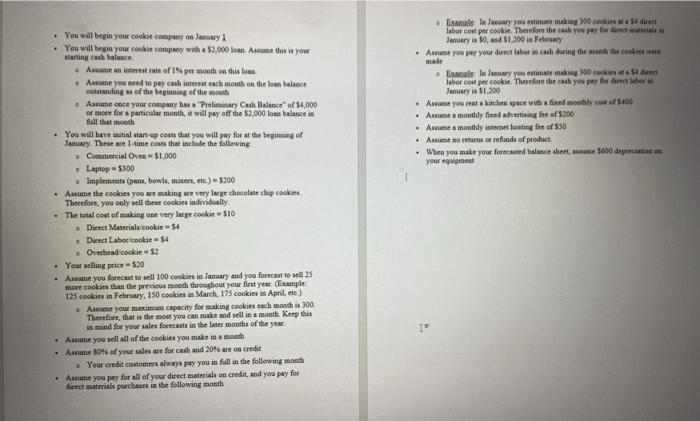

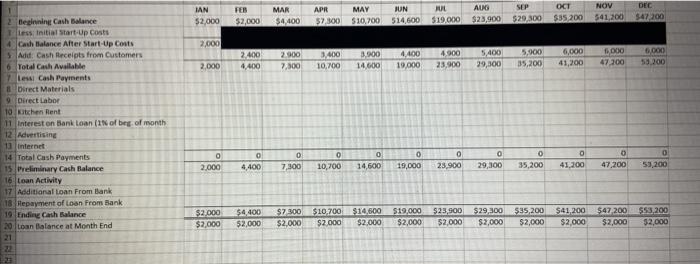

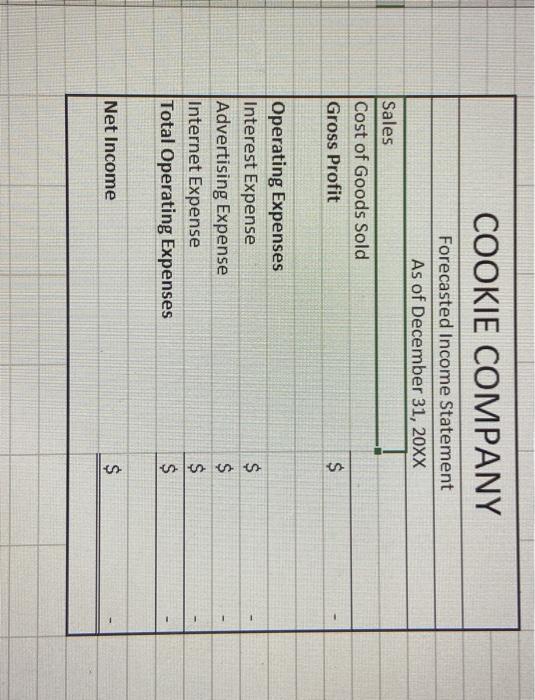

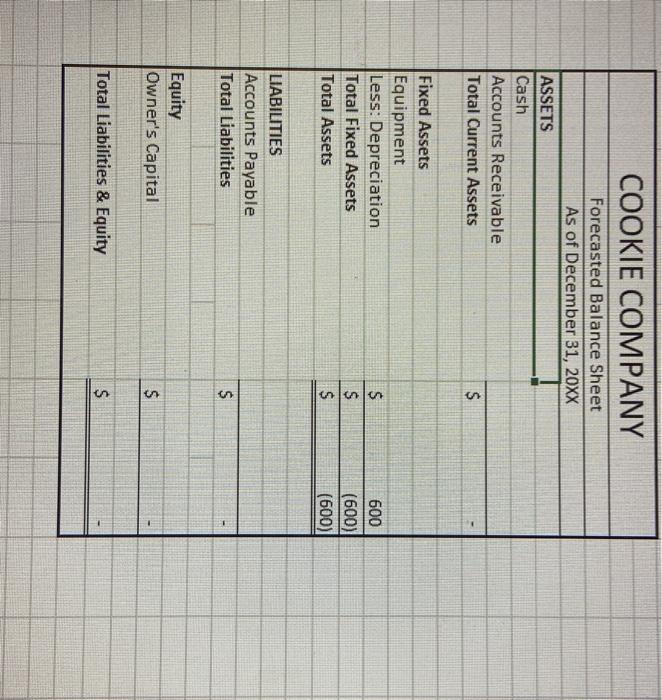

. Ex Is you estimate mg 100 cookies die labor cost per cookie. Therefore the cash you pay for details January 10, and $1.200 in February Aume you pay your direct laboris cash during the month that com made . Ex: In way you estimate making cookies dit labor couper cookie. Therefore the cash yo pey for dictatori Samaris 51,200 Anime you retkich space with a fixed athly cost of 5400 Ase & monthly feathering fee of $200 Asume a monthly hosting fee of $50 Arme no return or refunds of product . When you make your forecasted balance sheet 5800 derintis your em You will begin your cookie company onary . You will begin your cookie company with 52,000 loan. Are this is your starting cash balance Aame an interest rate of 19 per month on this loan Anime you need to pay cash interest each month on the loan balance outstanding of the beginning of the mouth Asume once your company has a Preliminary Cash Balance of 54.000 or more for a particular month, will pay off the $2.000 tonn balance in fall that mooth You will have initial start-up costs that you will pay for at the beginning of January. There are 1-time costs that include the following: . Commercial Oven $1,000 Laptop5300 Implementa (pana, bowis, moeste) $200 . Anume the cookies you are making are very large chocolate chip cookies Therefore, you only well these cookies individually The total cost of making one very large cookie - $10 Duet Materials cookie - 54 Duet Labor cookie = 54 Overhead cookies2 Yeur selling price - 520 Asume you forecast to sell 100 cookies in January and you forecast to sell 25 more cookies than the previous mouth throughout your first year (Example 125 cookies