Answered step by step

Verified Expert Solution

Question

1 Approved Answer

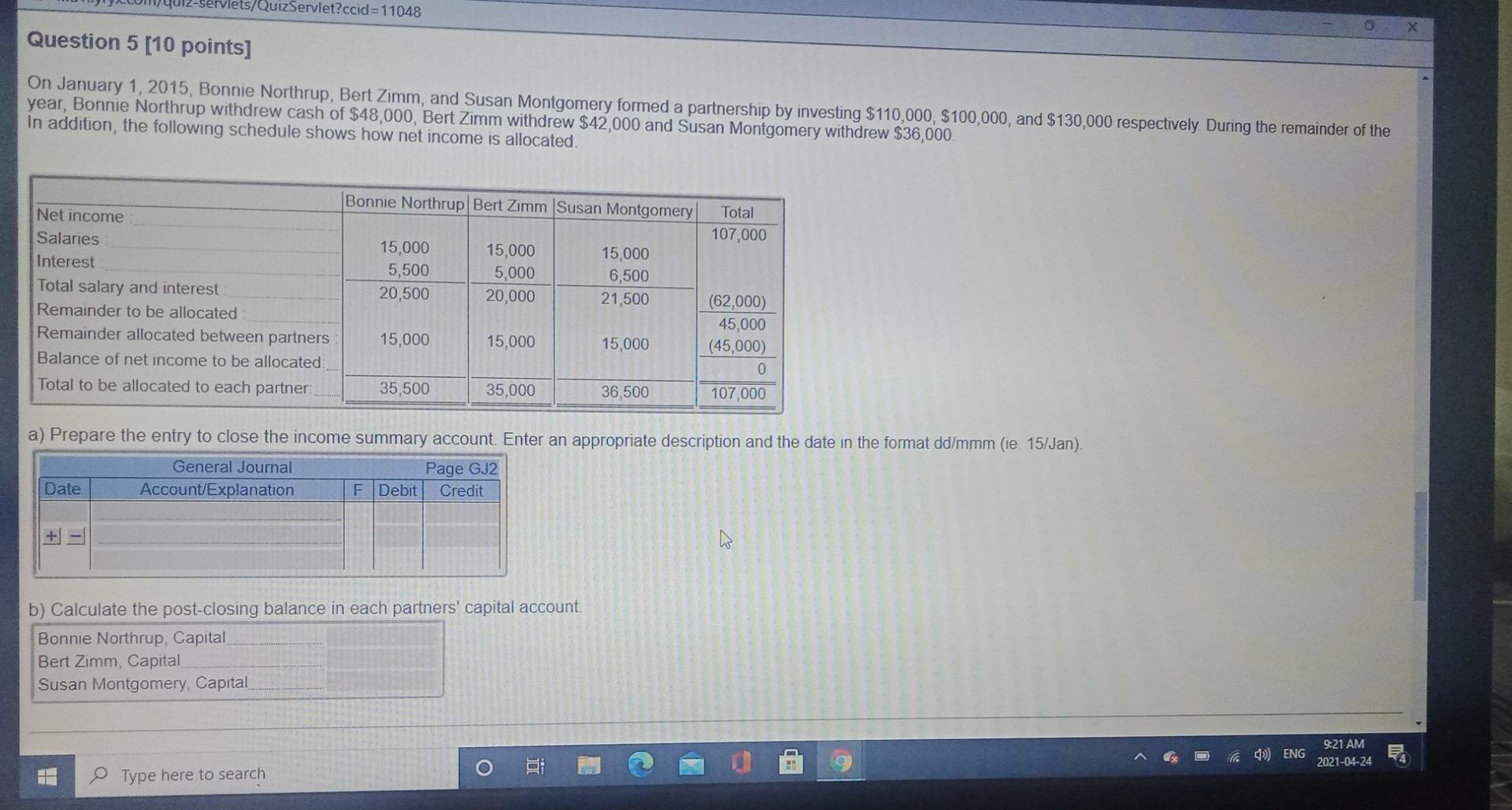

ets/QuizServlet?ccid=11048 Question 5 [10 points] On January 1, 2015, Bonnie Northrup, Bert Zimm, and Susan Montgomery formed a partnership by investing $110,000, $100,000, and $130,000

ets/QuizServlet?ccid=11048 Question 5 [10 points] On January 1, 2015, Bonnie Northrup, Bert Zimm, and Susan Montgomery formed a partnership by investing $110,000, $100,000, and $130,000 respectively During the remainder of the year, Bonnie Northrup withdrew cash of $48,000, Bert Zimm withdrew $42,000 and Susan Montgomery withdrew $36,000 In addition, the following schedule shows how net income is allocated Total 107,000 Bonnie Northrup Bert Zimm Susan Montgomery Net income Salaries 15,000 15,000 15,000 Interest 5,500 5,000 6,500 Total salary and interest 20,500 20,000 21,500 Remainder to be allocated Remainder allocated between partners 15,000 15,000 15,000 Balance of net income to be allocated Total to be allocated to each partner 35,500 35,000 36,500 (62,000) 45,000 (45,000) 0 107,000 a) Prepare the entry to close the income summary account. Enter an appropriate description and the date in the format dd/mmm (ie 15/Jan). General Journal Page GJ2 Date Account/Explanation F Debit Credit + - b) Calculate the post-closing balance in each partners' capital account. Bonnie Northrup. Capital Bert Zimm, Capital Susan Montgomery, Capital la ) ENG 9:21 AM 2021-04-24 PE Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started