Answered step by step

Verified Expert Solution

Question

1 Approved Answer

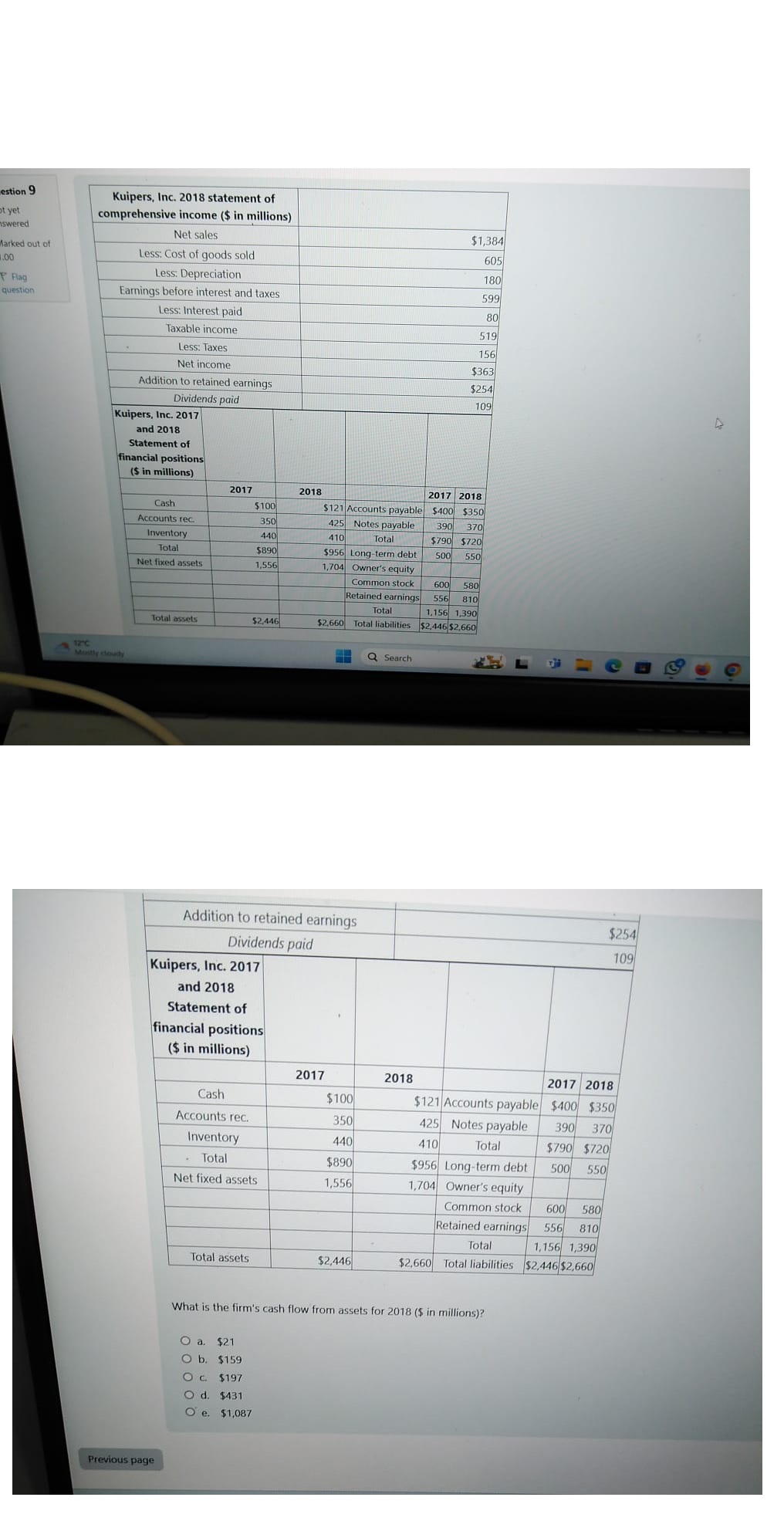

estion 9 Sot yet nswered Marked out of 1.00 Flag question Kuipers, Inc. 2018 statement of comprehensive income ($ in millions) Net sales Less:

estion 9 Sot yet nswered Marked out of 1.00 Flag question Kuipers, Inc. 2018 statement of comprehensive income ($ in millions) Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid Taxable income Less: Taxes Net income Addition to retained earnings Dividends paid Kuipers, Inc. 2017 and 2018 Statement of financial positions ($ in millions) 12C Mostly cloudy $1,384 605 180 599 80 519 156 $363 $254 109 4 2017 2018 2017 2018 Cash Accounts rec $100 $121 Accounts payable $400 $350 350 425 Notes payable 390 370 Inventory 440 410 Total $790 $720 Total $890 Net fixed assets 1,556 $956 Long-term debt 1,704 Owner's equity Common stock Retained earnings 500 550 Total 600 580 556 810 1,156 1,390 Total assets $2,446 $2,660 Total liabilities $2,446 $2,660 Addition to retained earnings Dividends paid Kuipers, Inc. 2017 and 2018 Statement of financial positions ($ in millions) Previous page Q Search $254 109 2017 2018 2017 2018 Cash $100 $121 Accounts payable $400 $350 Accounts rec. 350 425 Notes payable 390 370 Inventory 440 410 Total $790 $720 . Total $890 $956 Long-term debt 500 550 Net fixed assets 1,556 1,704 Owner's equity Total assets Common stock 600 580 Retained earnings 556 810 Total 1,156 1,390 $2,446 $2,660 Total liabilities $2,446 $2,660 What is the firm's cash flow from assets for 2018 ($ in millions)? O a. $21 O b. $159 C. $197 O d. $431 O e. $1,087

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started