Question

Esquire Products Inc. expects the following monthly sales: January $ 39,000 July $ 33,000 February 30,000 August 37,000 March 23,000 September 40,000 April 25,000 October

Esquire Products Inc. expects the following monthly sales:

| January | $ | 39,000 | July | $ | 33,000 |

| February | 30,000 | August | 37,000 | ||

| March | 23,000 | September | 40,000 | ||

| April | 25,000 | October | 45,000 | ||

| May | 19,000 | November | 53,000 | ||

| June | 17,000 | December | 35,000 | ||

| Total sales = $396,000 | |||||

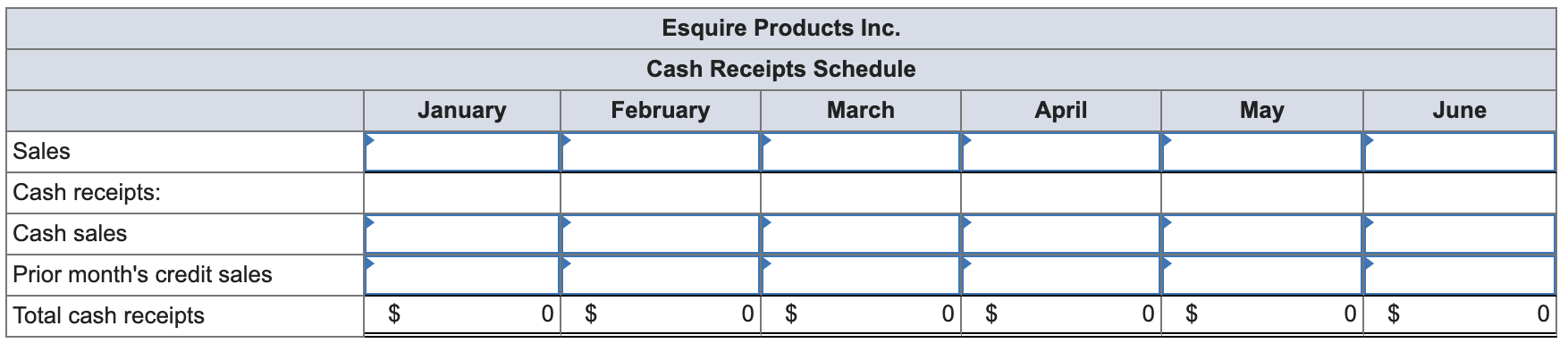

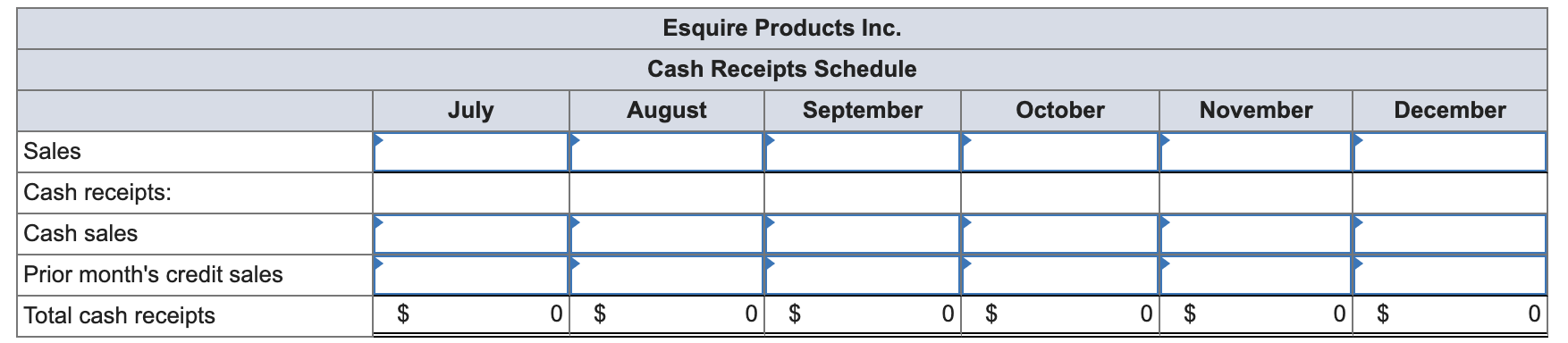

Cash sales are 40 percent in a given month, with the remainder going into accounts receivable. All receivables are collected in the month following the sale. Esquire sells all of its goods for $2 each and produces them for $1 each. Esquire uses level production, and average monthly production is equal to annual production divided by 12.

