Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate different financing options that can be used for raising the required funds for this project. Determine the best financing method and justify your decision

Evaluate different financing options that can be used for raising the required funds for this project. Determine the best financing method and justify your decision with relevant data, research evidence and calculations. You also should calculate the appropriate discount rate for this project.

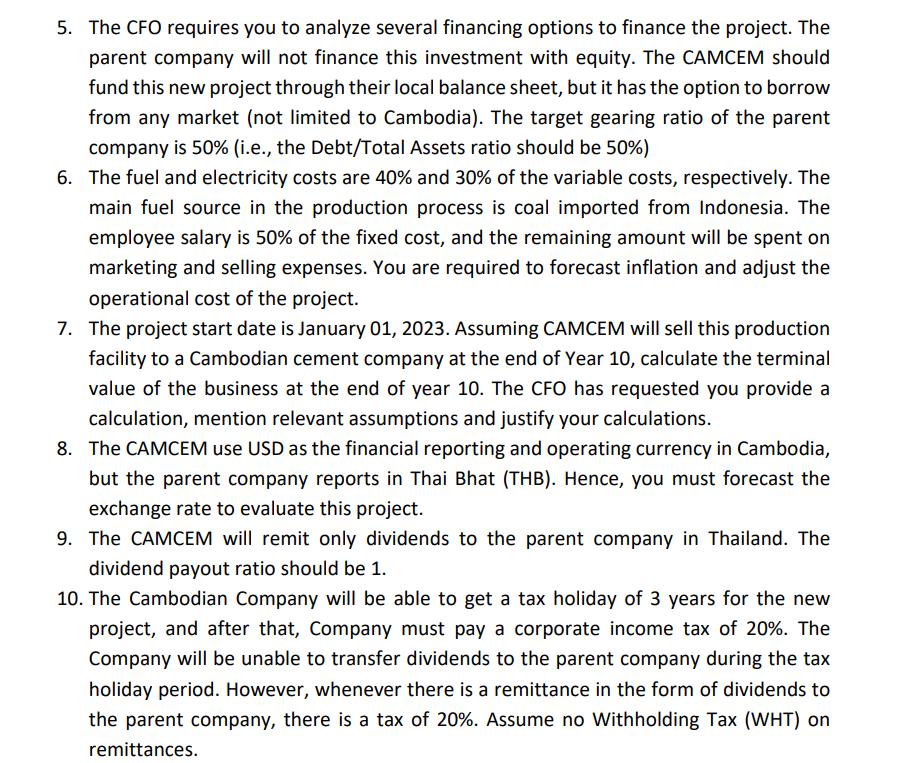

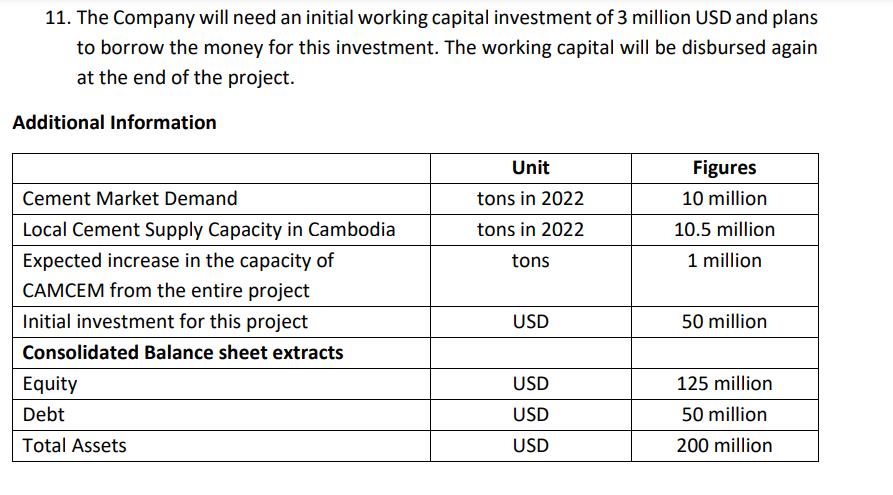

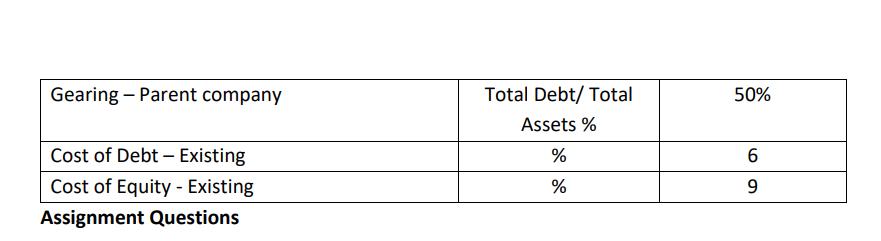

5. The CFO requires you to analyze several financing options to finance the project. The parent company will not finance this investment with equity. The CAMCEM should fund this new project through their local balance sheet, but it has the option to borrow from any market (not limited to Cambodia). The target gearing ratio of the parent company is 50% (i.e., the Debt/Total Assets ratio should be 50%) 6. The fuel and electricity costs are 40% and 30% of the variable costs, respectively. The main fuel source in the production process is coal imported from Indonesia. The employee salary is 50% of the fixed cost, and the remaining amount will be spent on marketing and selling expenses. You are required to forecast inflation and adjust the operational cost of the project. 7. The project start date is January 01, 2023. Assuming CAMCEM will sell this production facility to a Cambodian cement company at the end of Year 10, calculate the terminal value of the business at the end of year 10. The CFO has requested you provide a calculation, mention relevant assumptions and justify your calculations. 8. The CAMCEM use USD as the financial reporting and operating currency in Cambodia, but the parent company reports in Thai Bhat (THB). Hence, you must forecast the exchange rate to evaluate this project. 9. The CAMCEM will remit only dividends to the parent company in Thailand. The dividend payout ratio should be 1. 10. The Cambodian Company will be able to get a tax holiday of 3 years for the new project, and after that, Company must pay a corporate income tax of 20%. The Company will be unable to transfer dividends to the parent company during the tax holiday period. However, whenever there is a remittance in the form of dividends to the parent company, there is a tax of 20%. Assume no Withholding Tax (WHT) on remittances.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To address the question provided one must consider various financial aspects such as evaluating different financing options determining the best financing method and calculating the appropriate discou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started