Answered step by step

Verified Expert Solution

Question

1 Approved Answer

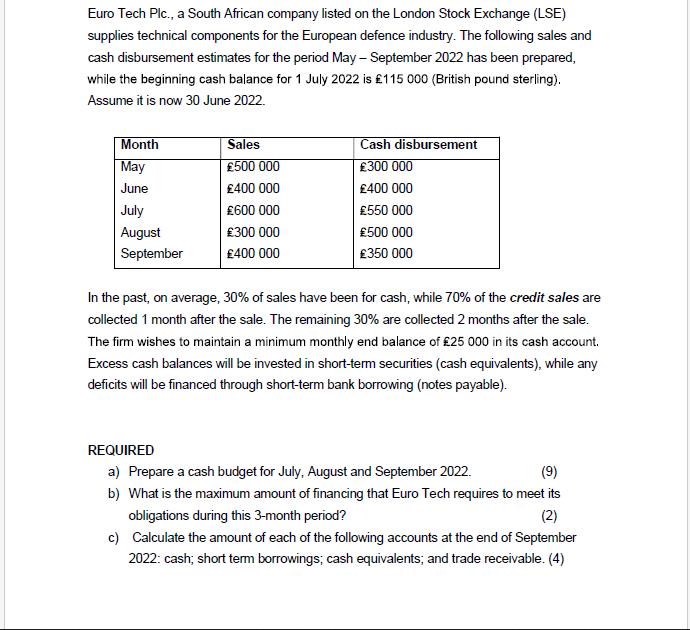

Euro Tech Plc., a South African company listed on the London Stock Exchange (LSE) supplies technical components for the European defence industry. The following

Euro Tech Plc., a South African company listed on the London Stock Exchange (LSE) supplies technical components for the European defence industry. The following sales and cash disbursement estimates for the period May - September 2022 has been prepared, while the beginning cash balance for 1 July 2022 is 115 000 (British pound sterling). Assume it is now 30 June 2022. Month Sales Cash disbursement May 500 000 300 000 June 400 000 400 000 July 600 000 550 000 August 300 000 500 000 September 400 000 350 000 In the past, on average, 30% of sales have been for cash, while 70% of the credit sales are collected 1 month after the sale. The remaining 30% are collected 2 months after the sale. The firm wishes to maintain a minimum monthly end balance of 25 000 in its cash account. Excess cash balances will be invested in short-term securities (cash equivalents), while any deficits will be financed through short-term bank borrowing (notes payable). REQUIRED a) Prepare a cash budget for July, August and September 2022. (9) b) What is the maximum amount of financing that Euro Tech requires to meet its obligations during this 3-month period? (2) c) Calculate the amount of each of the following accounts at the end of September 2022: cash; short term borrowings; cash equivalents; and trade receivable. (4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started