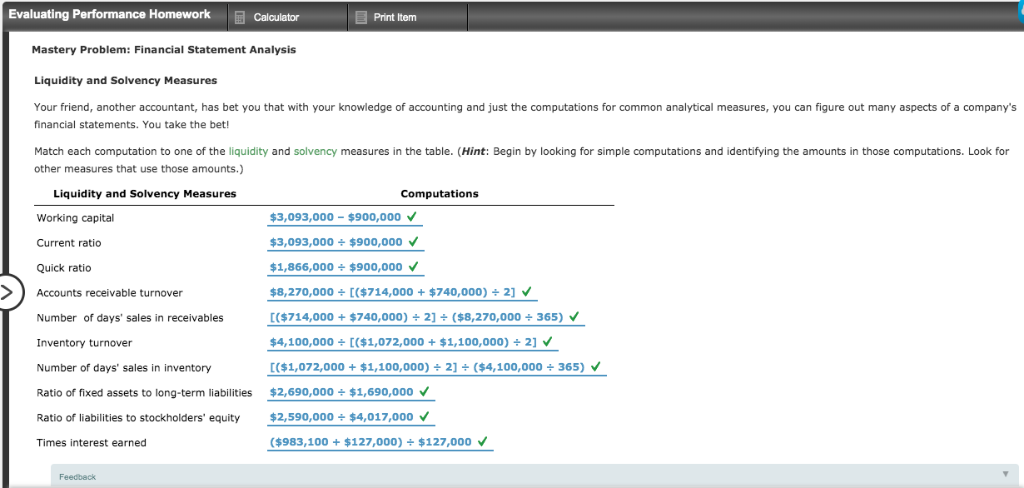

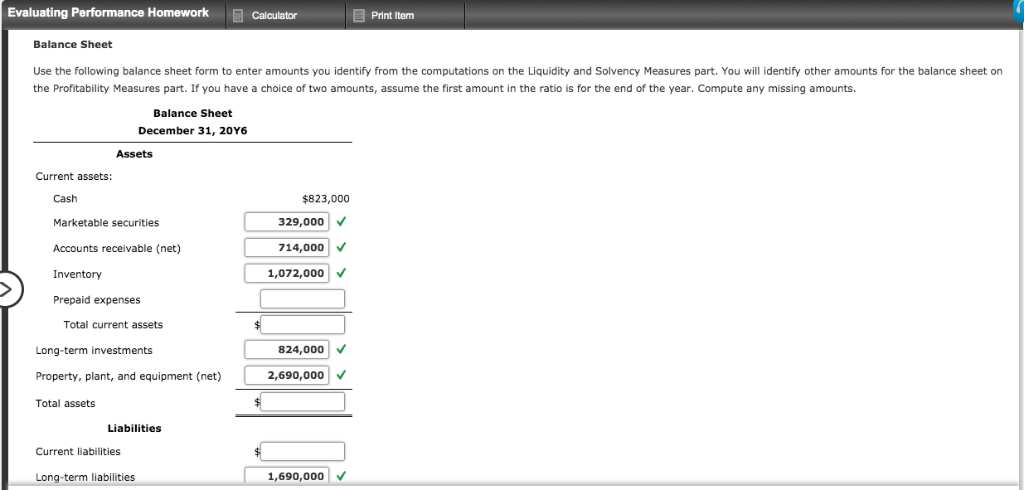

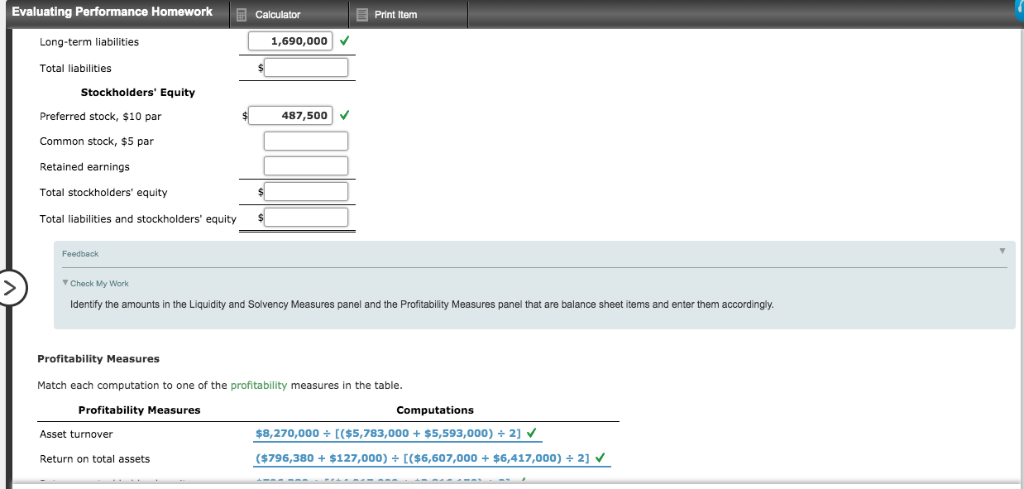

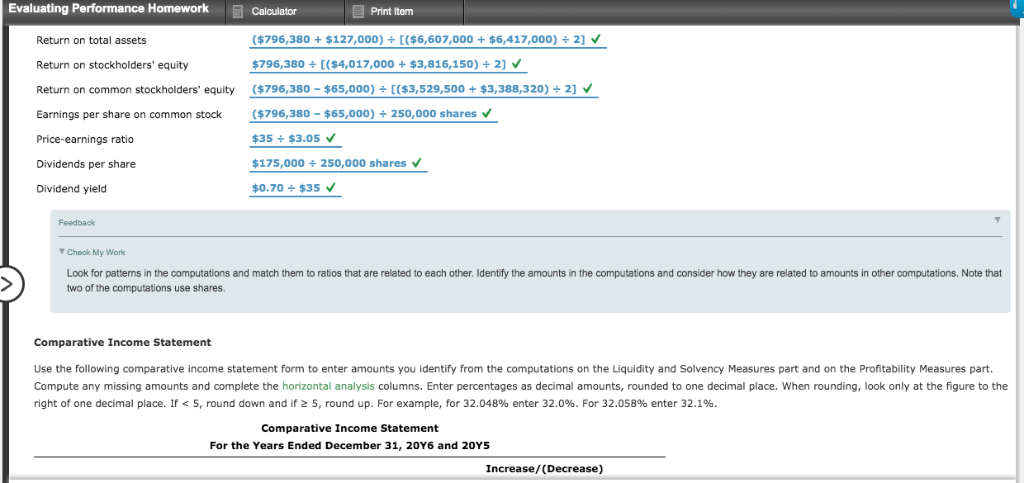

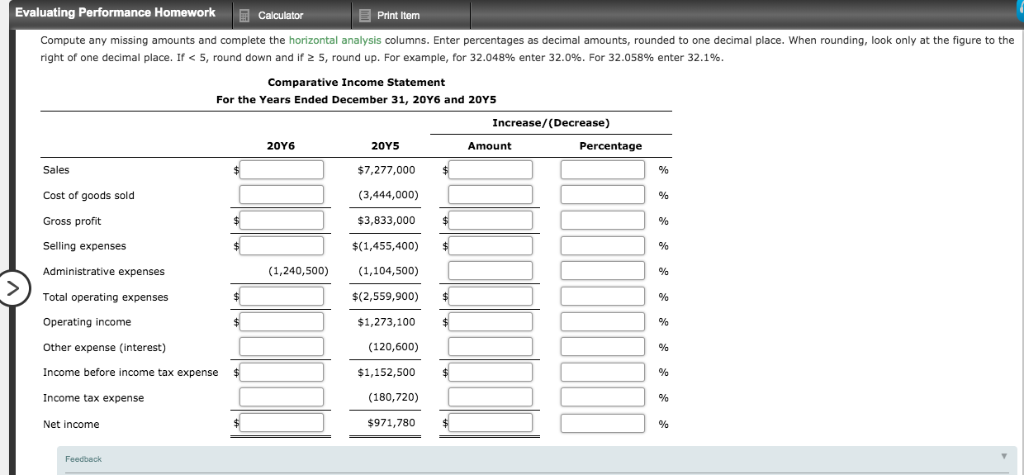

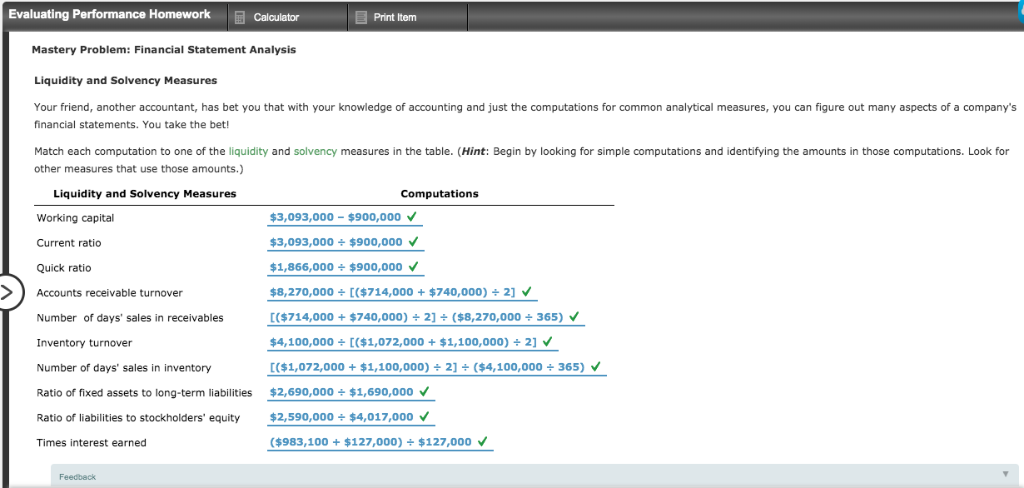

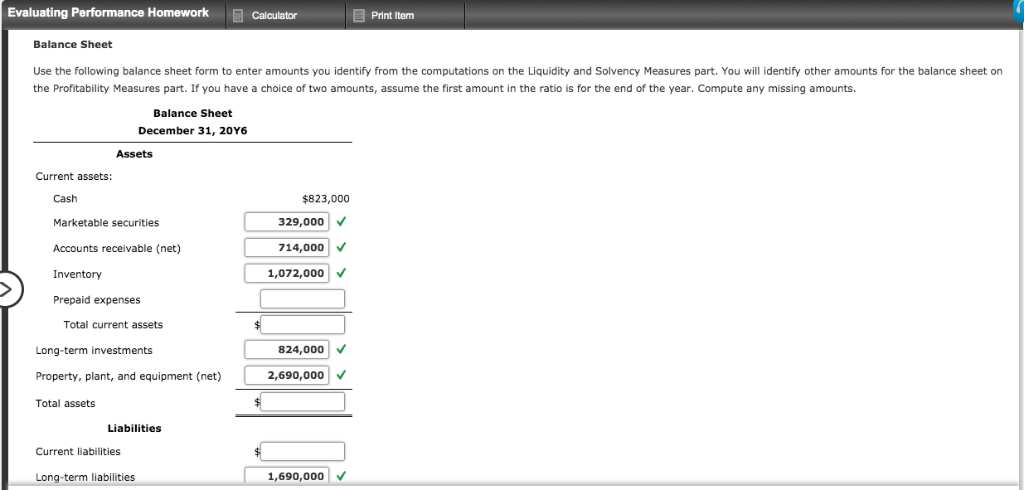

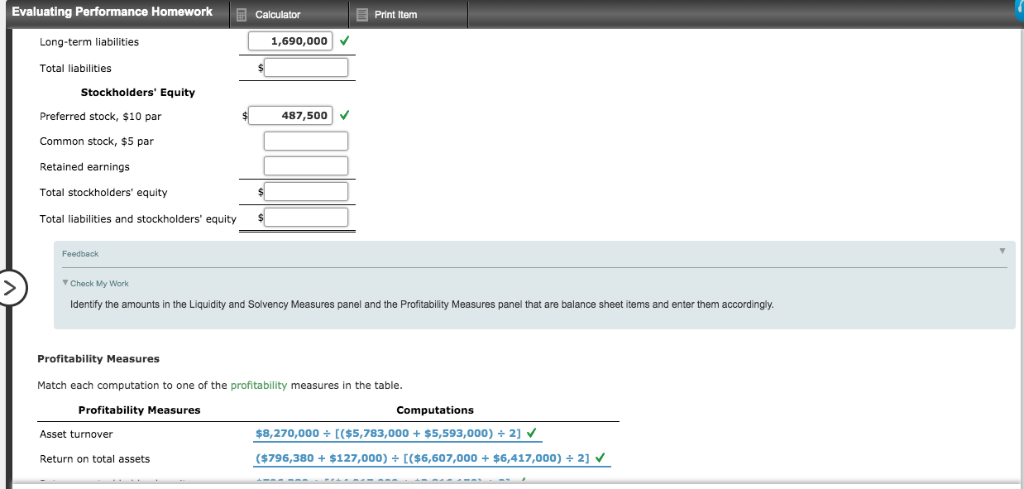

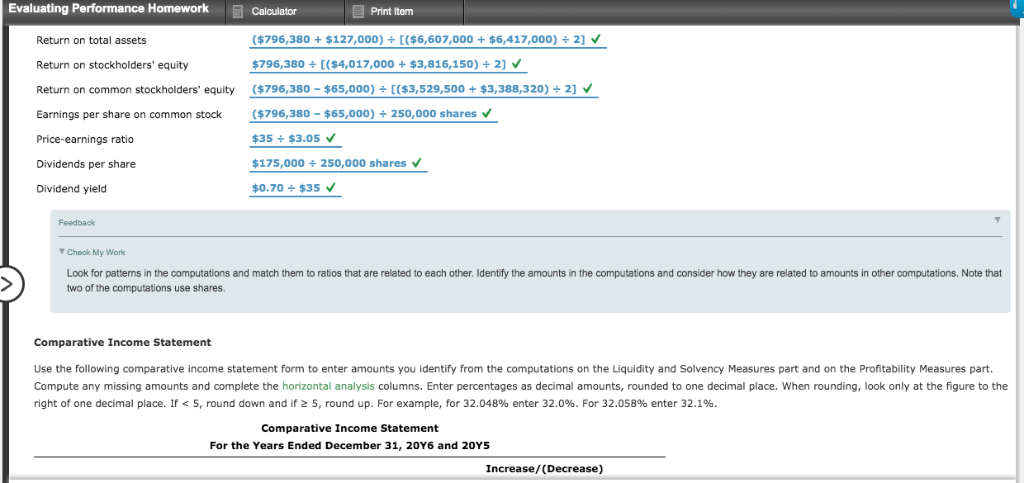

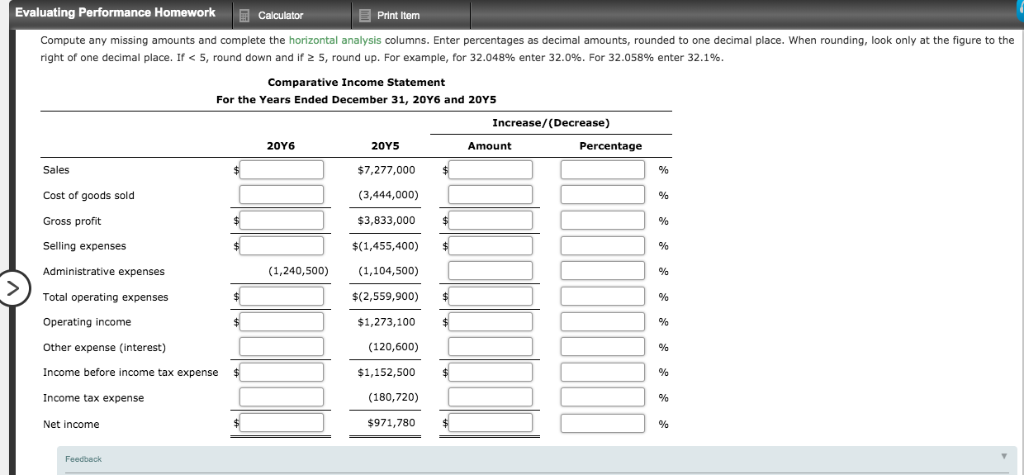

Evaluating Performance Homework Print ltenm Calculator Mastery Problem: Financial Statement Analysis Liquidity and Solvency Measures Your friend, another accountant, has bet you that with your knowledge of accounting and just the computations for common analytical measures, you can figure out many aspects of a company's financial statements. You take the bet! Match each computation to one of the liquidity and solvency