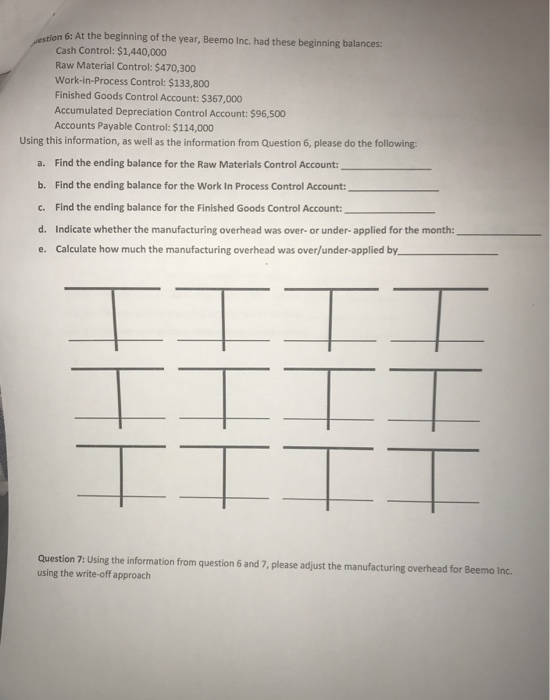

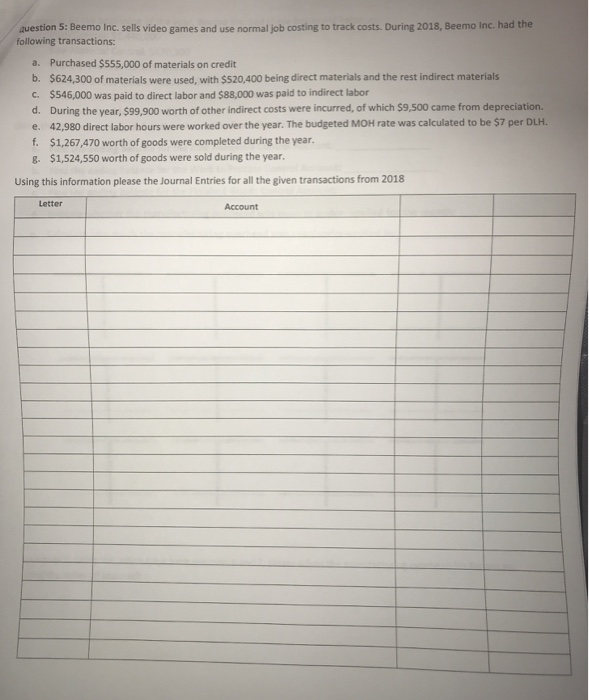

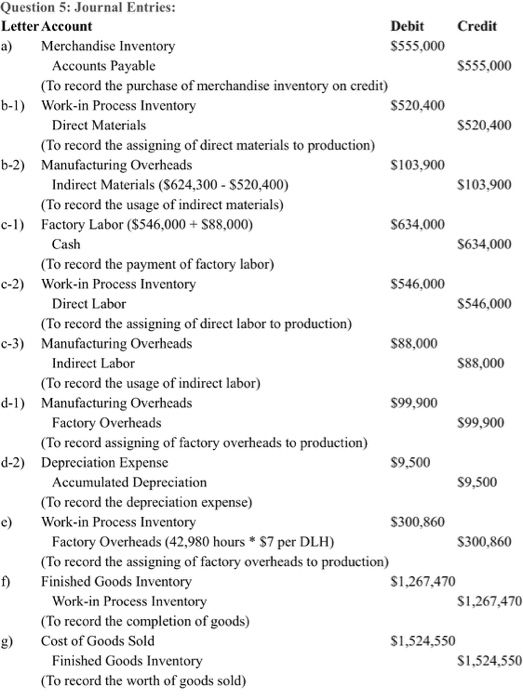

estion 6: At the beginning of the year, Beemo Inc. had these beginning balances: Cash Control: $1,440,000 Raw Material Control: $470,300 Work-in-Process Control: $133,800 Finished Goods Control Account: $367,000 Accumulated Depreciation Control Account: $96,500 Accounts Payable Control: $114,000 Using this information, as well as the information from Question 6, please do the following Find the ending balance for the Raw Materials Control Account: a. Find the ending balance for the Work In Process Control Account: b. c. Find the ending balance for the Finished Goods Control Account: d. Indicate whether the manufacturing overhead was over- or under- applied for the month: Calculate how much the manufacturing overhead was over/under-applied by e. Question 7: Using the information from question 6 and 7, please adjust the manufacturing overhead for Beemo Inc using the write-off approach HHH HH H question 5: Beemo Inc. sells video games and use normal job costing to track costs. During 2018, Beemo Inc. had the following transactions: Purchased $555,000 of materials on credit a. b. $624,300 of materials were used, with $520,400 being direct materials and the rest indirect materials C. $546,000 was paid to direct labor and $88,000 was paid to indirect labor d. During the year, $99,900 worth of other indirect costs were incurred, of which $9,500 came from depreciation. e. 42,980 direct labor hours were worked over the year. The budgeted MOH rate was calculated to be $7 per DLH. f. $1,267,470 worth of goods were completed during the year. 8 $1,524,550 worth of goods were sold during the year. Using this information please the Journal Entries for all the given transactions from 2018 Letter Account Question 5: Journal Entries: Credit Letter Account Debit Merchandise Inventory Accounts Payable (To record the purchase of merchandise inventory on credit) Work-in Process Inventory $555,000 a) $555,000 b-1) $520,400 Direct Materials $520,400 (To record the assigning of direct materials to production) b-2) Manufacturing Overheads Indirect Materials ($624,300 - $520,400) $103,900 $103,900 (To record the usage of indirect materials) Factory Labor ($546,000 + $88,000 c-1) $634,000 Cash $634,000 (To record the payment of factory labor) Work-in Process Inventory $546,000 c-2) $546,000 Direct Labor (To record the assigning of direct labor to production) Manufacturing Overheads c-3) $88,000 Indirect Labor $88,000 (To record the usage of indirect labor) Manufacturing Overheads Factory Overheads (To record assigning of factory overheads to production) d-1) $99,900 $99,900 d-2) Depreciation Expense $9,500 $9,500 Accumulated Depreciation (To record the depreciation expense) Work-in Process Inventory $300,860 e) Factory Overheads (42,980 hours $7 per DLH) (To record the assigning of factory overheads to production) Finished Goods Inventory S300,860 $1,267,470 Work-in Process Inventory S1,267,470 (To record the completion of goods) Cost of Goods Sold $1,524,550 g) Finished Goods Inventory S1,524,550 (To record the worth of goods sold)