Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods. Is the project acceptable? Briefly explain.

Evaluate the profitability of the project with the NPV, IRR, MIRR, simple payback period, and discounted payback period methods. Is the project acceptable? Briefly explain. Why is the NPV method superior to the other methods of capital budgeting? Briefly explain.

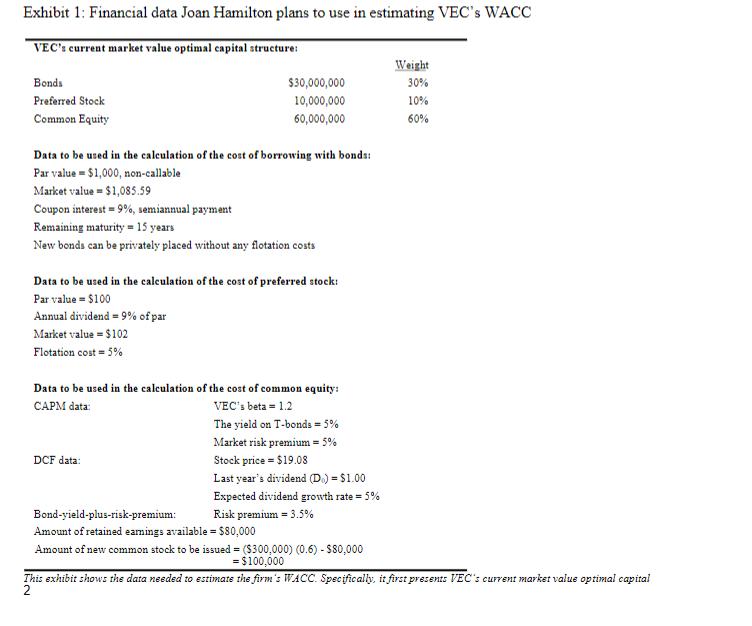

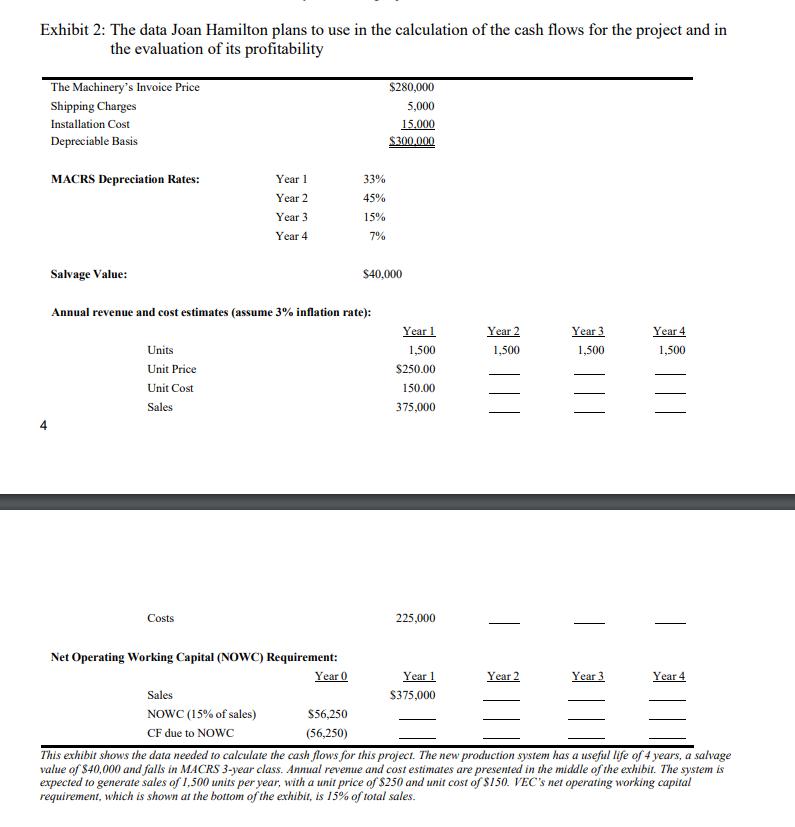

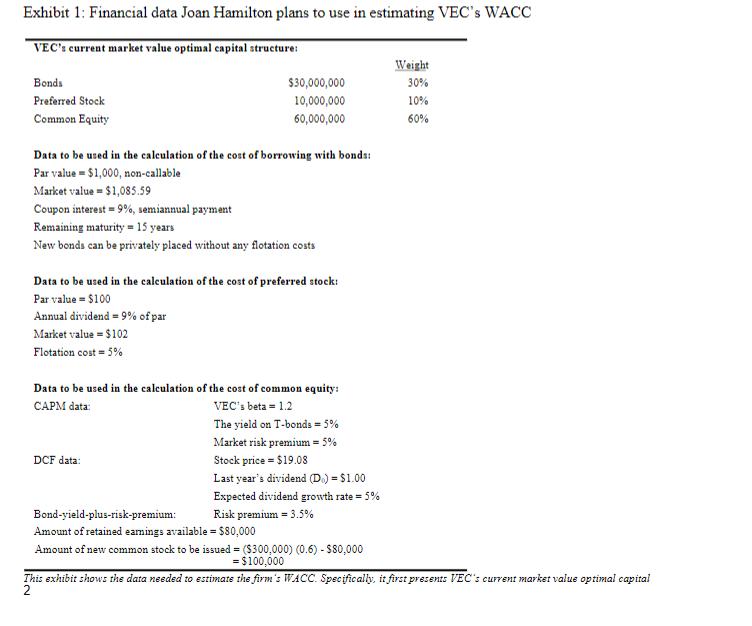

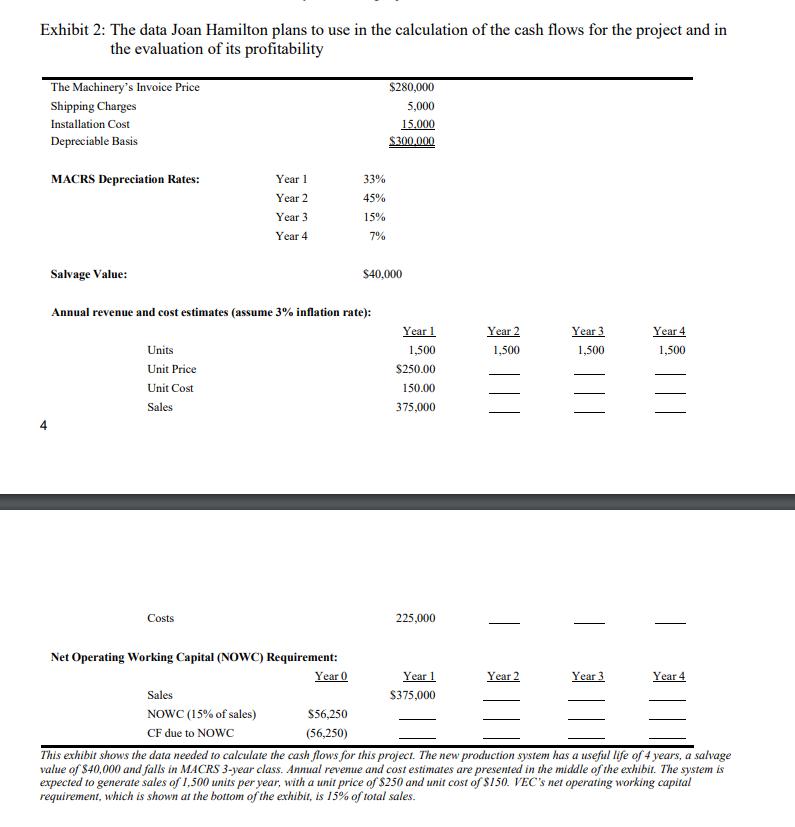

Exhibit 1: Financial data Joan Hamilton plans to use in estimating VEC's WACC VEC's current market value optimal capital structure: Bonds Preferred Stock Common Equity Data to be used in the calculation of the cost of borrowing with bonds: Par value = $1,000, non-callable Market value $1,085.59 Coupon interest = 9%, semiannual payment Remaining maturity = 15 years New bonds can be privately placed without any flotation costs $30,000,000 10,000,000 60,000,000 Data to be used in the calculation of the cost of preferred stock: Par value = $100 Annual dividend = 9% of par Market value = $102 Flotation cost = 5% Data to be used in the calculation of the cost of common equity: CAPM data: VEC's beta = 1.2 DCF data: The yield on T-bonds = 5% Market risk premium = 5% Stock price = $19.08 Last year's dividend (D) = $1.00 Expected dividend growth rate = 5% Risk premium = 3.5% Bond-yield-plus-risk-premium: Amount of retained earnings available = $80,000 Amount of new common stock to be issued = ($300,000) (0.6) - $80,000 = $100,000 Weight 30% 10% 60% This exhibit shows the data needed to estimate the firm's WACC. Specifically, it first presents VEC's current market value optimal capital 2

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Project Profitability Evaluation NPV To calculate the NPV we first need to determine the projects initial investment and the annual cash flows Initial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started