Question

Estimating Uncollectible Accounts by Aging Receivables Rainy Day Company, a wholesaler, uses the aging method to estimate bad debt losses. The following schedule of aged

Estimating Uncollectible Accounts by Aging Receivables

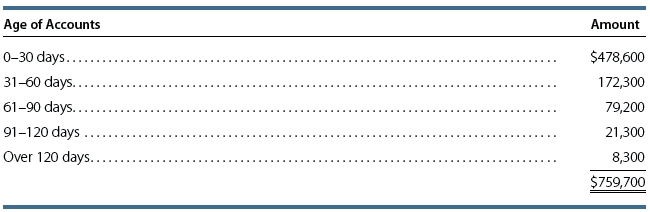

Rainy Day Company, a wholesaler, uses the aging method to estimate bad debt losses. The following schedule of aged accounts receivable was prepared at December 31, 20Y6.

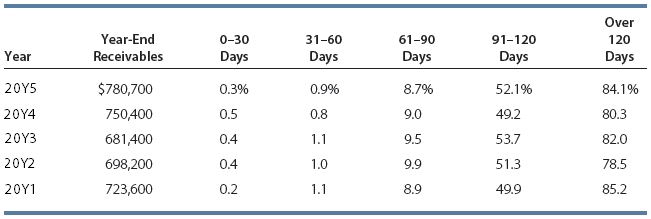

The following schedule shows the year-end receivables balances and uncollectible accounts experience for the previous five years.

The unadjusted Allowance for Bad Debts balance on December 31, 20Y6, is $30,124.

1. Compute the correct balance for the allowance account based on the average loss experience for the last five years. Round the average percentage loss values to two decimal places as you perform the intermediate calculations required to calculate the estimated uncollectible amount. Round dollar amount calculations and your final answer to the nearest dollar.

$ ----

2. Prepare the appropriate end-of-year adjusting entry. (i know the entry as below, just the amounts or how to do it please!)

Allowance for Bad Debts xxxx

Bad Debt Expense xxxx

Amount $478,600 172,300 79,200 21,300 8,300 S759,700 Age of Accounts 0-30 days 91-120 days Over 120daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started