Answered step by step

Verified Expert Solution

Question

1 Approved Answer

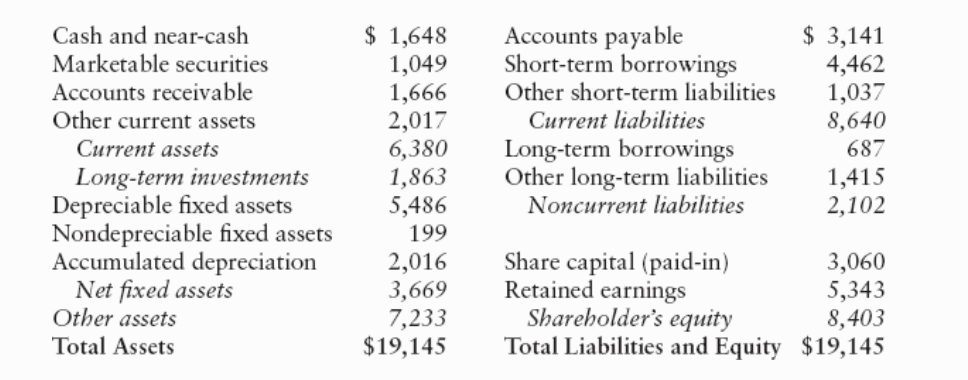

Estimate the firm's quick ratio. Would you draw any conclusions about the riskiness of Coca-Cola as a firm by looking at these numbers? Why or

Estimate the firm's quick ratio. Would you draw any conclusions about the riskiness of Coca-Cola as a firm by looking at these numbers? Why or why not?

Cash and near-cash Marketable securities Accounts receivable Other current assets Current assets Long-term investments Depreciable fixed assets Nondepreciable fixed assets Accumulated depreciation Net fixed assets Other assets Total Assets $ 1,648 1,049 1,666 2,017 6,380 1,863 5,486 199 2,016 3,669 7,233 $19,145 Accounts payable Short-term borrowings Other short-term liabilities Current liabilities Long-term borrowings Other long-term liabilities Noncurrent liabilities $ 3,141 4,462 1,037 8,640 687 1,415 2,102 Share capital (paid-in) 3,060 Retained earnings 5,343 Shareholder's equity 8,403 Total Liabilities and Equity $19,145Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started