Question

Etsy is the chosen Company and Shopify is the competitor use the data provided to answer the following question on WACC (Weighted Average Cost of

Etsy is the chosen Company and Shopify is the competitor

use the data provided to answer the following question on WACC (Weighted Average Cost of Capital)

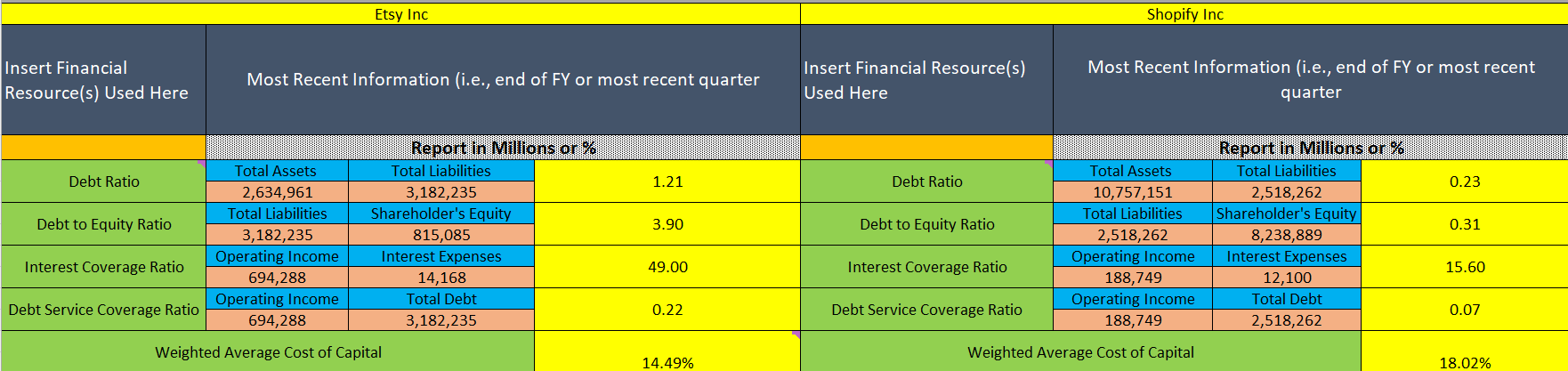

How do your chosen company's WACC and debt and leverage ratios compare to its closest competitor? What are the key drivers to the WACC and the debt and leverage ratios?

A firms WACC is likely to be higher if its stock is relatively volatile or if its debt is seen as risky because investors will demand greater returns. Considering this information, what is the WACC of your chosen company and its closest competitor? Does one company appear more volatile than the other? How does the WACC translate to both companies stock performance?

find three debt/leverage ratios for your chosen company and its closest competitor. How does your chosen company compare to its closest competitor, as far as these ratios? What inference can you draw from the historical ratios and where they are now?

Which of the two companies is the better run company?

find three debt/leverage ratios for your chosen company and its closest competitor. How does your chosen company compare to its closest competitor, as far as these ratios? What inference can you draw from the historical ratios and where they are now?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started