000. The expected useful life of the equipment is 10 years or 166,667 units of production ccumulated depreciation at the end of 2020 and 2021 are as follows: i Depreci Requirements 1. Identify the depreciation method used in each instance, and show the equation and computation for each (Round to the nearest dollar.) 2. Assume continued use of the same method through the year 2022 Determine the annual depreciation expense, accumulated depreciation, and carrying amount of the equipment for 2020 through 2022 under each method, assuming 15,000 units of production in 2022 3. How does a manager decide which method to use to depreciate their property, plant and equipment? Year Eumulated $ 2020 2021 preciation 2.400 5.400 Print Done -n under Method C (Enter any depreciation rate as a decimal to two places, XX.) then continue to the next question es To the company. The model mes the directions and become and of 2001 Click the icon to view the depreciation data) Requirements. Identity the most head to the By denting the dependence Deprecated Method Dosti B th www.coin Mint Det Coat 1000 werden alle A. 070 2001 www.econo de contro in polie Choose turnyres and the most outon De hele to watch As VivoBook A 7 6 8 0 9 5 D We 2 SA JUS WILLISION Xpense and the balance of accumulated depreciation at the end of 2020 and 2021 are as follows Click the icon to view the depreciation data.) Requirements Finally, select the equation and show the computation of depreciation under Method C (Enter any depreciation rate as a decimal to two places, XX Method depreciation 2020 2021 Requirement 2. Assumo continued use of the same method through year 2022 Determine the annual depreciation expense, accumulated depreciation and carrying amount of the of production in 2022 Begin with MethodA Method A Annual Depreciation Expense Carrying Accumulated Depreciation Year Amount 3 Start 2020 S 2025 2022 5.000 -5.000 5,000 10 000 Choose from any list or enter any number in the input fields and then continue to the next question O 11 C ED C 2 Type here to search ASUS VivoBook a FRP & 0 S ? 6 9 7 8 % 5 # 3 4 2 7 . C 2022 Next, complete the table for Method B Method B Annual Depreciation Expense Accumulated Depreciation Carrying Amount Year Start 2020 $ 2021 2022 $ 11.200 8.960 11,200 20.160 Now, complete the table for Method C Method Annual Depreciation Expense Accumulated Depreciation Carrying Amount Year Choose from any list or enter any number in the input fields and then continue to the next question HR Type here to search ASUS VivoBook 17 ESC Ech 13 14 $ # 3 % 5 ? 6 2 7 4 7 19 A 2021 202 8.800 20.00 No complete the title for the Nehoda Annun Depreciation Expense Accumulated Depreciation Carrying Amount Year S $ 2020 2001 2.4 2.000 2.400 5.400 Requirement Hommage de ched to the top Managers choose the mit besteeds wowowe God the Choose from any store any number in the notes and then to the next Type here to sech ASUS VivoBook 0 9 5 8 7 6 3 se 0 o P $ R > E T J L H G D A s F V B N M V C x Z 21 7. Alt Cor Cir All rod used in eaching ised in each instand Depreciation data Method utation of depreciatio Method A Annual Depreciation Accumulated Year Expense Depreciation 2020 s 5,000 $ 5,000 2021 5.000 10.000 Annual Depreciation Expense $ 11.200 8.960 Accumulated Depreciation $ 11.200 Method Annual Depreciation Accumulated Expense Depreciation $ 2.400 $ 2.400 3,000 5.400 Residual value 6000 20.160 putation of depreciatid Print Done Depreciation rate per mputation of depreciation under Method C (Enter any depreciation rate as a decimal to two places, xx.) in the input fields and then continue to the next question P o te 3 ASUS VivoBook OIR 19 E3 10 End 15 2 & 7 8 9 0 31 ary 1, 2020, for $56,000. The expected useful life of the equipment is 10 years or 166,667 units of production ccumulated depreciation at the end of 2020 and 2021 are as follows: i Depreci Requirements 1. Identify the depreciation method used in each instance, and show the equation and computation for each (Round to the nearest dollar.) 2. Assume continued use of the same method through the year 2022 Determine the annual depreciation expense, accumulated depreciation, and carrying amount of the equipment for 2020 through 2022 under each method, assuming 15,000 units of production in 2022 3. How does a manager decide which method to use to depreciate their property, plant and equipment? Year Eumulated $ 2020 2021 preciation 2.400 5.400 Print Done -n under Method C (Enter any depreciation rate as a decimal to two places, XX.) then continue to the next