Answered step by step

Verified Expert Solution

Question

1 Approved Answer

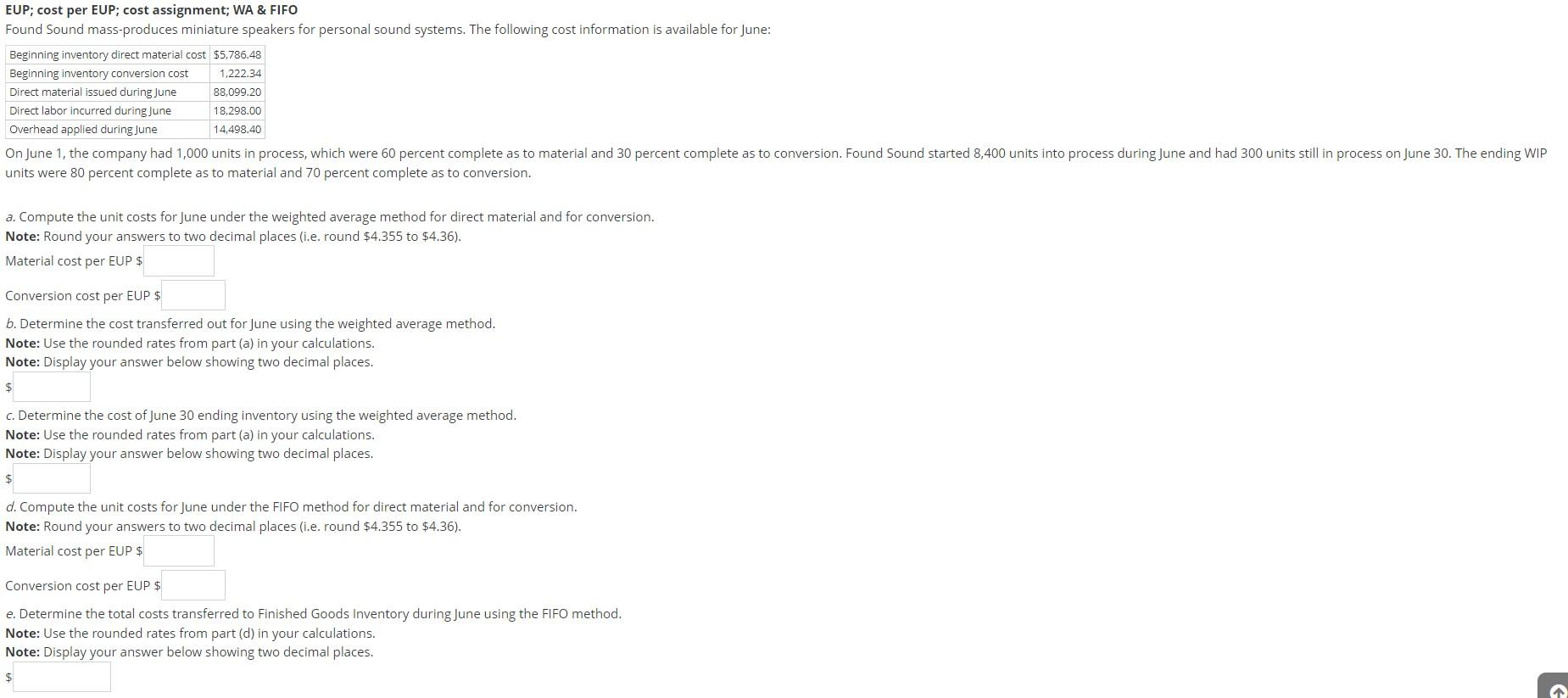

EUP; cost per EUP; cost assignment; WA & FIFO Found Sound mass-produces miniature speakers for personal sound systems. The following cost information is available

