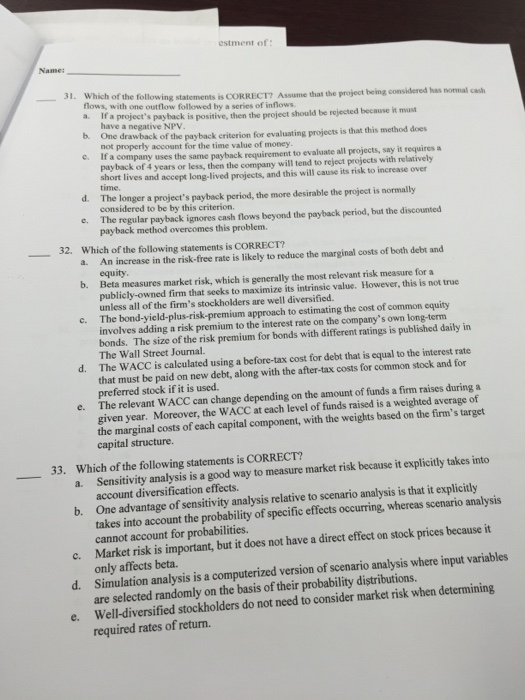

estment of: Name: Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows a. If a . If a project's pay back is positive, then the project should be rejected because it nwast have a negative NPv b. One drawback of One drawback of the payback eriterion for evaluating projects is that this method does not properly account for the time value of money c. If a company uses the same payback requirement to evaluate all projects, say it requires a payback of 4 years or less, then the company will tend to reject projects with relatively short lives and accept long-lived projects, and this will cause its risk to increase over time. d. The longer a project's payback period, the more desirable the project is normally considered to be by this criterion The regular payback ignores cash flows beyond the payback period, but the discounted e. payback method overcomes this problem. Which of the following statements is CORRECT? a. -32. An increase in the risk-free rate is likely to reduce the marginal costs of both debt and equity b. Beta measures market risk, which is generally the most relevant risk measure for a publicly-owned firm that seeks to maximize its intrinsic value. However, this is not true unless all of the firm's stockholders are well diversified. c. The bond-yield-plus-risk-premium approach to estimating the cost of common equity involves adding a risk premium to the interest rate on the company's own long-term bonds. The size of the risk premium for bonds with different ratings is published daily in The Wall Street Journal. d The WACC is calculated using a before-tax cost for debt that is equal to the interest rate that must be paid on new debt, along with the after-tax costs for common stock and for preferred stock if it is used The relevant WACC can change depending on the amount of funds a firm raises during a Moreover, the WACC at each level of funds raised is a weighted average of e. given year. the marginal costs of each capital component, with the weights based on the firm's target capital structure. Which of the following statements is CORRECT? a. 33. Sensitivity analysis is a good way to measure market risk because it explicitly takes into account diversification effects. One advantage of sensitivity analysis relative to scenario analysis is that it explicitly takes into account the probability of specific effects occurring, whereas scenario analysis cannot account for probabilities. Market risk is important, but it does not have a direct effect on stock prices because it only affects beta. Simulation analysis is a computerized version of scenario analysis where input variables b. c. Simulation analysis is a computerized version of scenario analysis where input variables are selected randomly on the basis of their probability distributions. Well-diversified stockholders do not need to consider market risk when determining required rates of return. d. e