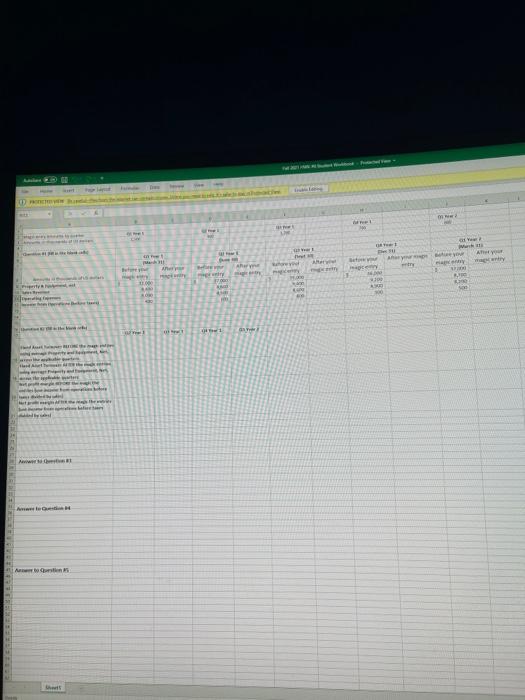

Evaluating an Ethical Dilemma: A Real-Life Example Assume you work as a staff member is a large accounting department for a stational public company Your job requires you to review documents relating to the company equipment purchases. Upon verifying that purchases more peoperly peoved, you prepare ournal entres to record the equipment purchases in the accounting system. Typically, you handle equipment purchases costung 550,000 or less This morning, you were contacted by the executive sustant to the coreffiscal officer (CFO). She says that the CFO has asked to see you mediately in his office. Although your bow's boas has attended a few mieties where the CFO wa peresent you have ant met the CFO during your three years with the company. You are anxious about the meeting Upon entering the CFO office, you are warmly preeted with a smile and friendly handbake The CFO compliments you on the great work that you have been doing for the company you soon feel like more comfortable particularly when e CFO mes that he has a special project for you. He states that he and the CEO have negotiated CFOs that for os restos that he did not want to dech will be procuing the payments through the operating dission of the company rather than the equipment ficant new mingement with the company's equippe uppliers, which require the company to make advance payments for equipment to be purchased in the future. The Coping group Given that the payment will be inde through the operating division, they will intually be canced as operating expenses of the company. He indicates that clearly the same med for property and quantold be recorded det, so he will be contacting you at the end of every quarter to make an adjusting joumal otry to capitalize the mounty inppropriately class operating expeek Heses you that a new account, called Prepaid Equipment, has been established for this purpoor. He quickly wrap up the meeting by telling you that point that you do not talk about the special project with you. You assume he does not want others to become aloos of your new portant responsibility A few weeks later the end of the first to you receive a Toscemail from the CFOstting. The adjustment that we discussed as S1.500.000 for this quarter" Before deleting the mape, you replay it to make sure you heard it right Your company prove 58 million in revenues and its cus-58 million in operating expenses every quarter, but you have made a malty for thut ch money. So just to be sure there and make you send to the CFO confirming the amount He phones you back immediately to abruptly inform you. There mistake that's the mob Feel embarrassed that you may have annoyed the CFO, you quietly make the adjusting journal entry For each of the remshee quarters in that you and for the first quartet (QI Year 3) in the following yes, you come to make these end of wartet adjustments. The mapemabet, the CFO ked to call it was $900,000 for the second quarter (Q2. You 13 S1,200,000 for the third quarter (Q3 Year 1). 5700.000 for the fourth quarter (04 Year 1). and 5600,000 for tre quarter of the following your CQI Yent 2) During this time, you have had sal meetings and lunches with the CFO where he provides you the mahe number, sometimes supported with nothing more than a Post it note with the number written on it. He frequently compliments you on your good work and promises that you will soon be in line for a bit promotion Despite the CFO's compliments and promise you are growing increasingly uncomfortable with the journal entries that you have been making. Typically, whenever a ordinary equipment purchase relves to advance payment the purchase is completed a few weeks later At that time, the amount of the advance is removed from an Equipment Deposit account and transferred to the appropriate equipment account. This has not been the case with the CEO's special propect. Instead, the Prepand Equipment account has continued to grow, now stand at over Strillion. There has been no discussion about how or when this balance will be redoved, and no depreciation has been recorded for it Just as you begin to reflect on the effect the adjustments have had on your company forests operating expenses, and operating income, you receive a call from the vice president for internal wodit. She needs to talk with you this afternoon about peculiar trend in the companys fedeniet utover and some uspicious journal entries that you've been making Required (dollars are in thousand 1. Complete the blank cells in the first table in the Excel document on D21. to determine what the company's accounting records look like after you made the journal entries as part of the CFO's special project. Note that when you made the journal entry, the Property and Equipment. Net account accumulated the mapie numbers each quarter For example, in Ol Yent 1 the entry to Property and Equipment. Not control in a balance of 532.000 plus $1.500 or 333 500 in Q2 Year I the amount would be $17,000 plus 1.300 from the prior guarter plus mother $900 for the current quarter of 539.400 and so on. Included in your workbook spreadsheet (3) are the dpostment amounts for each of the quarters so you can refer to