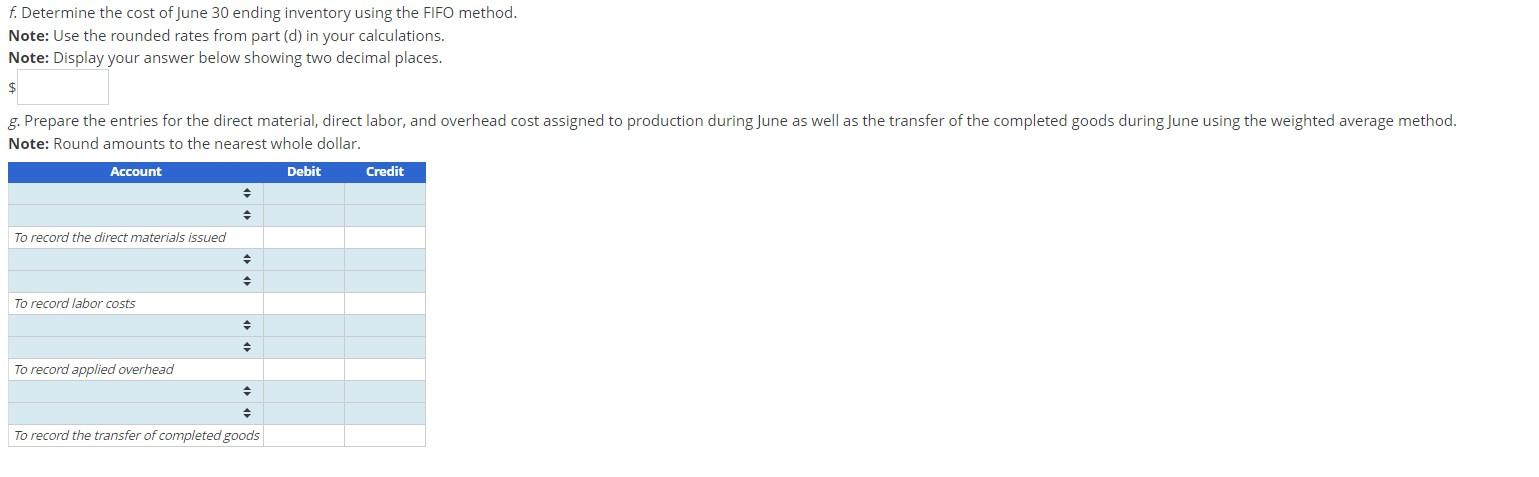

EUP; cost per EUP; cost assignment; WA & FIFO Found Sound mass-produces miniature speakers for personal sound systems. The following cost information is available for June: Beginning inventory direct material cost $5,786.48 Beginning inventory conversion cost Direct material issued during June Direct labor incurred during June Overhead applied during June 1,222.34 88,099.20 18,298.00 14,498.40 On June 1, the company had 1,000 units in process, which were 60 percent complete as to material and 30 percent complete as to conversion. Found Sound started 8,400 units into process during June and had 300 units still in process on June 30. The ending WIP units were 80 percent complete as to material and 70 percent complete as to conversion. a. Compute the unit costs for June under the weighted average method for direct material and for conversion. Note: Round your answers to two decimal places (i.e. round $4.355 to $4.36). Material cost per EUP $ Conversion cost per EUP $ b. Determine the cost transferred out for June using the weighted average method. Note: Use the rounded rates from part (a) in your calculations. Note: Display your answer below showing two decimal places. $ c. Determine the cost of June 30 ending inventory using the weighted average method. Note: Use the rounded rates from part (a) in your calculations. Note: Display your answer below showing two decimal places. $ d. Compute the unit costs for June under the FIFO method for direct material and for conversion. Note: Round your answers to two decimal places (i.e. round $4.355 to $4.36). Material cost per EUP $ Conversion cost per EUP $ e. Determine the total costs transferred to Finished Goods Inventory during June using the FIFO method. Note: Use the rounded rates from part (d) in your calculations. Note: Display your answer below showing two decimal places. $ G

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started