Estimating the Return on Equity (ROE) Using DuPont Model. Use the DuPont equation to provide a summary and overview of your company financial condition. Based on DuPont Equation, what are the firms major strengths and weaknesses?

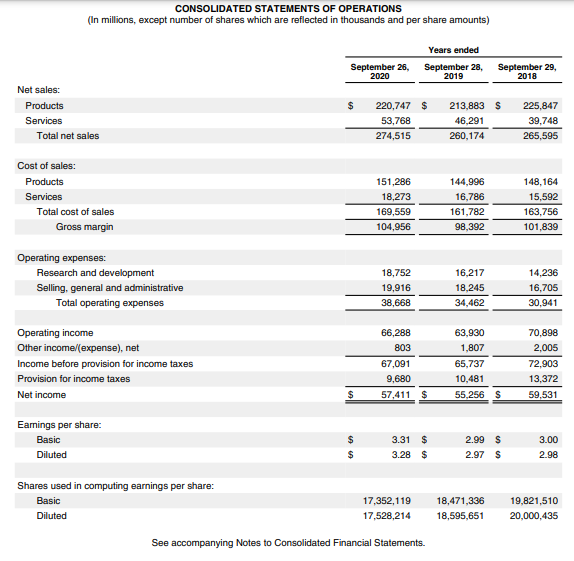

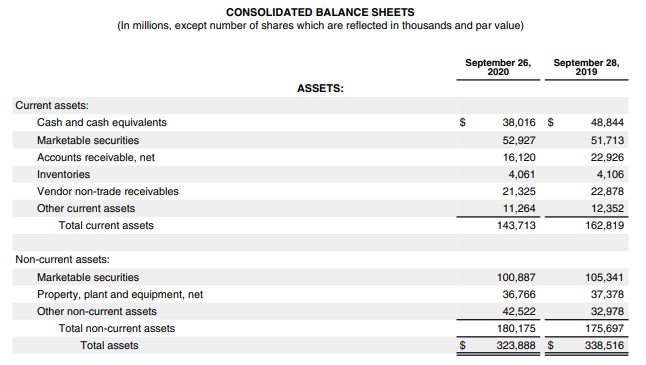

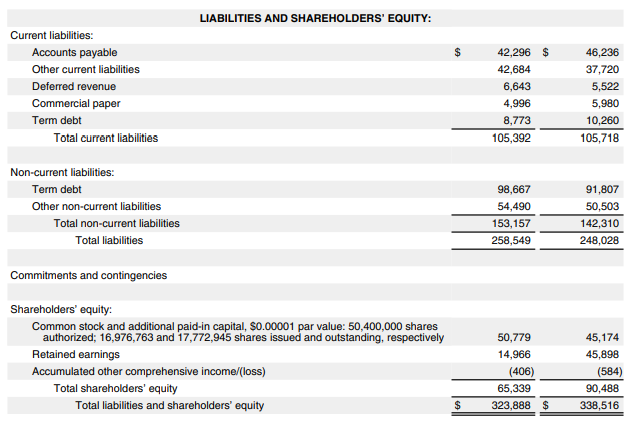

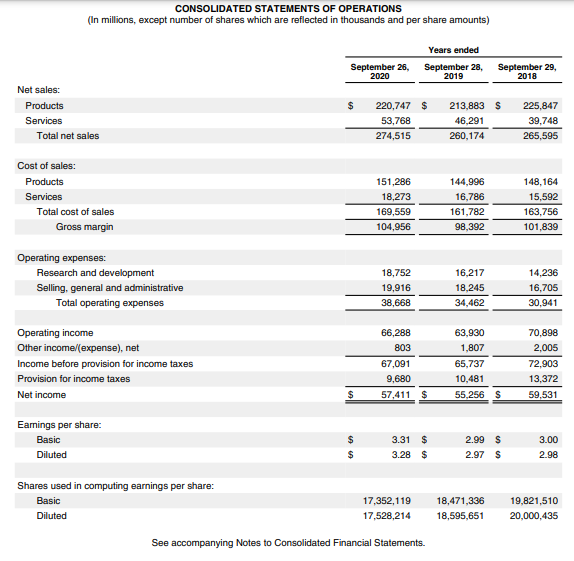

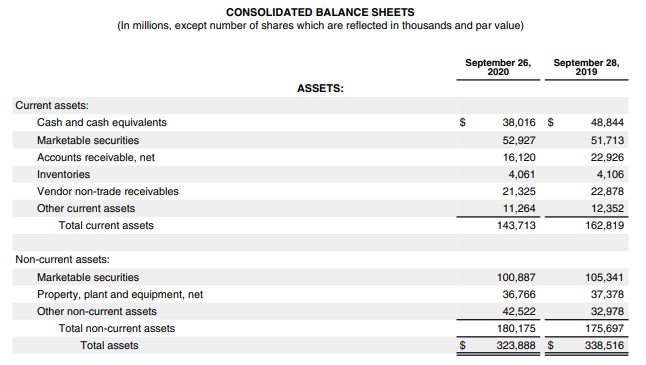

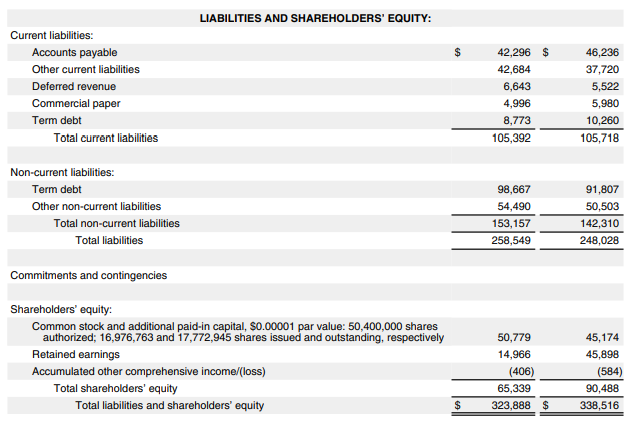

I have attached the income statement and balance sheet below - to be calculated for both year 2019 and 2020

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) September 26, 2020 Years ended September 28, September 29, 2019 2018 Net sales: Products Services Total net sales 220,747 $ 53,768 274,515 213,883 $ 46.291 260,174 225,847 39,748 265,595 Cost of sales: Products Services Total cost of sales Gross margin 151,286 18,273 169,559 104,956 144.996 16,786 161,782 98.392 148,164 15,592 163.756 101,839 Operating expenses: Research and development Selling, general and administrative Total operating expenses 18,752 19,916 38,668 16,217 18.245 34,462 14,236 16,705 30,941 Operating income Other income (expense), net Income before provision for income taxes Provision for income taxes