Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimate Bartmans and Reynoldss betas by running regressions of their returns against the indexs returns. (Hint: Refer to Web Appendix 8A.) Are these betas con-

Estimate Bartmans and Reynoldss betas by running regressions of their returns against the indexs returns. (Hint: Refer to Web Appendix 8A.) Are these betas con- sistent with your graph?

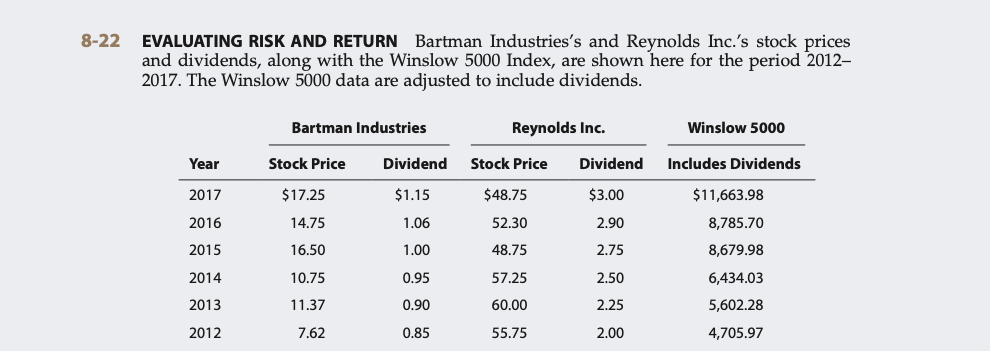

-22 EVALUATING RISK AND RETURN Bartman Industries's and Reynolds Inc.'s stock prices and dividends, along with the Winslow 5000 Index, are shown here for the period 20122017. The Winslow 5000 data are adjusted to include dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started