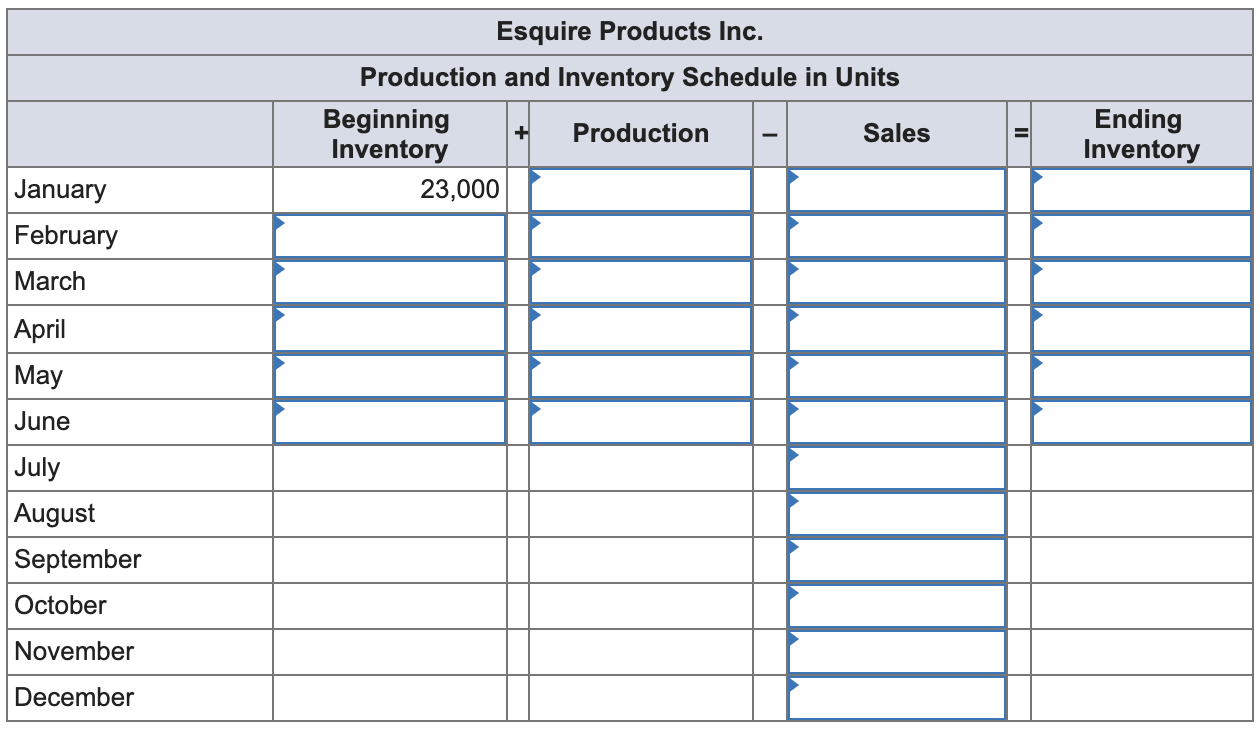

a. Generate a monthly production and inventory schedule in units. Beginning inventory in January is 23,000 units.  b. Prepare a cash receipts schedule for January through December. Assume that dollar sales in the prior December were $20,000.

b. Prepare a cash receipts schedule for January through December. Assume that dollar sales in the prior December were $20,000.