Net income 66,288 803 67,091 9,680 57,411 $ 63,930 1,807 65,737 10,481 55,256 $ 70.898 2,005 72.903 13,372 59,531 $ Earnings per share: Basic Diluted $ $ 3.31 $ 3.28 $ 2.99 $ 2.97 $ 3.00 2.98 Shares used in computing earnings per share: Basic Diluted 17,352,119 17,528,214 18,471,336 18,595,651 19,821,510 20,000,435 See accompanying Notes to Consolidated Financial Statements. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 26, 2020 September 28, 2019 ASSETS: Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 38,016 $ 52,927 16,120 4,061 21,325 11,264 143,713 48,844 51,713 22,926 4,106 22,878 12,352 162,819 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 100,887 36,766 42,522 180, 175 323,888 $ 105,341 37,378 32,978 175,697 338,516 $ LIABILITIES AND SHAREHOLDERS' EQUITY: $ Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 42,296 $ 42,684 6,643 4,996 8,773 105,392 46,236 37,720 5,522 5,980 10,260 105,718 Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 98,667 54,490 153, 157 258,549 91,807 50,503 142,310 248,028 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 16,976,763 and 17,772,945 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and shareholders' equity 50,779 14,966 (406) 65,339 323,888 $ 45,174 45,898 (584) 90,488 338,516 $