Answered step by step

Verified Expert Solution

Question

1 Approved Answer

eVade, an online retailer, fulfills its online orders by shipping its products directly to customers in all 50 states. eVade does not have a brick-and-mortar

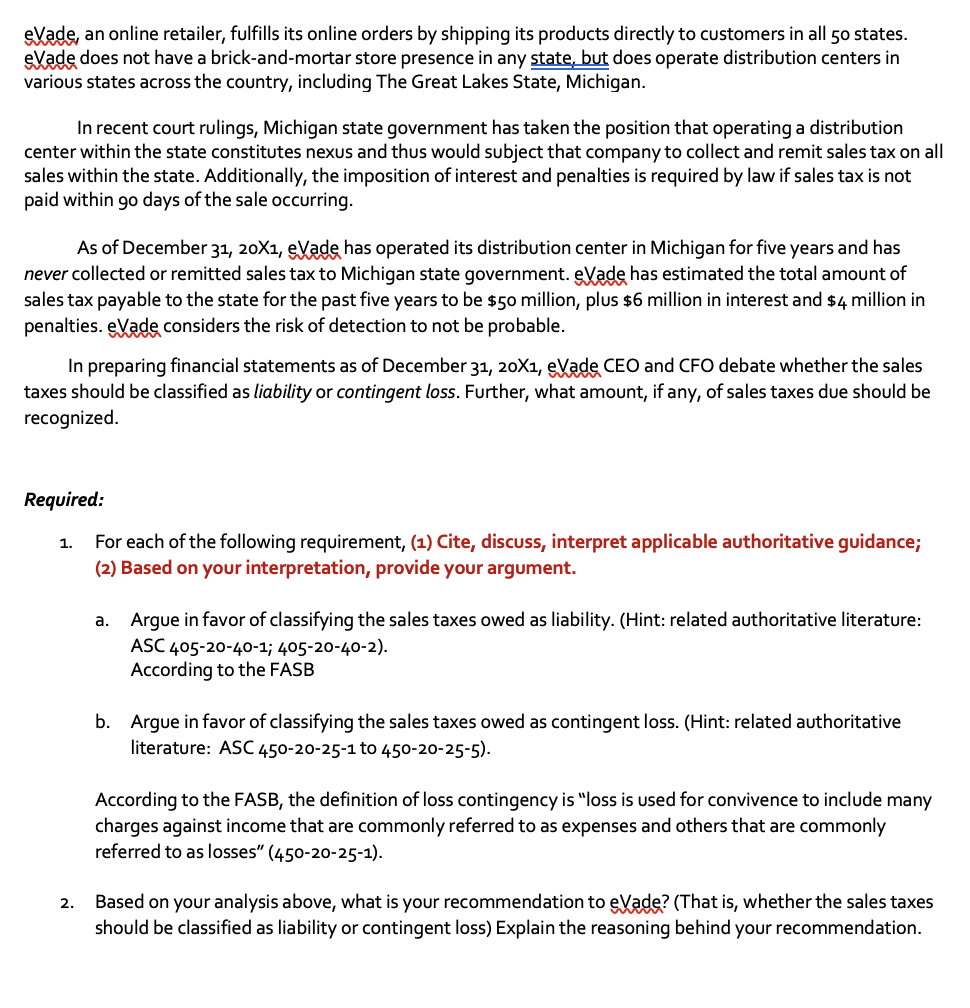

eVade, an online retailer, fulfills its online orders by shipping its products directly to customers in all 50 states. eVade does not have a brick-and-mortar store presence in any state, but does operate distribution centers in various states across the country, including The Great Lakes State, Michigan. In recent court rulings, Michigan state government has taken the position that operating a distribution center within the state constitutes nexus and thus would subject that company to collect and remit sales tax on all sales within the state. Additionally, the imposition of interest and penalties is required by law if sales tax is not paid within go days of the sale occurring. As of December 31,20X1, eVade has operated its distribution center in Michigan for five years and has never collected or remitted sales tax to Michigan state government. eVade has estimated the total amount of sales tax payable to the state for the past five years to be $50 million, plus $6 million in interest and $4million in penalties. eVade considers the risk of detection to not be probable. In preparing financial statements as of December 31,20X1, eVade CEO and CFO debate whether the sales taxes should be classified as liability or contingent loss. Further, what amount, if any, of sales taxes due should be recognized. Required: 1. For each of the following requirement, (1) Cite, discuss, interpret applicable authoritative guidance; (2) Based on your interpretation, provide your argument. a. Argue in favor of classifying the sales taxes owed as liability. (Hint: related authoritative literature: ASC 405-20-40-1; 405-20-40-2). According to the FASB b. Argue in favor of classifying the sales taxes owed as contingent loss. (Hint: related authoritative literature: ASC 450-20-25-1 to 450-20-25-5). According to the FASB, the definition of loss contingency is "loss is used for convivence to include many charges against income that are commonly referred to as expenses and others that are commonly referred to as losses" (45020251) 2. Based on your analysis above, what is your recommendation to eVade? (That is, whether the sales taxes should be classified as liability or contingent loss) Explain the reasoning behind your recommendation

eVade, an online retailer, fulfills its online orders by shipping its products directly to customers in all 50 states. eVade does not have a brick-and-mortar store presence in any state, but does operate distribution centers in various states across the country, including The Great Lakes State, Michigan. In recent court rulings, Michigan state government has taken the position that operating a distribution center within the state constitutes nexus and thus would subject that company to collect and remit sales tax on all sales within the state. Additionally, the imposition of interest and penalties is required by law if sales tax is not paid within go days of the sale occurring. As of December 31,20X1, eVade has operated its distribution center in Michigan for five years and has never collected or remitted sales tax to Michigan state government. eVade has estimated the total amount of sales tax payable to the state for the past five years to be $50 million, plus $6 million in interest and $4million in penalties. eVade considers the risk of detection to not be probable. In preparing financial statements as of December 31,20X1, eVade CEO and CFO debate whether the sales taxes should be classified as liability or contingent loss. Further, what amount, if any, of sales taxes due should be recognized. Required: 1. For each of the following requirement, (1) Cite, discuss, interpret applicable authoritative guidance; (2) Based on your interpretation, provide your argument. a. Argue in favor of classifying the sales taxes owed as liability. (Hint: related authoritative literature: ASC 405-20-40-1; 405-20-40-2). According to the FASB b. Argue in favor of classifying the sales taxes owed as contingent loss. (Hint: related authoritative literature: ASC 450-20-25-1 to 450-20-25-5). According to the FASB, the definition of loss contingency is "loss is used for convivence to include many charges against income that are commonly referred to as expenses and others that are commonly referred to as losses" (45020251) 2. Based on your analysis above, what is your recommendation to eVade? (That is, whether the sales taxes should be classified as liability or contingent loss) Explain the reasoning behind your recommendation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started