Foreign Currency Hedging and Interest rate hedging

calculation hedge the hard one is Q1e

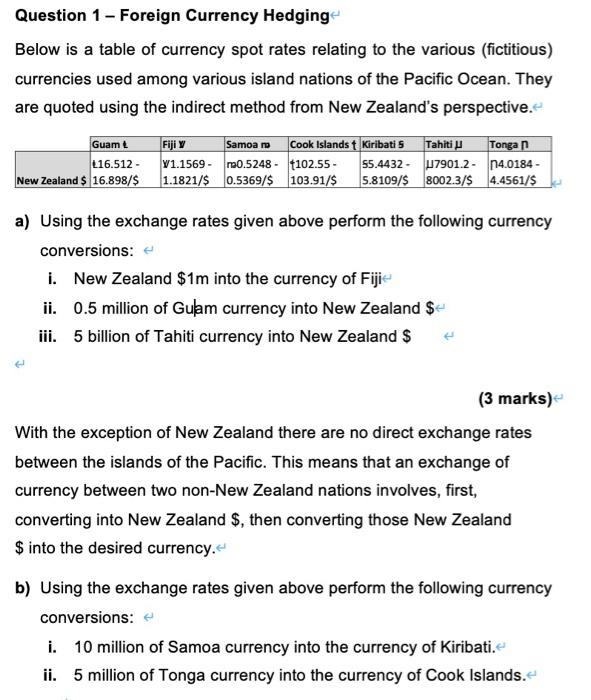

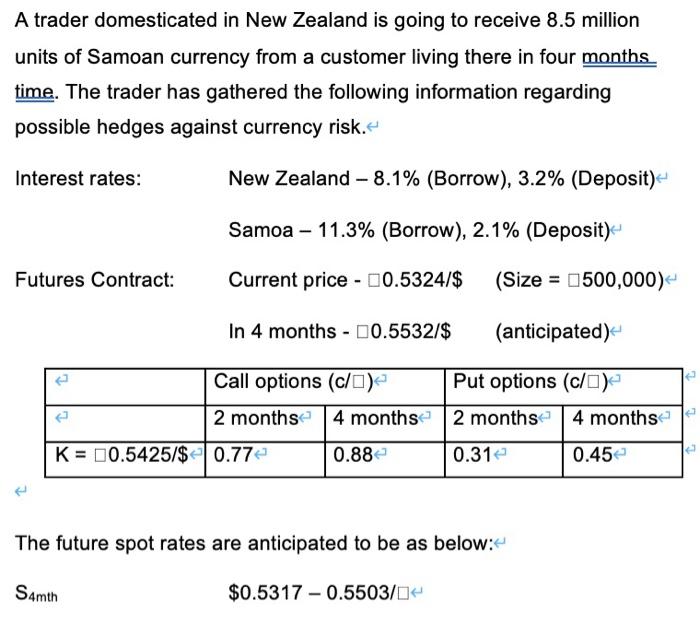

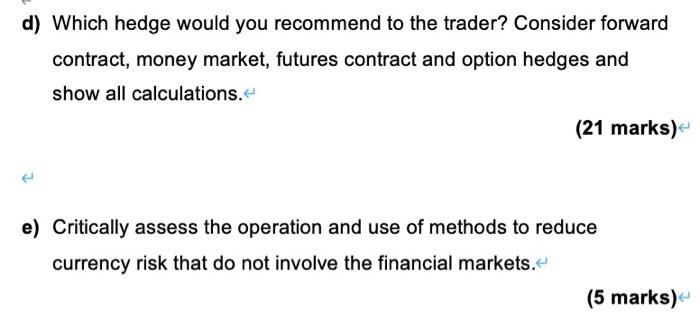

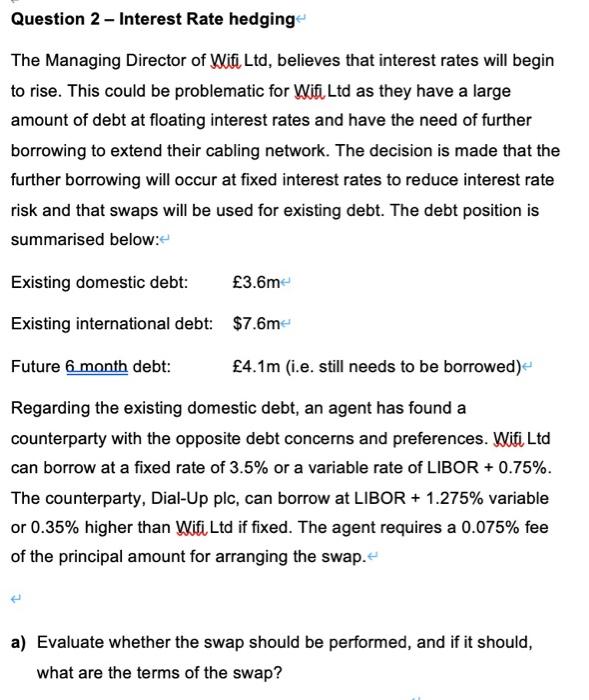

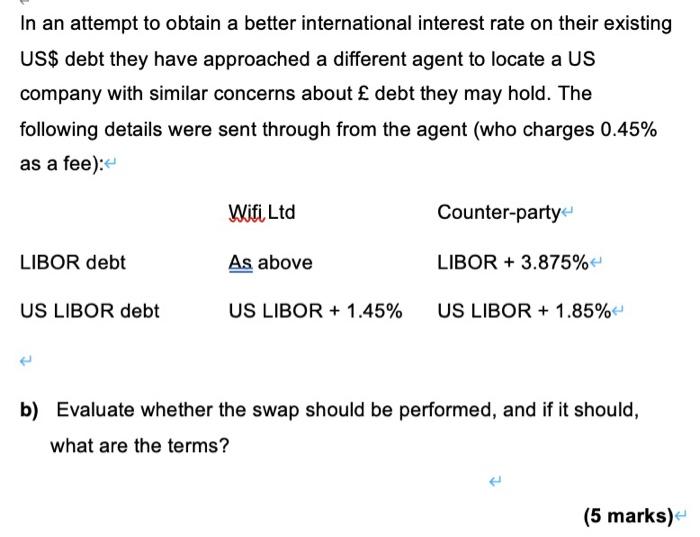

Question 1 - Foreign Currency Hedging Below is a table of currency spot rates relating to the various (fictitious) currencies used among various island nations of the Pacific Ocean. They are quoted using the indirect method from New Zealand's perspective. Guam L16.512 New Zealand $ 16.898/$ Fiji Samoa Cook Islands t Kiribati s Tahiti u Tongan V1.1569 0.5248 - 102.55 - 55.4432 07901.2 - 14.0184 - 1.1821/$ 0.5369/$ 103.91/$ 5.8109/$ 8002.3/6 4.4561/$ a) Using the exchange rates given above perform the following currency conversions: 1. New Zealand $1m into the currency of Fiji ii. 0.5 million of Gulam currency into New Zealand $ iii. 5 billion of Tahiti currency into New Zealand $ (3 marks) With the exception of New Zealand there are no direct exchange rates between the islands of the Pacific. This means that an exchange of currency between two non-New Zealand nations involves, first, converting into New Zealand $, then converting those New Zealand $ into the desired currency. b) Using the exchange rates given above perform the following currency conversions: i. 10 million of Samoa currency into the currency of Kiribati. ii. 5 million of Tonga currency into the currency of Cook Islands. A trader domesticated in New Zealand is going to receive 8.5 million units of Samoan currency from a customer living there in four months. time. The trader has gathered the following information regarding possible hedges against currency risk. Interest rates: New Zealand - 8.1% (Borrow), 3.2% (Deposit) Samoa - 11.3% (Borrow), 2.1% (Deposit) Futures Contract: Current price - 00.5324/$ (Size = 500,000) In 4 months - 0.5532/$ (anticipated) Call options (c/o) Put options (c/a) 2 months 4 months 2 