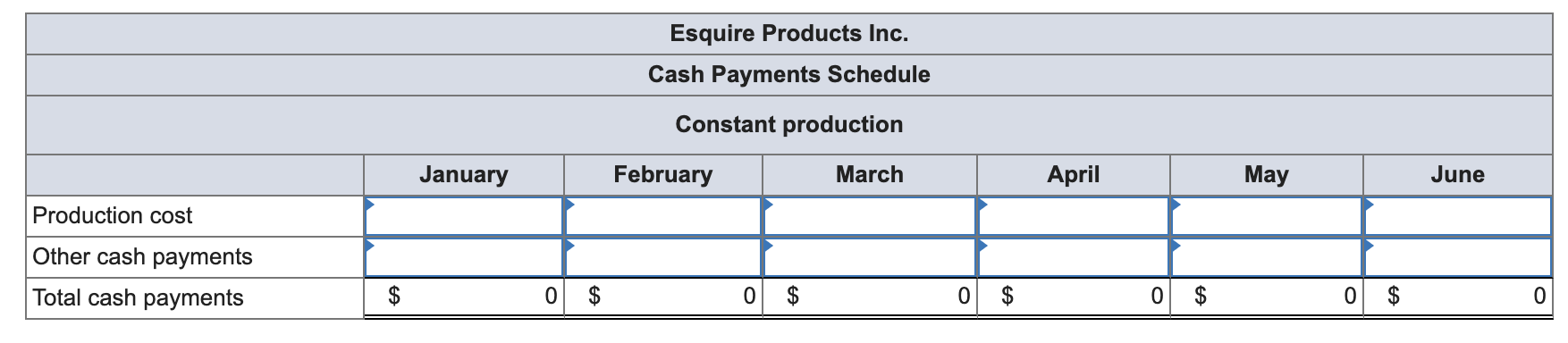

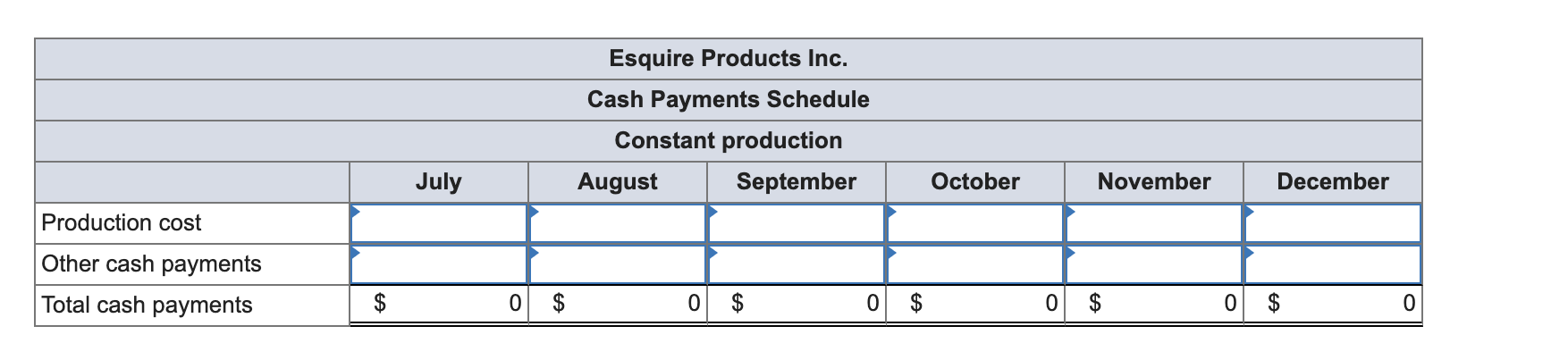

c. Prepare a cash payments schedule for January through December. The production costs ($1 per unit produced) are paid for in the month in which they occur. Other cash payments (besides those for production costs) are $8,500 per month.

c. Prepare a cash payments schedule for January through December. The production costs ($1 per unit produced) are paid for in the month in which they occur. Other cash payments (besides those for production costs) are $8,500 per month.

