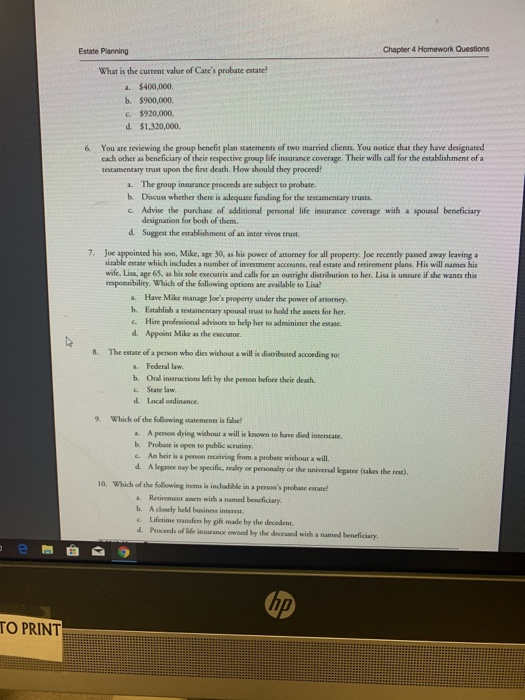

Estate Planning Chapter 4 Homework Questions What is the current value of Cate's probate estate a. $400,000. b. $900,000. C, $920,000. d. $1,320,000. 6. You are reviewing the group benefit plan statements of two married clients. You notice that they have designated each other as beneficiary of their respective group life insurance coverage. Their wills call for the establishment ofa testamentary trust upon the first death. How should they proceed? a. The group insurance proceeds are subject to probate. b. Discuss whether there is adequate funding for the testamentary trusts c Advise the purchane of addistional penonal life insurance coverage with a spousal bencficiary designation for both of them. d Suggest the establishment of an inter vivos trust. 7. Joe appointed his son, Mike, age 30, as his power of attorney for all property. Joe recently passed away leaving a irable estate which includes a number of investment accounes, real estate and retirement plans. His will numes his wife, Lisa, age 65, as his sole executris and calls for an outright distribution to her. Lisa is unsure if she wanes this reponsibility. Which of the following options are available to Lia? Have Make manage Joe's property under the power of amorncy b. Establish a testamentary spousal trust to hold the assets for her. c. Hire professional advisors so help her to administer the esate. d Apposint Mike s the eecunor. 8. The estate of a penon who dies without a will is distributed according to a. Federal law . Orl instructions left by the person before their death c. Seate law d. Local oedinance. 9. Which of the folowing statements is fiahe a A person dying wihout a will is known to have died inserstate. b. Probase is open to public scrutiny c. Am beir is a penson receiving from a probane wichour a will. d. A legnce ay be specific, realy cr personalty or the univeral legatce (takes the reut), 10. Which of the following items is includible in a pernon's probate estate a. Retirement assets with a named beneficiary b. A closely held business interest e Lifetime tranafens by gifi made by the decedent d. Proceeds of life inurance owsed by the decessed with a named beneficiary ip TO PRINT Estate Planning Chapter 4 Homework Questions What is the current value of Cate's probate estate a. $400,000. b. $900,000. C, $920,000. d. $1,320,000. 6. You are reviewing the group benefit plan statements of two married clients. You notice that they have designated each other as beneficiary of their respective group life insurance coverage. Their wills call for the establishment ofa testamentary trust upon the first death. How should they proceed? a. The group insurance proceeds are subject to probate. b. Discuss whether there is adequate funding for the testamentary trusts c Advise the purchane of addistional penonal life insurance coverage with a spousal bencficiary designation for both of them. d Suggest the establishment of an inter vivos trust. 7. Joe appointed his son, Mike, age 30, as his power of attorney for all property. Joe recently passed away leaving a irable estate which includes a number of investment accounes, real estate and retirement plans. His will numes his wife, Lisa, age 65, as his sole executris and calls for an outright distribution to her. Lisa is unsure if she wanes this reponsibility. Which of the following options are available to Lia? Have Make manage Joe's property under the power of amorncy b. Establish a testamentary spousal trust to hold the assets for her. c. Hire professional advisors so help her to administer the esate. d Apposint Mike s the eecunor. 8. The estate of a penon who dies without a will is distributed according to a. Federal law . Orl instructions left by the person before their death c. Seate law d. Local oedinance. 9. Which of the folowing statements is fiahe a A person dying wihout a will is known to have died inserstate. b. Probase is open to public scrutiny c. Am beir is a penson receiving from a probane wichour a will. d. A legnce ay be specific, realy cr personalty or the univeral legatce (takes the reut), 10. Which of the following items is includible in a pernon's probate estate a. Retirement assets with a named beneficiary b. A closely held business interest e Lifetime tranafens by gifi made by the decedent d. Proceeds of life inurance owsed by the decessed with a named beneficiary ip TO PRINT