Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Essentials of Corporate Finance, Asia Global Edition by Ross, Westerfield, Jordan, Wong (10th edition), Chapter 7, Intermediate, Q20 The following information was obtained from a

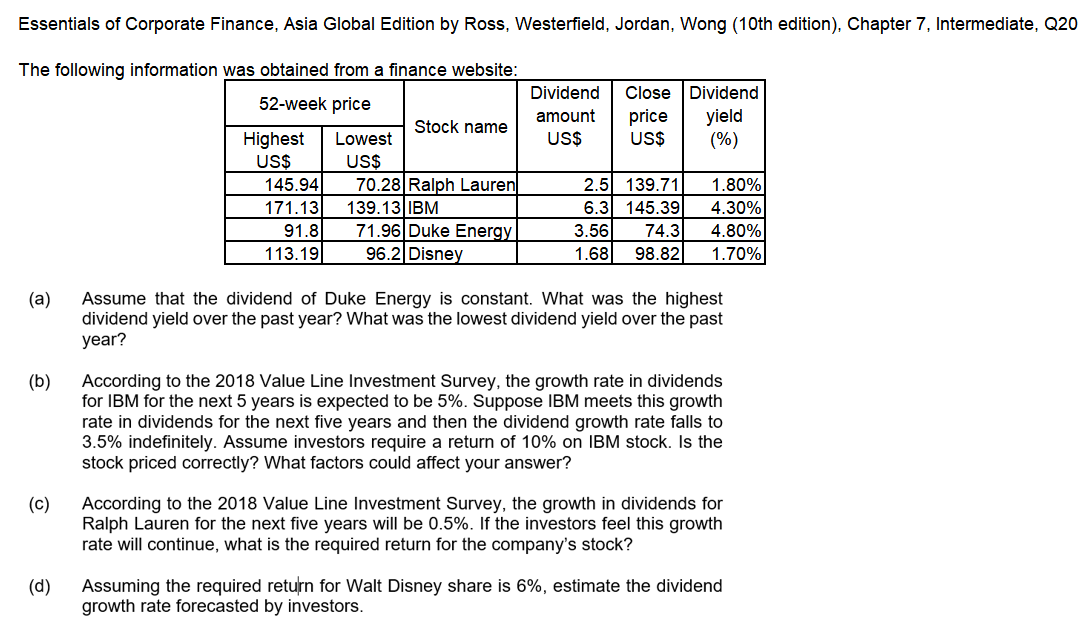

Essentials of Corporate Finance, Asia Global Edition by Ross, Westerfield, Jordan, Wong (10th edition), Chapter 7, Intermediate, Q20 The following information was obtained from a finance website: (a) Assume that the dividend of Duke Energy is constant. What was the highest dividend yield over the past year? What was the lowest dividend yield over the past year? (b) According to the 2018 Value Line Investment Survey, the growth rate in dividends for IBM for the next 5 years is expected to be 5%. Suppose IBM meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 3.5% indefinitely. Assume investors require a return of 10% on IBM stock. Is the stock priced correctly? What factors could affect your answer? (c) According to the 2018 Value Line Investment Survey, the growth in dividends for Ralph Lauren for the next five years will be 0.5%. If the investors feel this growth rate will continue, what is the required return for the company's stock? (d) Assuming the required return for Walt Disney share is 6%, estimate the dividend growth rate forecasted by investors

Essentials of Corporate Finance, Asia Global Edition by Ross, Westerfield, Jordan, Wong (10th edition), Chapter 7, Intermediate, Q20 The following information was obtained from a finance website: (a) Assume that the dividend of Duke Energy is constant. What was the highest dividend yield over the past year? What was the lowest dividend yield over the past year? (b) According to the 2018 Value Line Investment Survey, the growth rate in dividends for IBM for the next 5 years is expected to be 5%. Suppose IBM meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 3.5% indefinitely. Assume investors require a return of 10% on IBM stock. Is the stock priced correctly? What factors could affect your answer? (c) According to the 2018 Value Line Investment Survey, the growth in dividends for Ralph Lauren for the next five years will be 0.5%. If the investors feel this growth rate will continue, what is the required return for the company's stock? (d) Assuming the required return for Walt Disney share is 6%, estimate the dividend growth rate forecasted by investors Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started