Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of ( $ 2.29 ) million. The fixed asset

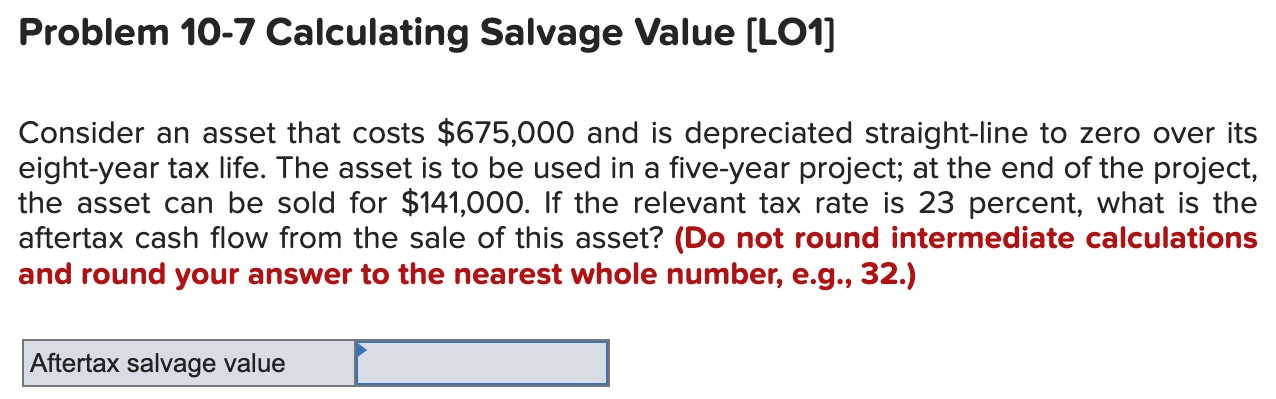

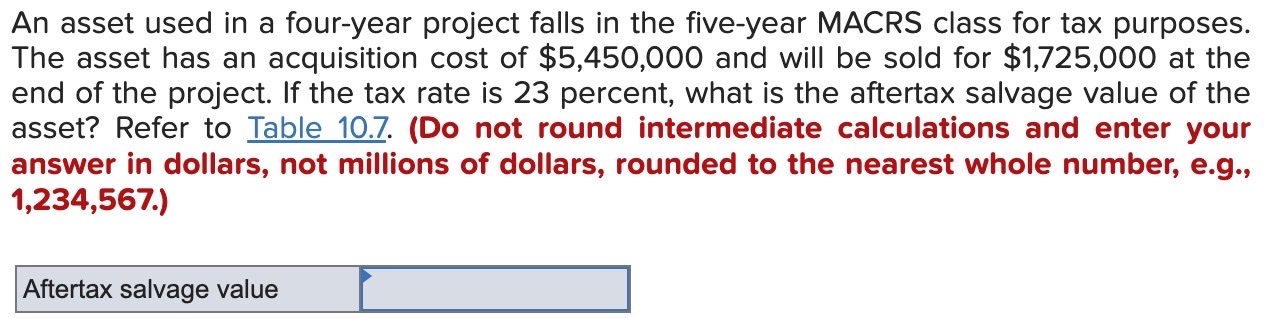

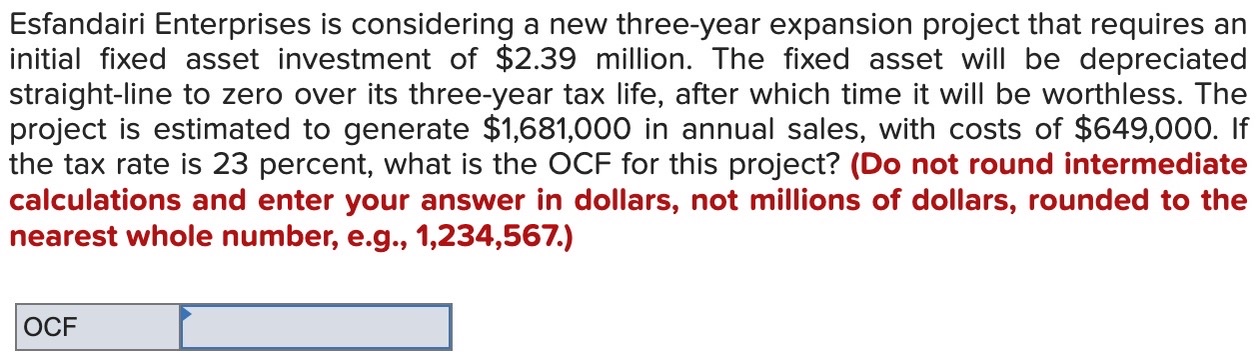

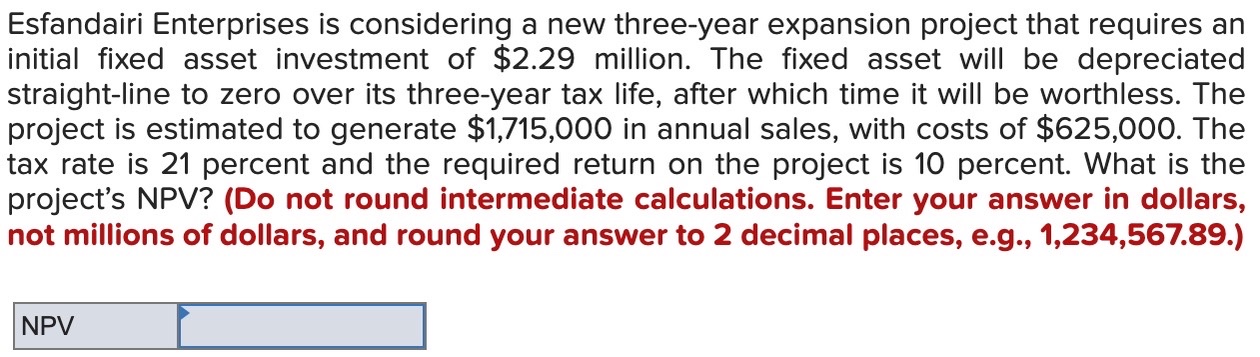

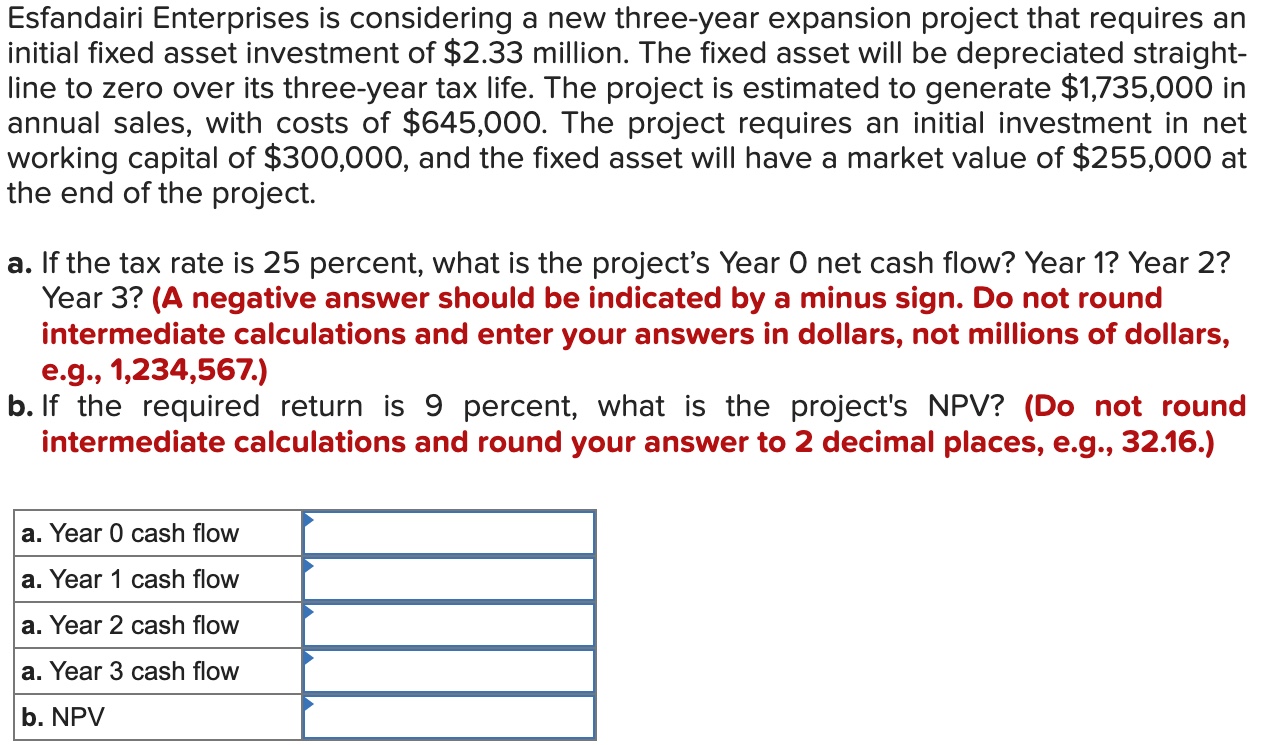

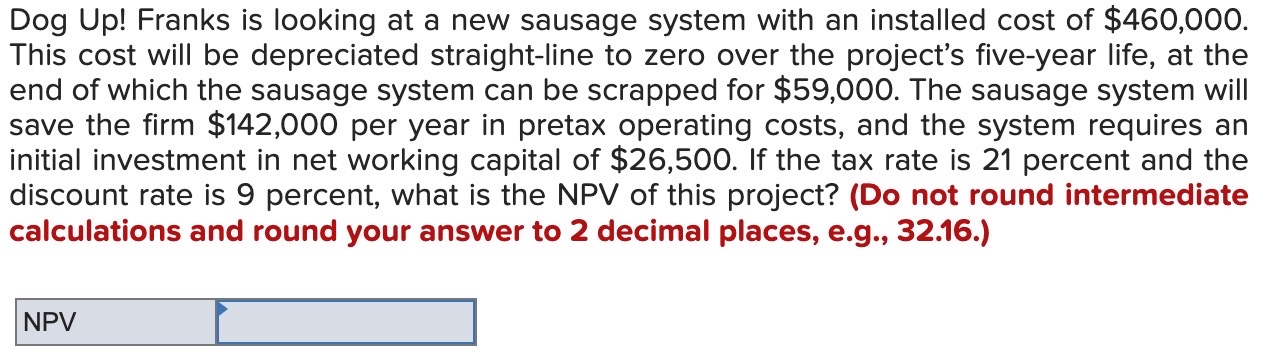

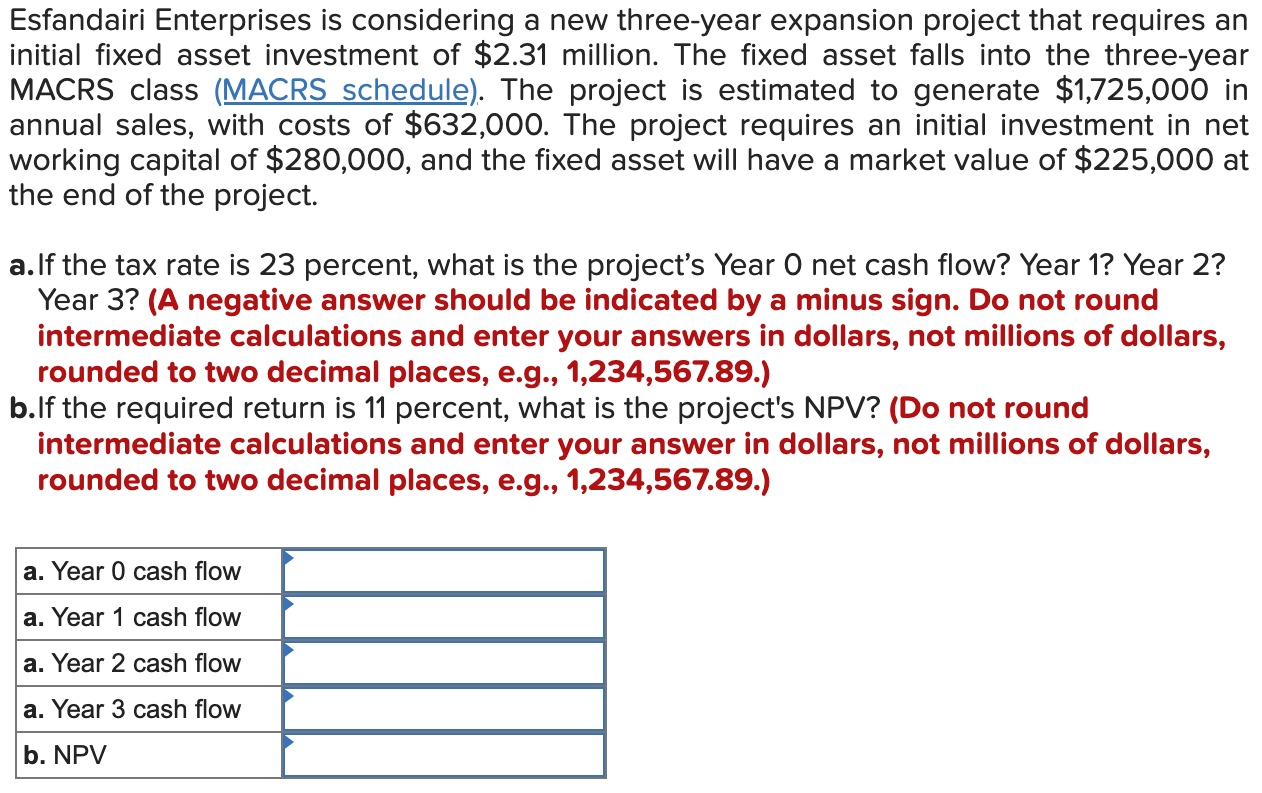

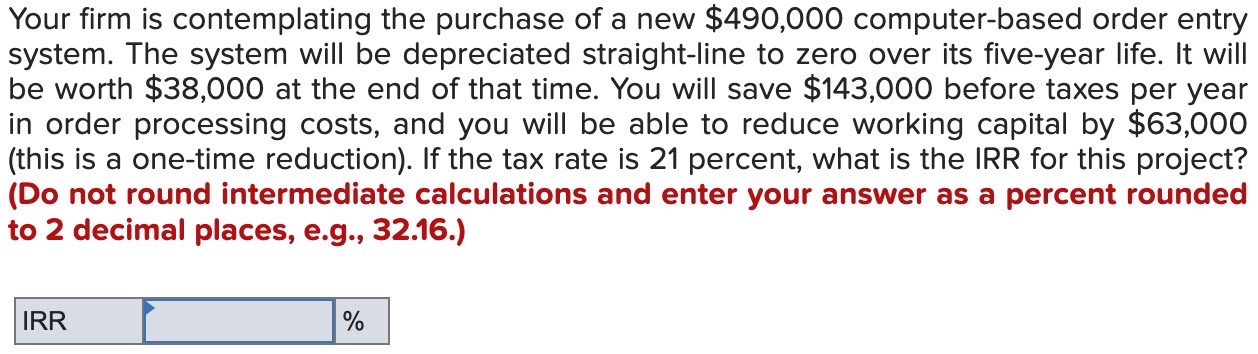

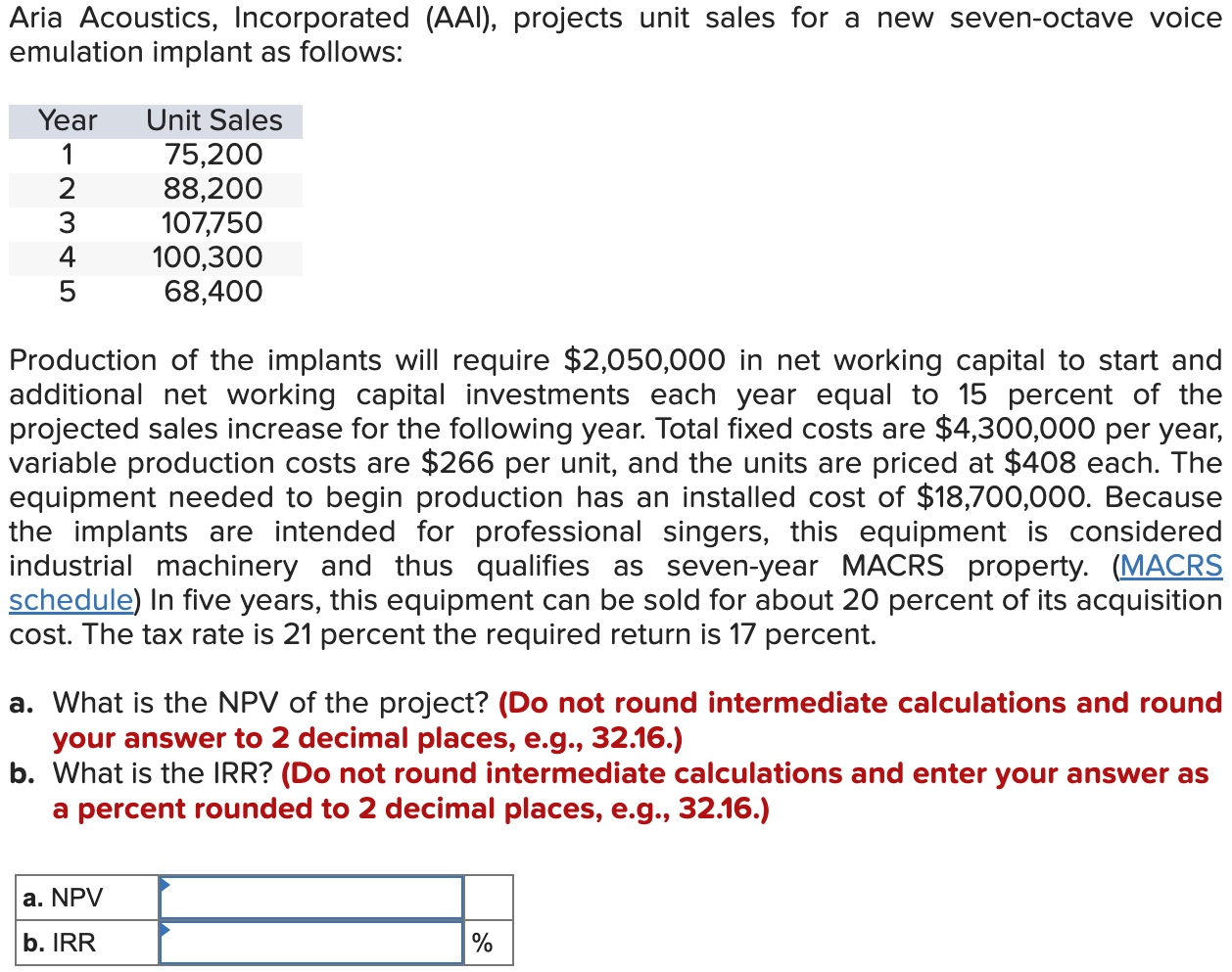

Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.29 \\) million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate \\( \\$ 1,715,000 \\) in annual sales, with costs of \\( \\$ 625,000 \\). The tax rate is 21 percent and the required return on the project is 10 percent. What is the project's NPV? