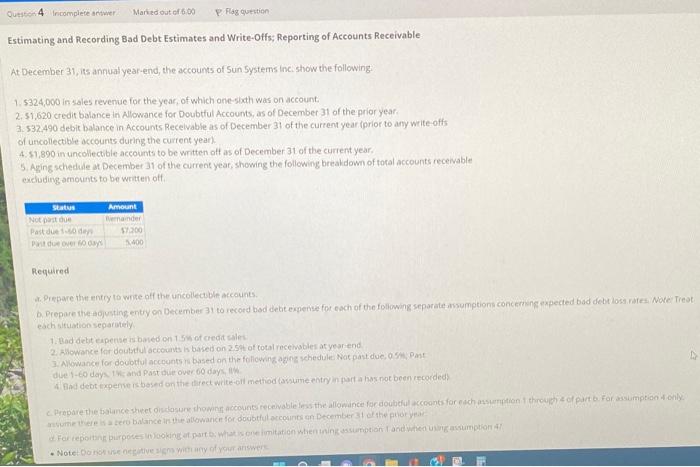

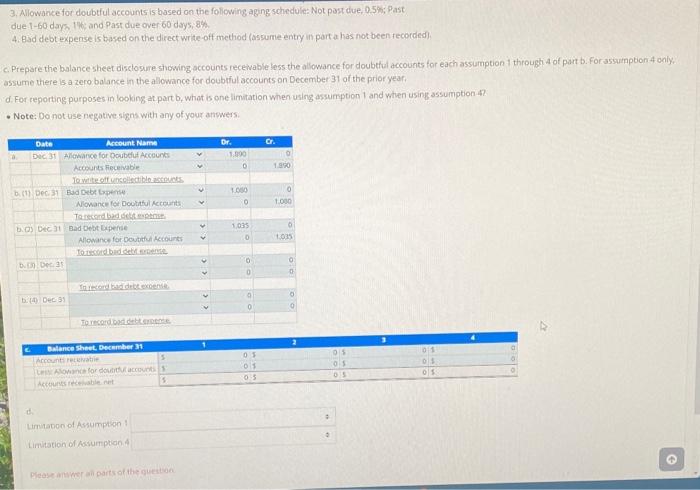

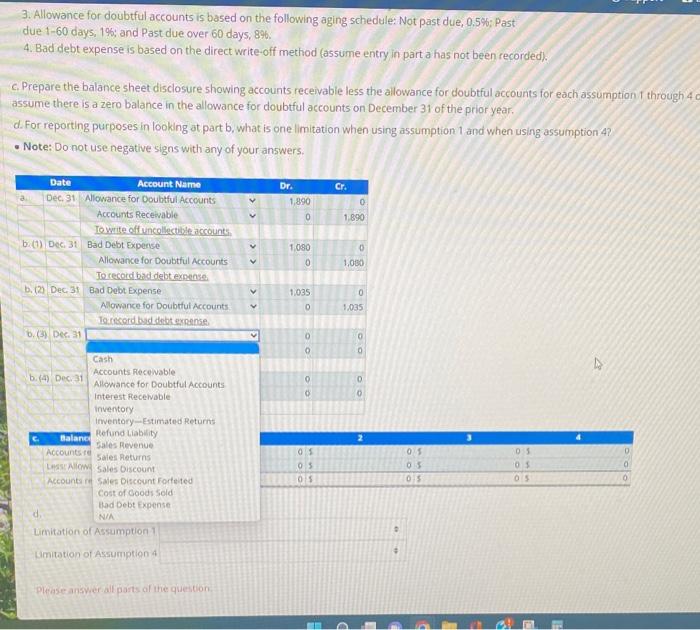

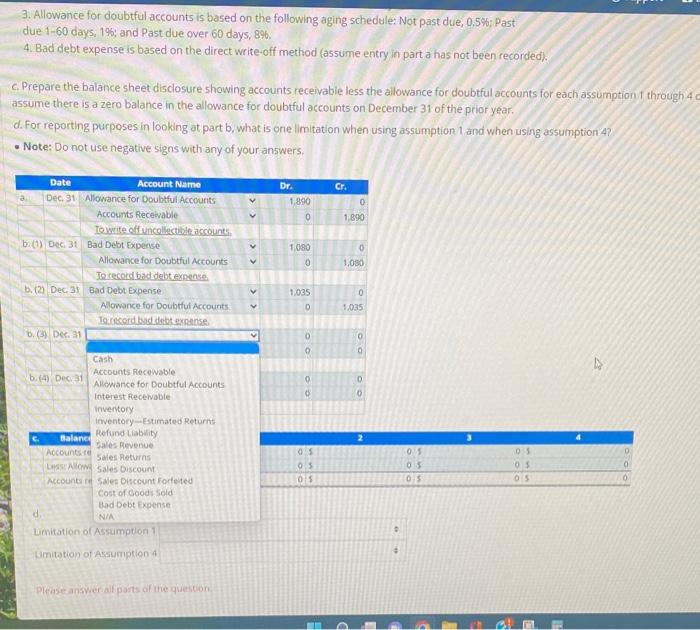

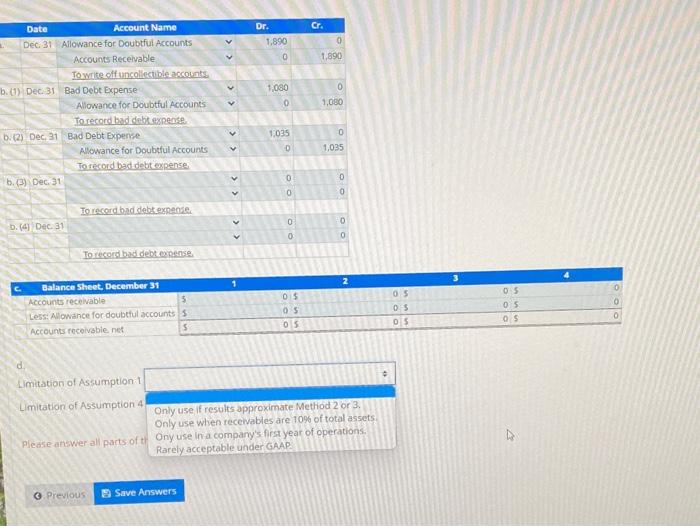

Estimating and Recording Bad Debt Estimates and Write-Offs; Reporting of Accounts Receivable At December 31, its annual year-end, the accounts of Sun Systems inci show the following 1. $324,000 in sales revenue for theyear, of which one-sixth was on account. 2.51,620 credit balance in Allowance for Doubtful Accounts, as of December 31 of the prior year: 3. 537.490 debit balance in Accounts Recelvable as of December 31 of the curtent year iprior to any wette-offs of uncollectible occounts during the current year). 4. \$1,890 ir uncollectible accounts to be wnitten aff as of December 31 of the current year. 5. Aging schedude at December 31 of the current year, showing the following breakdown of toral accounts receivablet exchuding amounts to be written off Required 3. Prepare thet entcy to wiste att the uncollectble accounts. each bituation separately 1. Had detit expense is baned on 1.5 is of credit walet. 3. Alowance for douotiul accounts deee 1-6o days 1 higatud Past die over 60 days, 1 the 3. Allowance for doubtful accounts is based on the foliowing aging scheduric: Not past due, 0.5%; Past, due 1-60 days 14t and Past due over 60 days, 8% 4. Bajd debt expense is based on the direct write-off-method (assume entry in part a has not been recorded). c. Prepare the balance sheet disclogure showing accounts recewable less the allowance for doubtful accounts for each assiamption 1 through 4 of pait b. For assuinption 4 only. assume there is a zero balance in the allowance for doubtful accounts on December 31 of the prior yeafi d. For reporting purposes in looking at part b, whot is one limitation when using assumption 1 and when using assumption - at? - Note: Do not-use negative signs with any of your arwwers. 3. Allowance for doubtful accounts is based on the following aging schedule: Not past due, 0.5%; Past due 1-60 days, 19; and Past due over 60 days, 8%. 