Answered step by step

Verified Expert Solution

Question

1 Approved Answer

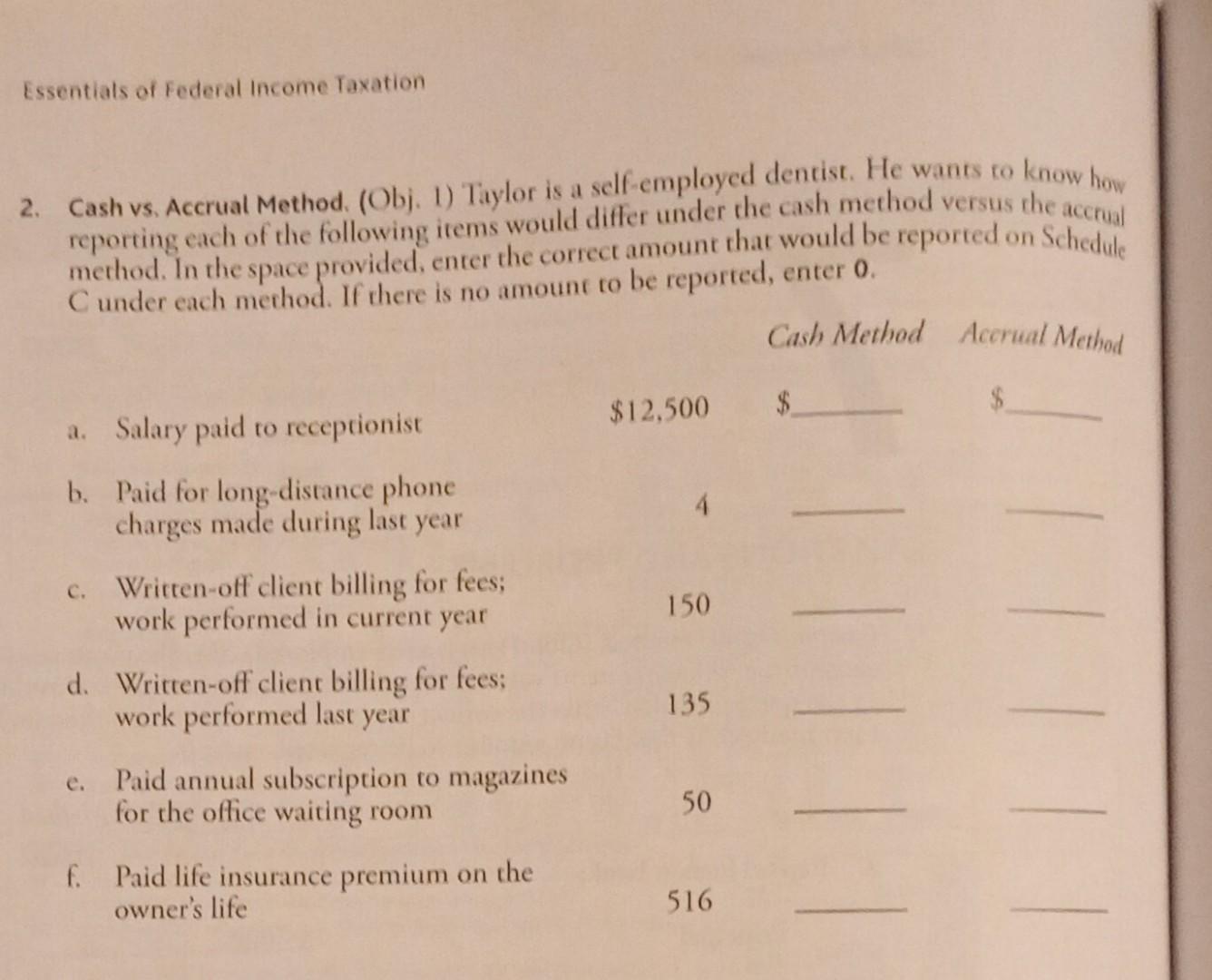

Essentials of Federal Income Taxation 2. Cash vs. Accrual Method. (Obj. 1) Taylor is a self-employed dentist. He wants to know how reporting each of

Essentials of Federal Income Taxation 2. Cash vs. Accrual Method. (Obj. 1) Taylor is a self-employed dentist. He wants to know how reporting each of the following items would differ under the cash method versus the accrual method. In the space provided, enter the correct amount that would be reported on Schedule C under each method. If there is no amount to be reported, enter 0. Cash Method AccrualMethod a. Salary paid to receptionist $12,500 $ $ b. Paid for long-distance phone charges made during last year 4 c. Written-off client billing for fees; work performed in current year 150 d. Written-off client billing for fees; work performed last year 135 e. Paid annual subscription to magazines for the office waiting room 50 f. Paid life insurance premium on the owner's life 516

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started