Answered step by step

Verified Expert Solution

Question

1 Approved Answer

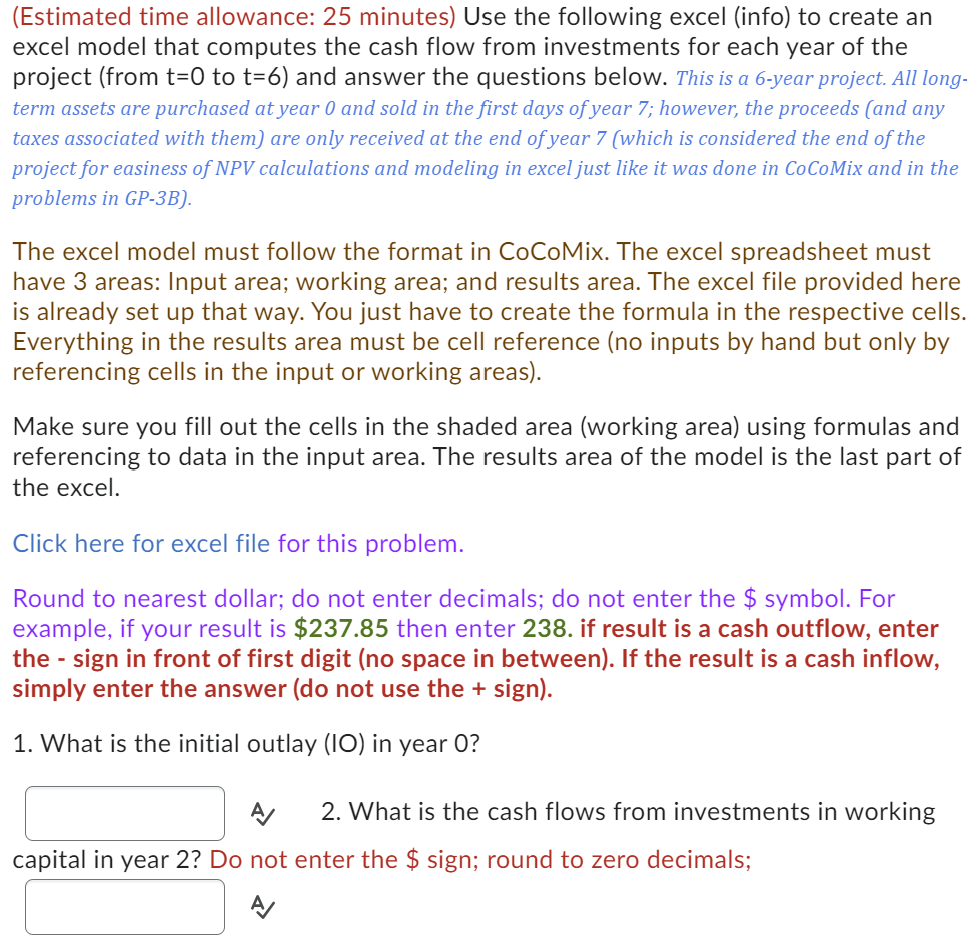

( Estimated time allowance: 2 5 minutes ) Use the following excel ( info ) to create an excel model that computes the cash flow

Estimated time allowance: minutes Use the following excel info to create an

excel model that computes the cash flow from investments for each year of the

project from to and answer the questions below. This is a year project. All long

term assets are purchased at year and sold in the first days of year ; however, the proceeds and any

taxes associated with them are only received at the end of year which is considered the end of the

project for easiness of NPV calculations and modeling in excel just like it was done in CoCoMix and in the

problems in GPB

The excel model must follow the format in CoCoMix. The excel spreadsheet must

have areas: Input area; working area; and results area. The excel file provided here

is already set up that way. You just have to create the formula in the respective cells.

Everything in the results area must be cell reference no inputs by hand but only by

referencing cells in the input or working areas

Make sure you fill out the cells in the shaded area working area using formulas and

referencing to data in the input area. The results area of the model is the last part of

the excel.

Click here for excel file for this problem.

Round to nearest dollar; do not enter decimals; do not enter the $ symbol. For

example, if your result is $ then enter if result is a cash outflow, enter

the sign in front of first digit no space in between If the result is a cash inflow,

simply enter the answer do not use the sign

What is the initial outlay in year

A What is the cash flows from investments in working

capital in year Do not enter the $ sign; round to zero decimals;

A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started