4. Bad debt expense is based on the direct write-off method (assume entry in part a has not been recorded). c. Prepare the balance sheet disclosure showing accounts receivabie less the allowance for doubtful accounts for each assumption t through 4 e assume there is a zero balance in the allowance for doubtful accounts on December 31 of the prior year. d. For reporting purposes in looking at part b, what is one limitation when using assumption 1 and when using assumption 4 ? - Note: Do not use negative signs with any of your answers. 3. Allowance for doubtful accounts is based on the following aging schedule: Not past due, 0.5%; Past due 1-60 days, 19; and Past due over 60 days, 8%. 4. Bad debt expense is based on the direct write-off method (assume entry in part a has not been recorded). c. Prepare the balance sheet disclosure showing accounts receivabie less the allowance for doubtful accounts for each assumption t through 4 e assume there is a zero balance in the allowance for doubtful accounts on December 31 of the prior year. d. For reporting purposes in looking at part b, what is one limitation when using assumption 1 and when using assumption 4 ? - Note: Do not use negative signs with any of your answers. Limitation of Assumption: 1 Limitation of Assumption 4 Please ansver all parts of Estimating and Recording Bad Debt Estimates and Write-Offs; Reporting of Accounts Receivable At December 31, its annual year-end, the accounts of Sun Systems inci show the following 1. $324,000 in sales revenue for theyear, of which one-sixth was on account. 2.51,620 credit balance in Allowance for Doubtful Accounts, as of December 31 of the prior year: 3. 537.490 debit balance in Accounts Recelvable as of December 31 of the curtent year iprior to any wette-offs of uncollectible occounts during the current year). 4. \$1,890 ir uncollectible accounts to be wnitten aff as of December 31 of the current year. 5. Aging schedude at December 31 of the current year, showing the following breakdown of toral accounts receivablet exchuding amounts to be written off Required 3. Prepare thet entcy to wiste att the uncollectble accounts. each bituation separately 1. Had detit expense is baned on 1.5 is of credit walet. 