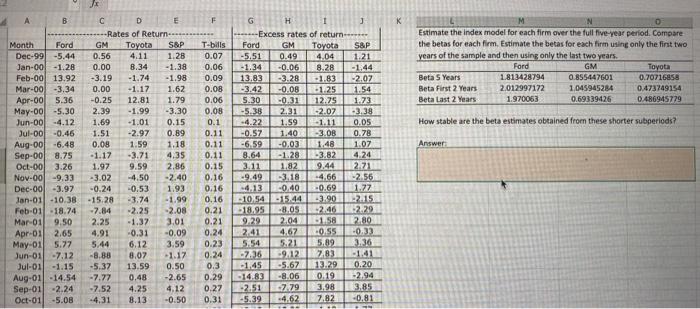

Estimate the index model for each firm over the full five-year period. Compare the betas for each firm. Estimate the betas for each firm using only the first two years of the sample and then using only the last two years.

Ford

Beta 5 Years: 1.813428794

Beta First 2 Years: 2.012997172

Beta Last 2 Years: 1.970063

GM

Beta 5 Years: 0.855447601

Beta First 2 Years: 1.045945284

Beta Last 2 Years: 0.69339426

Toyota

Beta 5 Years: 0.70716858

Beta First 2 Years: 0.473749154

Beta Last 2 Years: 0.486945779

How stable are the beta estimates obtained from these shorter sub periods?