months 4 months K = 0.5425/$0.772 0.882 0.31 0.45 The future spot rates are anticipated to be as below: Samth $0.5317 - 0.5503/04 d) Which hedge would you recommend to the trader? Consider forward contract, money market, futures contract and option hedges and show all calculations. (21 marks) e) Critically assess the operation and use of methods to reduce currency risk that do not involve the financial markets. (5 marks) Question 2 - Interest Rate hedging The Managing Director of Wifi, Ltd, believes that interest rates will begin to rise. This could be problematic for Wifi Ltd as they have a large amount of debt at floating interest rates and have the need of further borrowing to extend their cabling network. The decision is made that the further borrowing will occur at fixed interest rates to reduce interest rate risk and that swaps will be used for existing debt. The debt position is summarised below: Existing domestic debt: 3.6m Existing international debt: $7.6m Future 6 month debt: 4.1m (i.e. still needs to be borrowed) Regarding the existing domestic debt, an agent has found a counterparty with the opposite debt concerns and preferences. Wifi Ltd can borrow at a fixed rate of 3.5% or a variable rate of LIBOR + 0.75%. The counterparty, Dial-Up plc, can borrow at LIBOR + 1.275% variable or 0.35% higher than Wifi Ltd if fixed. The agent requires a 0.075% fee of the principal amount for arranging the swap. a) Evaluate whether the swap should be performed, and if it should, what are the terms of the swap? In an attempt to obtain a better international interest rate on their existing US$ debt they have approached a different agent to locate a US company with similar concerns about debt they may hold. The following details were sent through from the agent (who charges 0.45% as a fee): Wifi Ltd Counter-party LIBOR debt As above LIBOR + 3.875% US LIBOR debt US LIBOR + 1.45% US LIBOR + 1.85% b) Evaluate whether the swap should be performed, and if it should, what are the terms