3. Alowance for douotiul accounts deee 1-6o days 1 higatud Past die over 60 days, 1 the 3. Allowance for doubtful accounts is based on the foliowing aging scheduric: Not past due, 0.5%; Past, due 1-60 days 14t and Past due over 60 days, 8% 4. Bajd debt expense is based on the direct write-off-method (assume entry in part a has not been recorded). c. Prepare the balance sheet disclogure showing accounts recewable less the allowance for doubtful accounts for each assiamption 1 through 4 of pait b. For assuinption 4 only. assume there is a zero balance in the allowance for doubtful accounts on December 31 of the prior yeafi d. For reporting purposes in looking at part b, whot is one limitation when using assumption 1 and when using assumption - at? - Note: Do not-use negative signs with any of your arwwers. 3. Allowance for doubtful accounts is based on the following aging schedule: Not past due, 0.5%; Past due 1-60 days, 19; and Past due over 60 days, 8%. 4. Bad debt expense is based on the direct write-off method (assume entry in part a has not been recorded). c. Prepare the balance sheet disclosure showing accounts receivabie less the allowance for doubtful accounts for each assumption t through 4 e assume there is a zero balance in the allowance for doubtful accounts on December 31 of the prior year. d. For reporting purposes in looking at part b, what is one limitation when using assumption 1 and when using assumption 4 ? - Note: Do not use negative signs with any of your answers. 3. Allowance for doubtful accounts is based on the following aging schedule: Not past due, 0.5%; Past due 1-60 days, 19; and Past due over 60 days, 8%. 4. Bad debt expense is based on the direct write-off method (assume entry in part a has not been recorded). c. Prepare the balance sheet disclosure showing accounts receivabie less the allowance for doubtful accounts for each assumption t through 4 e assume there is a zero balance in the allowance for doubtful accounts on December 31 of the prior year. d. For reporting purposes in looking at part b, what is one limitation when using assumption 1 and when using assumption 4 ? - Note: Do not use negative signs with any of your answers. Limitation of Assumption: 1 Limitation of Assumption 4 Please ansver all parts of