in February, 150 cookies in March, 175 cookies in April, etc) Anume your maximum capacity for making cookies each month is 300 Therefore, that is the most you can make and sell in a month. Keep this is mind for your sales forecasts in the Inter months of the year Asume you sell all of the cookies you make inah Asume 30% of your sales are forces and 20are on credit Your credit comers always pay you in full in the following mouth Anume you pay for all of your direct materials on credit, and you pay for deret material purchases in the following month IT IAN $2.000 FEB $2,000 MAR $4,400 APR MAY BUN 57.300 $10,700 514,600 RUL $19.000 AL $23,900 SEP $29 300 OCT $35 200 NOV 541,200 DEC $47200 2,000 2.400 4,400 2.900 7,300 3.400 10,700 3.000 14.600 4.400 19.000 4.000 23.900 5,400 99,300 5,900 35,200 6,000 41,200 1,000 47.300 6.000 50.200 2.000 2 Beginning Cash Balance less Initial start-Up Costs Cash Balance After Start-Up Costs 5 Adet: Cash Receipts from Customers 6 Total Cash Available Les Cash Payments Direct Materials Direct Labor 10 Kitchen Rent 11 Interest on Bank Loan (1 of beg of month 12 Advertising 11 Internet 14 Total Cash Payments 15 Preliminary Cash Balance 16 Loan Activity 17 Additional Loan From Bank 18 Repayment of loan from Bank 19 Ending Cash Balance 20 loan balance at Month End 21 0 O 0 o 2.000 0 4,400 0 7,300 0 10,700 0 14,600 o 29,300 0 35,200 0 47,200 O 53,200 19,000 23,900 41.200 $2.000 $2,000 $4.400 52,000 $7 300 $2,000 $10.700 $14,500 $2.000 $2,000 $19,000 $2,000 $23,900 $2.000 $29,300 $2,000 $35,200 $2,000 $41.200 $2,000 $47200 $2,000 $53,200 32,000 COOKIE COMPANY Forecasted Income Statement As of December 31, 20XX Sales Cost of Goods Sold Gross Profit $ Operating Expenses Interest Expense Advertising Expense Internet Expense Total Operating Expenses - $ $ $ $ - Net Income $