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, and round your answer to 2 decimal places, e.g., 1,234,567.89.) Your firm is contemplating the purchase of a new \\( \\$ 490,000 \\) computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth \\( \\$ 38,000 \\) at the end of that time. You will save \\( \\$ 143,000 \\) before taxes per year in order processing costs, and you will be able to reduce working capital by \\( \\$ 63,000 \\) (this is a one-time reduction). If the tax rate is 21 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Consider an asset that costs \\( \\$ 675,000 \\) and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for \\( \\$ 141,000 \\). If the relevant tax rate is 23 percent, what is the aftertax cash flow from the sale of this asset? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.39 \\) million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate \\( \\$ 1,681,000 \\) in annual sales, with costs of \\( \\$ 649,000 \\). If the tax rate is 23 percent, what is the OCF for this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of \\( \\$ 5,450,000 \\) and will be sold for \\( \\$ 1,725,000 \\) at the end of the project. If the tax rate is 23 percent, what is the aftertax salvage value of the asset? Refer to Table 10.7. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Aria Acoustics, Incorporated (AAl), projects unit sales for a new seven-octave voice emulation implant as follows: Production of the implants will require \\( \\$ 2,050,000 \\) in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are \\( \\$ 4,300,000 \\) per year, variable production costs are \\( \\$ 266 \\) per unit, and the units are priced at \\( \\$ 408 \\) each. The equipment needed to begin production has an installed cost of \\( \\$ 18,700,000 \\). Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. (MACRS schedule) In five years, this equipment can be sold for about 20 percent of its acquisition cost. The tax rate is 21 percent the required return is 17 percent. a. What is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Dog Up! Franks is looking at a new sausage system with an installed cost of \\( \\$ 460,000 \\). This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for \\( \\$ 59,000 \\). The sausage system will save the firm \\( \\$ 142,000 \\) per year in pretax operating costs, and the system requires an initial investment in net working capital of \\( \\$ 26,500 \\). If the tax rate is 21 percent and the discount rate is 9 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.33 \\) million. The fixed asset will be depreciated straightline to zero over its three-year tax life. The project is estimated to generate \\( \\$ 1,735,000 \\) in annual sales, with costs of \\( \\$ 645,000 \\). The project requires an initial investment in net working capital of \\( \\$ 300,000 \\), and the fixed asset will have a market value of \\( \\$ 255,000 \\) at the end of the project. a. If the tax rate is 25 percent, what is the project's Year 0 net cash flow? Year 1? Year 2? Year 3 ? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 9 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.31 \\) million. The fixed asset falls into the three-year MACRS class (MACRS schedule). The project is estimated to generate \\( \\$ 1,725,000 \\) in annual sales, with costs of \\( \\$ 632,000 \\). The project requires an initial investment in net working capital of \\( \\$ 280,000 \\), and the fixed asset will have a market value of \\( \\$ 225,000 \\) at the end of the project. a. If the tax rate is 23 percent, what is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) b.If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.)

Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.29 \\) million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate \\( \\$ 1,715,000 \\) in annual sales, with costs of \\( \\$ 625,000 \\). The tax rate is 21 percent and the required return on the project is 10 percent. What is the project's NPV? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, and round your answer to 2 decimal places, e.g., 1,234,567.89.) Your firm is contemplating the purchase of a new \\( \\$ 490,000 \\) computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth \\( \\$ 38,000 \\) at the end of that time. You will save \\( \\$ 143,000 \\) before taxes per year in order processing costs, and you will be able to reduce working capital by \\( \\$ 63,000 \\) (this is a one-time reduction). If the tax rate is 21 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Consider an asset that costs \\( \\$ 675,000 \\) and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for \\( \\$ 141,000 \\). If the relevant tax rate is 23 percent, what is the aftertax cash flow from the sale of this asset? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.39 \\) million. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate \\( \\$ 1,681,000 \\) in annual sales, with costs of \\( \\$ 649,000 \\). If the tax rate is 23 percent, what is the OCF for this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of \\( \\$ 5,450,000 \\) and will be sold for \\( \\$ 1,725,000 \\) at the end of the project. If the tax rate is 23 percent, what is the aftertax salvage value of the asset? Refer to Table 10.7. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Aria Acoustics, Incorporated (AAl), projects unit sales for a new seven-octave voice emulation implant as follows: Production of the implants will require \\( \\$ 2,050,000 \\) in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are \\( \\$ 4,300,000 \\) per year, variable production costs are \\( \\$ 266 \\) per unit, and the units are priced at \\( \\$ 408 \\) each. The equipment needed to begin production has an installed cost of \\( \\$ 18,700,000 \\). Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. (MACRS schedule) In five years, this equipment can be sold for about 20 percent of its acquisition cost. The tax rate is 21 percent the required return is 17 percent. a. What is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Dog Up! Franks is looking at a new sausage system with an installed cost of \\( \\$ 460,000 \\). This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for \\( \\$ 59,000 \\). The sausage system will save the firm \\( \\$ 142,000 \\) per year in pretax operating costs, and the system requires an initial investment in net working capital of \\( \\$ 26,500 \\). If the tax rate is 21 percent and the discount rate is 9 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.33 \\) million. The fixed asset will be depreciated straightline to zero over its three-year tax life. The project is estimated to generate \\( \\$ 1,735,000 \\) in annual sales, with costs of \\( \\$ 645,000 \\). The project requires an initial investment in net working capital of \\( \\$ 300,000 \\), and the fixed asset will have a market value of \\( \\$ 255,000 \\) at the end of the project. a. If the tax rate is 25 percent, what is the project's Year 0 net cash flow? Year 1? Year 2? Year 3 ? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 9 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Esfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of \\( \\$ 2.31 \\) million. The fixed asset falls into the three-year MACRS class (MACRS schedule). The project is estimated to generate \\( \\$ 1,725,000 \\) in annual sales, with costs of \\( \\$ 632,000 \\). The project requires an initial investment in net working capital of \\( \\$ 280,000 \\), and the fixed asset will have a market value of \\( \\$ 225,000 \\) at the end of the project. a. If the tax rate is 23 percent, what is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) b.If the required return is 11 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started