measures in the table. (Hint: Begin by looking for simple computations and identifying the amounts in those computations. Look for other measures that use those amounts.) Liquidity and Solvency Measures Working capital Current ratio Quick ratio Accounts receivable turnover Number of days' sales in receivables Inventory turnover Number of days' sales in inventory Ratio of fixed assets to long-term liabilities $2,690,000 $1,690,000 Ratio of liabilities to stockholders' equity$2,590,000+$4,017,000 Times interest earned Computations $3,093,000-$900,000 $3,093,000 $900,000 $1,866,000$900,000 $8,270,000+($714,000+$740,000)2] V ($714,000+$740,000) 2]($8,270,000365) $4,100,000 ($1,072,000+$1,100,000)+2]V [($1,072,000+$1,100,000)21($4,100,000+365) ($983,100+$127,000)$127,000 Feedback Evaluating Performance Homework Print Iterm Balance Sheet Use the following balance sheet form to enter amounts you identify from the computations on the Liquidity and Solvency Measures part. You will identify other amounts for the balance sheet on the Profitability Measures part. If you have a choice of two amounts, assume the first amount in the ratio is for the end of the year. Compute any missing amounts. Balance Sheet December 31, 20Y6 Assets Current assets: Cash Marketable securities Accounts receivable (net) Inventory Prepaid expenses $823,000 329,000 714,000 1,072,000 Total current assets 824,000 Long-term investments Property, plant, and equipment (net) Total assets 2,690,000 Liabilities Current liabilities 1,690,000 Long-term liabilities Calculator Evaluating Performance Homework Print ltem 1,690,000 Long-term liabilities Total liabilities Stockholders' Equity 