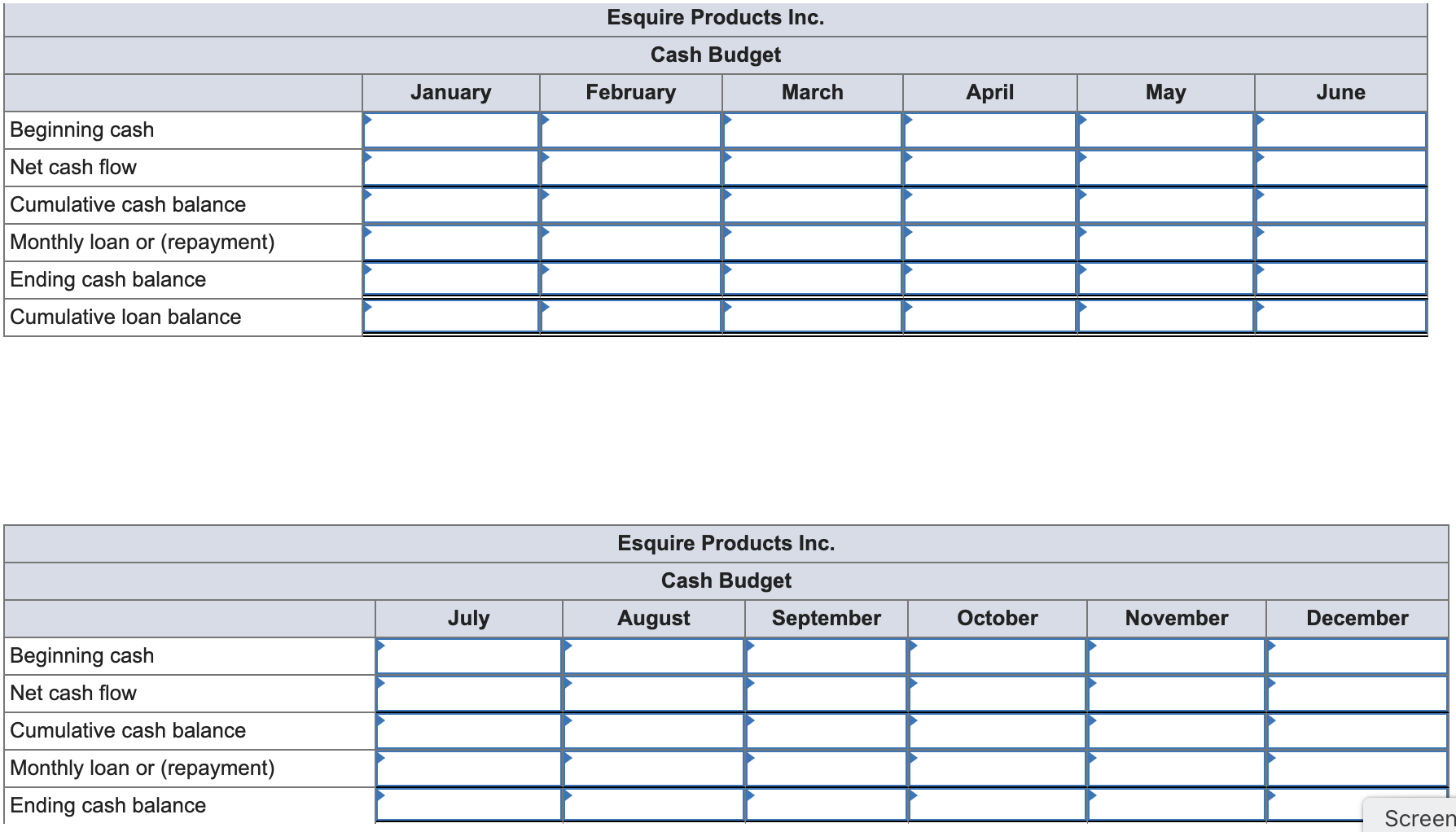

d. Construct a cash budget for January through December using the cash receipts schedule from part b and the cash payments schedule from part c. The beginning cash balance is $3,000, which is also the minimum desired. (Negative amounts should be indicated by a minus sign.)

d. Construct a cash budget for January through December using the cash receipts schedule from part b and the cash payments schedule from part c. The beginning cash balance is $3,000, which is also the minimum desired. (Negative amounts should be indicated by a minus sign.)

