Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Speedy Gonzales is a courier services company. The company needs to replace a few of its older vehicles to improve service delivery and reduce

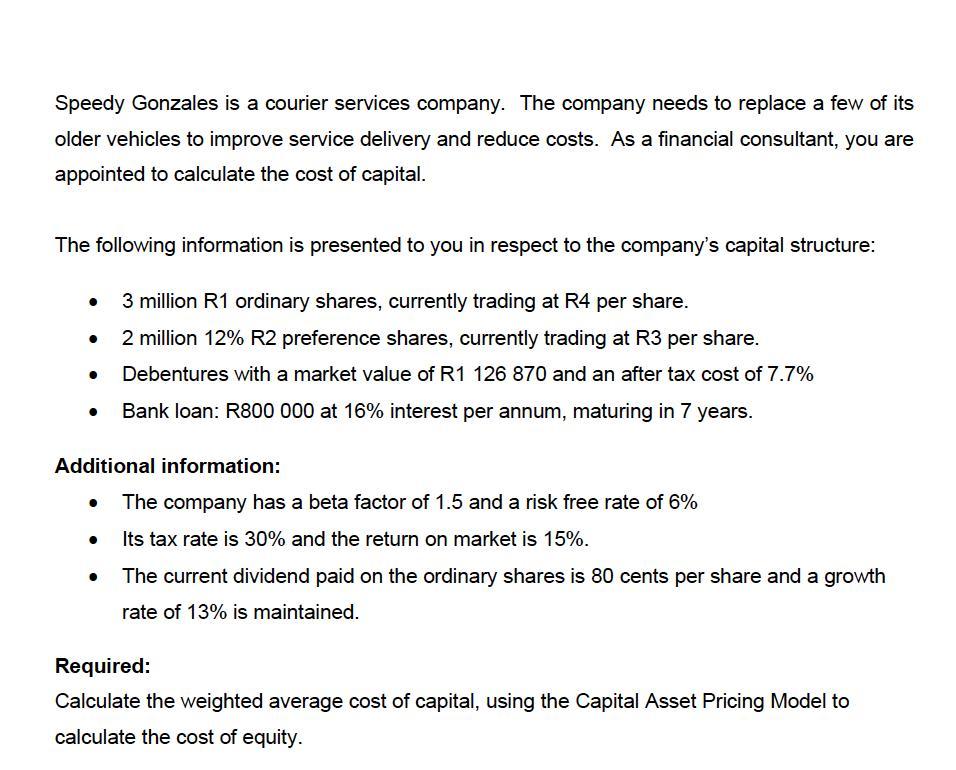

Speedy Gonzales is a courier services company. The company needs to replace a few of its older vehicles to improve service delivery and reduce costs. As a financial consultant, you are appointed to calculate the cost of capital. The following information is presented to you in respect to the company's capital structure: 3 million R1 ordinary shares, currently trading at R4 per share. 2 million 12% R2 preference shares, currently trading at R3 per share. Debentures with a market value of R1 126 870 and an after tax cost of 7.7% Bank loan: R800 000 at 16% interest per annum, maturing in 7 years. Additional information: The company has a beta factor of 1.5 and a risk free rate of 6% Its tax rate is 30% and the return on market is 15%. The current dividend paid on the ordinary shares is 80 cents per share and a growth rate of 13% is maintained. Required: Calculate the weighted average cost of capital, using the Capital Asset Pricing Model to calculate the cost of equity.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The weighted average cost of capital is 1159 Explanation The cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started