the cells when doing your calculations. Also note the operating expenses will be reduced each period by the amount capitalized in that penod. For example, in Q1 Year 1 operating expenses would be reduced by the $1.500 and in Q2 Year operating expenses would be reduced by $900 2. Complete the second table in the Excel documento Lun both before and after the magic entry numbers. You will need to compute the fixed asset turnover ratio (rounded to three decimal places) for the periods coded 02-01 of you and QI of yent 2. Note you cannot answer this for Q1 of Year 1 because you don't have beginning Property and Equipment. Net. For the same quarters also calculate the net profit margin before and after the magic entry Discuss in 24 sentences in a text Despite the CFOs compliment and promote you we growing increasingly uncomfortable with the journal entries that you have been making Typically whenever as many equipment purchase involves and shake pema puchoses completed a few weet Art, armor the moned from an Equipment Deposit account and transferred to the appropriate con This has been the case with CFO's special project tead, the Prepaid Tiquipment account has continued to wstanding over 1 million. There has been no decision about how when this balance will be reduced, and no deprecationis benecorded for it Jouts you begin to reflect on the effect the best have had on your company's fixed its operating expenses, and operating income, you receve a call from the vice president for intermal modit She needs to talk with you this iternoon be ape the company's faced me tomover ratio and some picious journal entries that you've Required dollars are short 1 Complete the blank cells in the first table is the Excel documentos D21. 1o determine what the company's accounting records look like after you made the jumal entries al part of the CFOspecial project. Note that when you te jete dhe Property and .Net so accumulated the magic numbers each quartet For comple, in QI Year the entry to Property and Equipment, Nec restance of 532.000 por 1,500 533,500. In Q2 Year I the amount would be $27.000 plus si 300 from the poor quarter plus de 3.900 for create or 539,000 and so fadded a your workbookspreadsheet Crow are the ament amounts for each of the queso you can to host celle de your calea Also note the operating express will be reduced each period by the most capitalized in that period. For example 1 Year 1 operating expenses would be reduced by the 1500 2 Yenti operating expenses would be seduced by 5900 2. Complete the second blew the domain both before and atter the yumber You will need to compute the fixed asset turnover ratio crounded to the decimal places) for the periodi de 02-0% of year 1 and 1 of year 2 Note you can this for Q1 of Year I because you don't have beginning Property and Equipment. Net For the quarters also calculate the set profit margin before and after the mape try Discut in 2-4 cm text box what you notice about two 3 Before your return with the vice president for internal rodit, you think about the vanery of precoline conceding the special project for the CFO Die at least three things you think are peculiar circumstances and the special project 4. Your meeting with internal met was short and plant. The swe president indicated that she had duscussed her findes with the CFO before meeting with you. The CFO claimed that he too had noticed the peculiar brendshed over that he had a chance to invite further Hermal edit to get to the bottom of things, supting that perhaps some might be making productes lateral dit in identified you at the source of the journal entries and had been able to find my documents that approved or substansted the headed the meeting by advise you to find a food lawyer. Discus, in a few sentences, how you should have handed the son with the CFOs order to your 3. In the roalcase on which this one is based the internal auton poed over the son of whether they had covered from or whether they were jumping to the utong conclusion The Wall Street Journal mentioned that on October 30, 2002. by tint was clear that the findings would be devastating for the company They worried about whether their revelations would result in layoffs. Plus they feared that they would somehow end up being blamed for the mess Beyond the personal consequences mentioned in this quote discuss in a few times what other groups could be afected by the findings of the metals and how the findings would potentially affect them Epilogue: This case is based on a fraud committed at World.Com (now called Verizon). The case duam the stude of its members, the nature of the unsupported journal entries, and the CFO's role in carrying out the fraud from a report issued by World Com's bankruptcy exame Year in this case was actually 2001 and yet was 2007. This case excludes other fraudulent activities that contributed to WaddCom $11 billion fraud. The year old CEO was sentenced to 25 years in prison for planning and executing the biggest fraud in the history of American business. The CFO, who cooperated in the investigation of the CEO, was sentenced to five years in prison 1 The car is based on your book U B hu Ae how Ary Bu - in LE them he Thew www Aques SI