Answer the Following Initial Investment Balance after year 1 Balance after year 2 Balance after year 3 Balance after year 4 Account A $ 85.00

Answer the Following

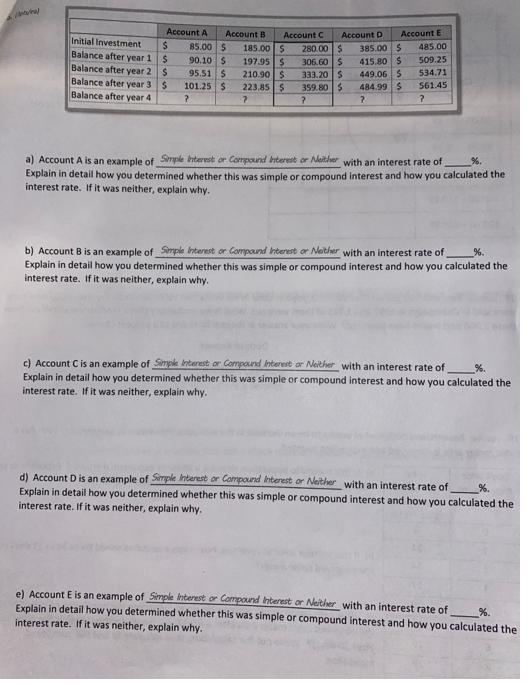

Initial Investment Balance after year 1 Balance after year 2 Balance after year 3 Balance after year 4 Account A $ 85.00 $ 90.10 $ 95.51 $ $ S 101.25 $ ? S Account B Account C 185.00 $ 197.95 $ 210.90 $ 223,85 $ ? Account D 280.00 $ 306.60 $ 333.20 $ 359.80 $ ? Account E 385.00 $ 415.80 $ 449.06 5 484.99 S ? 485.00 509.25 534.71 561.45 ? a) Account A is an example of Simple Interest or Compound Interest or Neither with an interest rate of %. Explain in detail how you determined whether this was simple or compound interest and how you calculated the interest rate. If it was neither, explain why. b) Account B is an example of Simple Interest or Compound Interest or Nother with an interest rate of %. Explain in detail how you determined whether this was simple or compound interest and how you calculated the interest rate. If it was neither, explain why. c) Account C is an example of Simple Interest or Compound Interest or Neither with an interest rate of %. Explain in detail how you determined whether this was simple or compound interest and how you calculated the interest rate. If it was neither, explain why. d) Account D is an example of Simple Interest or Compound Interest or Neither with an interest rate of Explain in detail how you determined whether this was simple or compound interest and how you calculated the interest rate. If it was neither, explain why. e) Account E is an example of Simple Interest or Compound Interest or Neither with an interest rate of %. Explain in detail how you determined whether this was simple or compound interest and how you calculated the interest rate. If it was neither, explain why.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

4 Simple interest is the sum paid for using for a fixed period borrowed money ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started