487,500 Preferred stock, $10 par Common stock, $5 par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Feedback Check My Work ldentify the amounts in the Liquidity and Solvency Measures panel and the Profitability Measures panel that are balance sheet tems and enter en according . Profitability Measures Match each computation to one of the profitability measures in the table Profitability Measures Computations $8,270,000($5,783,000+$5,593,000) 2] V Asset turnover ($796,380 + $127,000)+6,607,0+$6,417,000)+21 Return on total assets Evaluating Performance HomeworkCalculator Print Item ($796,380+$127,000)($6,607,000+$6,417,000) 2] Return on total assets $796,380[($4,017,000+$3,816,150)2] V Return on stockholders' equity Return on common stockholders' equity ($796,380- $60)3,529,500+3,388,320)21 Earnings per share on common stock Price-earnings ratio Dividends per share Dividend yield ($796,380-$65,000) 250,000 shares $35$3.05 $175,000250,000 shares $0.70 $35 Feedback Choak My Work Look for patterns in the computations and match them to ratios that are related to each other. Identify the amounts in the computations and consider how they are related to amounts in other computations. Note that two of the computations use shares. Comparative Income Statement Use the following comparative income statement form to enter amounts you identify from the computations on the Liquidity and Solvency Measures part and on the Profitability Measures part. Compute any missing amounts and complete the horizontal analysis columns. Enter percentages as decimal amounts, rounded to one decimal place. When rounding, look only at the figure to the right of one decimal place. If