Question

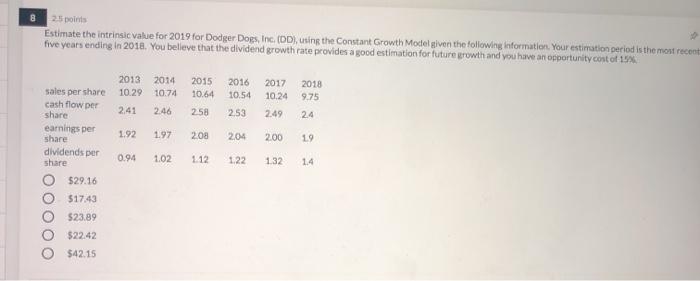

25 points Estimate the intrinsic value for 2019 for Dodger Dogs, Inc. (DD), using the Constant Growth Model given the following information. Your estimation

25 points Estimate the intrinsic value for 2019 for Dodger Dogs, Inc. (DD), using the Constant Growth Model given the following information. Your estimation period is the most recent five years ending in 2018. You believe that the dividend growth rate provides a good estimation for future growth and you have an opportunity cost of 15% sales per share cash flow per share earnings per share dividends per share $29.16 $17.43 $23.89 $22.42 $42.15 2013 2014 10.29 10.74 2.46 2.58 2.53 2.41 2.04 1.92 0.94 1.97 1.02 2015 2016 2017 10.64 10.54 10.24 2.49 24 2.08 1.12 1.22 2018 9.75 2.00 19 1.32 14

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Option c is correct As per Constant growth model or Gordon model share price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App