Answered step by step

Verified Expert Solution

Question

1 Approved Answer

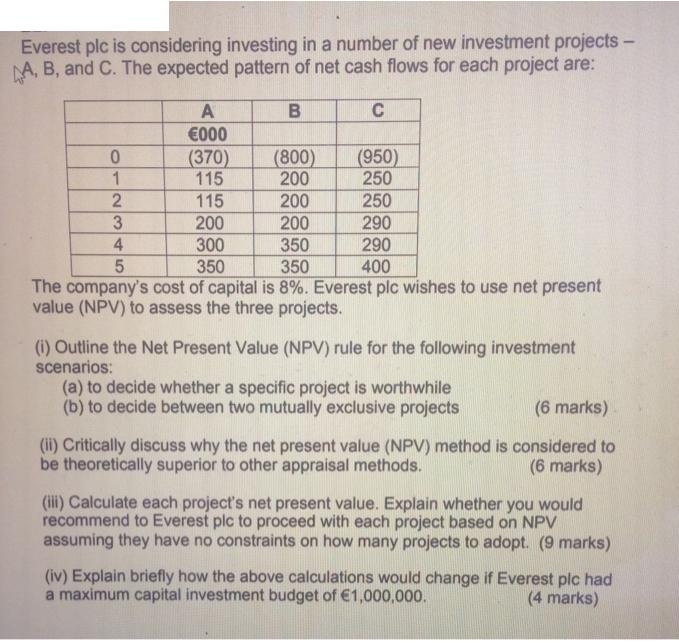

Everest plc is considering investing in a number of new investment projects - A, B, and C. The expected pattern of net cash flows

Everest plc is considering investing in a number of new investment projects - A, B, and C. The expected pattern of net cash flows for each project are: B 0 1 (800) (950) 200 250 200 250 200 290 350 290 350 400 The company's cost of capital is 8%. Everest plc wishes to use net present value (NPV) to assess the three projects. 2 3 A 000 (370) 115 115 200 4 5 C 300 350 (i) Outline the Net Present Value (NPV) rule for the following investment scenarios: (a) to decide whether a specific project is worthwhile (b) to decide between two mutually exclusive projects (6 marks) (ii) Critically discuss why the net present value (NPV) method is considered to be theoretically superior to other appraisal methods. (6 marks) (iii) Calculate each project's net present value. Explain whether you would recommend to Everest plc to proceed with each project based on NPV assuming they have no constraints on how many projects to adopt. (9 marks) (iv) Explain briefly how the above calculations would change if Everest plc had a maximum capital investment budget of 1,000,000. (4 marks)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Solution i a The Net Present Value NPV rule for deciding whether a specific project is worthwhile states that if the present value of the expected fut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started