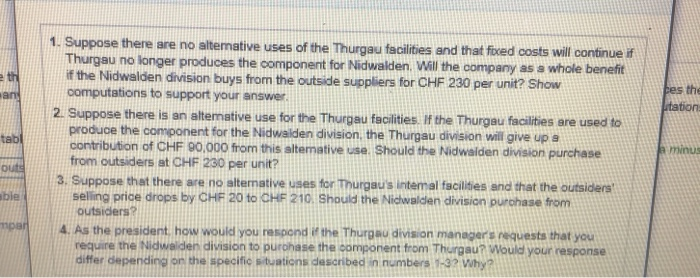

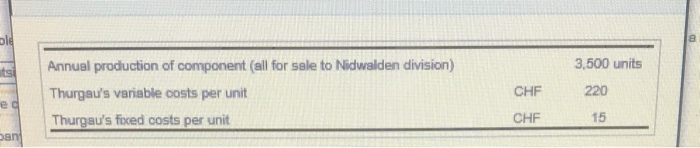

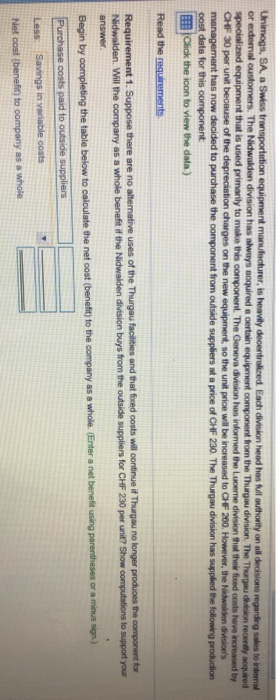

eth an tes the Litation tabi 1. Suppose there are no alternative uses of the Thurgau facilities and that fixed costs will continue if Thurgau no longer produces the component for Nidwalden. Will the company as a whole benefit if the Nidwalden division buys from the outside suppliers for CHF 230 per unit? Show computations to support your answer. 2. Suppose there is an alternative use for the Thurgau facilities. If the Thurgau facilities are used to produce the component for the Nidwalden division, the Thurgau division will give up a contribution of CHF 90.000 from this alternative use. Should the Nidwalden division purchase from outsiders at CHF 230 per unit? 3. Suppose that there are no alternative uses for Thurgau's internal facilities and that the outsiders! selling price drops by CHF 20 to CHF 210. Should the Nichwalden division purchase from outsiders? 4. As the president how would you respond if the Thurgau division manager's requests that you require the Nidwalden division to purchase the component from Thurgau? Would your response differ depending on the specific situations described in numbers 1-3? Why? minus out able mpar old 3,500 units Annual production of component (all for sale to Nidwalden division) Thurgau's variable costs per unit Thurgau's fixed costs per unit CHF 220 e CHF 15 ben Unimogs, SA, a Swiss transportation equipment manufacturer, is heavily decentralized. Each division head has full authority on all decisions regarding sales to internal or eademal customers. The Nichwalden division has always noquired a certain equipment component from the Thurgau division. The Thurgau division recently squired specialized equipment that is used primarily to make this component. The Geneva division has informed the Lucerne division that their foed costs have increased by CHF 30 per unit because of the depreciation charges on the new equipment, so the unit prion will be increased to CHF 260. However, the Nidwalden division's management has now decided to purchase the component from outside suppliers at a price of CHF 230. The Thurgau division has supplied the following production oost data for this component Click the icon to view the data) Read the requirements Requirement 1. Suppose there are no alternative uses of the Thurgau facilities and that foved costs will continue if Thurgau no longer produces the component for Nidwalden. Will the company as a whole benefit if the Nidwalden division buys from the outside suppliers for CHF 230 per unit? Show computations to support your answer. Begin by completing the table below to calculate the net oost (benefit) to the company as a whole. (Enter a net benefit using parentheses or a minus sion) Purchase costs paid to outside suppliers Less Savings in variable costs Net cost benefit) to company as a whole