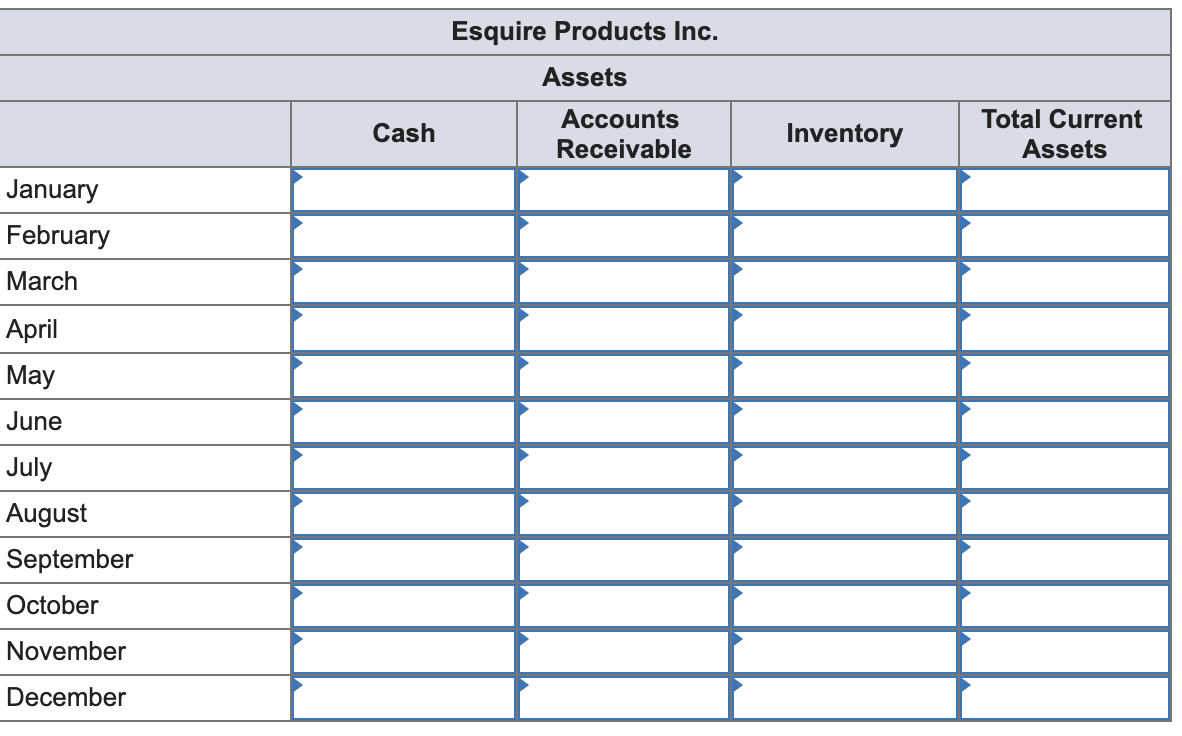

e. Determine total current assets for each month. Include cash, accounts receivable, and inventory. The accounts receivable for a given month is equal to 60 percent of that month's sales. Inventory is equal to ending inventory (part a) times the cost of $1 per unit.

e. Determine total current assets for each month. Include cash, accounts receivable, and inventory. The accounts receivable for a given month is equal to 60 percent of that month's sales. Inventory is equal to ending inventory (part a) times the cost of $1 per unit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started