Answered step by step

Verified Expert Solution

Question

1 Approved Answer

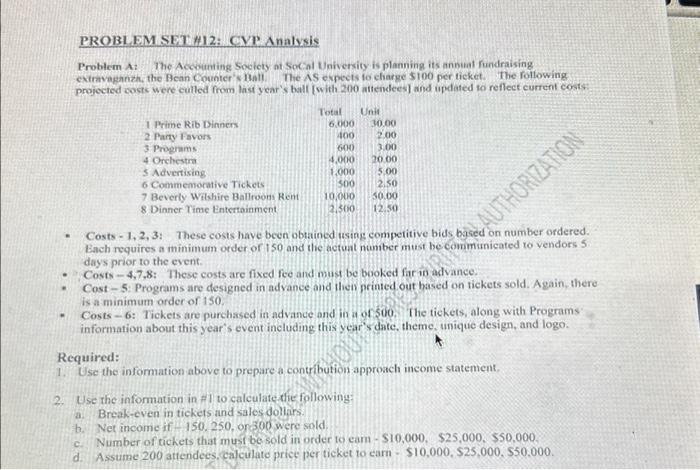

PROBLEM SET #12: CVE Analysis The Accounting Society at Socal University is planning its annual fundraising extravaganza, the Bean Counter's Balli The AS expects to

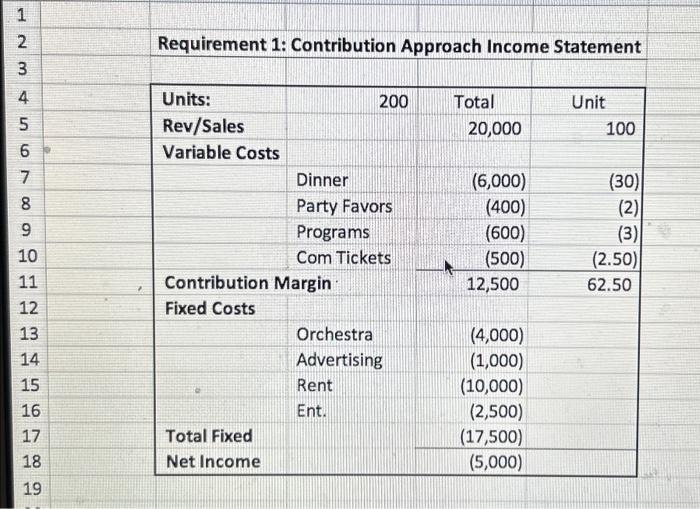

PROBLEM SET #12: CVE Analysis The Accounting Society at Socal University is planning its annual fundraising extravaganza, the Bean Counter's Balli The AS expects to charge $100 per ticket. The following projected costs were culled from last year's ball (with 200 attendees] and updated to reflect current costs. 1 Prime Rib Dinners 2 Party Favors 3 Programs 4 Orchestra 5 Advertising 6 Commemorative Tickets 7 Beverly Wilshire Ballroom Rent & Dinner Time Entertainment Total 6.000 600 1.000 500 10.000 2.500 Unit 30.00 2.00 3.00 20.00 12.50 AUTHORIZATION Costs 1, 2, 3: These costs have been obtained using competitive bids based on number ordered. Each requires a minimum order of 150 and the actual number must be communicated to vendors 5 days prior to the event. Costs -4,7,8: These costs are fixed fee and must be booked far in advance. Cost-5: Programs are designed in advance and then printed out based on tickets sold. Again, there is a minimum order of 150. Costs 6: Tickets are purchased in advance and in a of 500. The tickets, along with Programs information bout this year's event including this year's date, theme, unique design, and logo. Required: Use the information above to prepare a contribution approach income statement. Use the information in #1 to calculate the following: 2. Break-even in tickets and sales dollars. Net income if-150, 250, or 300 were sold. Number of tickets that must be sold in order to earn - $10,000, $25,000, $50,000. $10,000, $25,000, $50,000. d. Assume 200 attendees, calculate price per ticket to earn -

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started