A B K Estimate the index model for each firm over the full five-year period. Compare the betas for each firm. Estimate the betas for each firm using only the first two years of the sample and then using only the last two years. Ford GM Toyota Beta 5 Years 1.813428794 0.855447601 0.70716858 Beta First 2 years 2.012997172 1.045945284 0.473749154 Beta Last 2 years 1.970063 0.69339426 0.486945779 How stable are the beta estimates obtained from these shorter subperiods? 1.48 1.07 Answer Month Ford Dec-99 -5.44 Jan-00 -1.28 Feb-00 13.92 Mar-00 -3.34 Apr-00 5.36 May-00 -5.30 Jun-00 -4.12 Jul-00 -0.46 Aug-00 -6.48 Sep-00 8.75 Oct-00 3.26 Nov-00-9.33 Dec-00-3.97 Jan-01 -10.38 Feb-01 -18.74 Mar-01 9.50 Apr-01 2.65 May-01 5.77 Jun-01 -7.12 Jul-011 -1.15 Aug.01 -14.54 Sep-01 -2.24 Oct-01 -5.08 D E -Rates of Return GM Toyota S&P 0.56 4.11 1.28 0.00 8.34 -1.38 -3.19 -1.74 -1.98 0.00 -1.17 1.62 -0.25 12.81 1.79 2.39 -1.99 -3.30 1.69 -1.01 0.15 1.51 -2.97 0.89 0.08 1.59 1.18 -1.17 -3.71 4,35 1.97 9.59 2.86 -3.02 -4.50 -2.40 -0.24 -0.53 1.93 -15.28 -3.74 -1.99 -7.84 -2.25 2.08 2.25 -1.37 3.01 4.91 -0.31 -0.09 5.44 6.12 3.59 -8.88 8.07 1.17 -5.37 13.59 0.50 -7.77 0.48 -2.65 -7.52 4.25 4.12 -4.31 8.13 -0.50 F G H J Excess rates of return T-bills Ford GM Toyota S&P 0.07 -5.51 0.49 4.04 1.21 0.06 -1.34 -0.06 8.28 -1.44 0.09 13.83 -3.28 -1.83 -2.07 0.08 -3.42 -0.08 -1.25 1.54 0.06 5.30 -0.31 12.75 0.08 -5.38 2.31 -2.07 -3.38 0.1 -4.22 1.59 -1.11 0.05 0.11 -0.57 1.40 -3.08 0.78 0.11 -6.59 -0.03 0.11 8.64 -1.28 -3.82 4.24 0.15 3.11 1.82 9.44 2.21 0.16 9.49 3.18 -4.66 0.16 -4.13 -0.40 -0.69 0.16 -10.54 - 15.44 32.90 2.15 0.21 18.95 80s -2.46 2.29 0.21 9.29 2.04 2.80 0.24 2.41 4.67 -0.55 -0.3) 0.23 5.54 5.21 5.89 2.36 0.24 -2.36 -9.12 7.83 0.3 -1.45 -5.67 13.29 0.20 0.29 -14.83 -8.06 0.19 -2.94 0.27 2.79 3.98 0.31 -5.39 -4.62 7.82 -0.81 1.27 11 3.85 A B K Estimate the index model for each firm over the full five-year period. Compare the betas for each firm. Estimate the betas for each firm using only the first two years of the sample and then using only the last two years. Ford GM Toyota Beta 5 Years 1.813428794 0.855447601 0.70716858 Beta First 2 years 2.012997172 1.045945284 0.473749154 Beta Last 2 years 1.970063 0.69339426 0.486945779 How stable are the beta estimates obtained from these shorter subperiods? 1.48 1.07 Answer Month Ford Dec-99 -5.44 Jan-00 -1.28 Feb-00 13.92 Mar-00 -3.34 Apr-00 5.36 May-00 -5.30 Jun-00 -4.12 Jul-00 -0.46 Aug-00 -6.48 Sep-00 8.75 Oct-00 3.26 Nov-00-9.33 Dec-00-3.97 Jan-01 -10.38 Feb-01 -18.74 Mar-01 9.50 Apr-01 2.65 May-01 5.77 Jun-01 -7.12 Jul-011 -1.15 Aug.01 -14.54 Sep-01 -2.24 Oct-01 -5.08 D E -Rates of Return GM Toyota S&P 0.56 4.11 1.28 0.00 8.34 -1.38 -3.19 -1.74 -1.98 0.00 -1.17 1.62 -0.25 12.81 1.79 2.39 -1.99 -3.30 1.69 -1.01 0.15 1.51 -2.97 0.89 0.08 1.59 1.18 -1.17 -3.71 4,35 1.97 9.59 2.86 -3.02 -4.50 -2.40 -0.24 -0.53 1.93 -15.28 -3.74 -1.99 -7.84 -2.25 2.08 2.25 -1.37 3.01 4.91 -0.31 -0.09 5.44 6.12 3.59 -8.88 8.07 1.17 -5.37 13.59 0.50 -7.77 0.48 -2.65 -7.52 4.25 4.12 -4.31 8.13 -0.50 F G H J Excess rates of return T-bills Ford GM Toyota S&P 0.07 -5.51 0.49 4.04 1.21 0.06 -1.34 -0.06 8.28 -1.44 0.09 13.83 -3.28 -1.83 -2.07 0.08 -3.42 -0.08 -1.25 1.54 0.06 5.30 -0.31 12.75 0.08 -5.38 2.31 -2.07 -3.38 0.1 -4.22 1.59 -1.11 0.05 0.11 -0.57 1.40 -3.08 0.78 0.11 -6.59 -0.03 0.11 8.64 -1.28 -3.82 4.24 0.15 3.11 1.82 9.44 2.21 0.16 9.49 3.18 -4.66 0.16 -4.13 -0.40 -0.69 0.16 -10.54 - 15.44 32.90 2.15 0.21 18.95 80s -2.46 2.29 0.21 9.29 2.04 2.80 0.24 2.41 4.67 -0.55 -0.3) 0.23 5.54 5.21 5.89 2.36 0.24 -2.36 -9.12 7.83 0.3 -1.45 -5.67 13.29 0.20 0.29 -14.83 -8.06 0.19 -2.94 0.27 2.79 3.98 0.31 -5.39 -4.62 7.82 -0.81 1.27 11 3.85