Exam. Help now. Do 1-7 or more. Give me the answer. No need explanation. Fail or pass is on your hands. Thank you

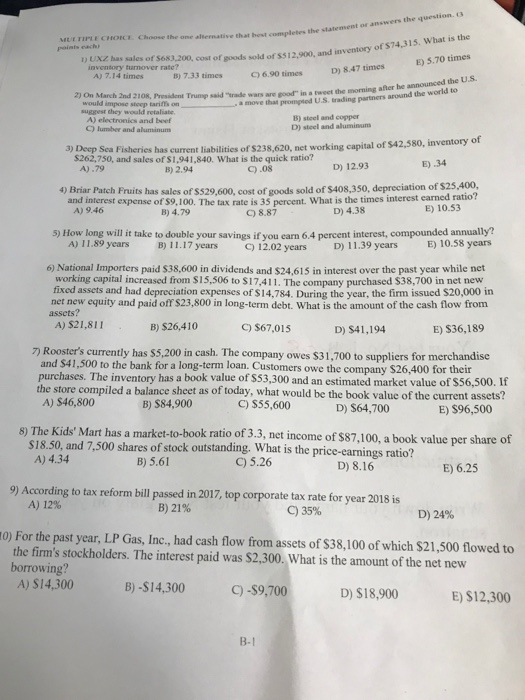

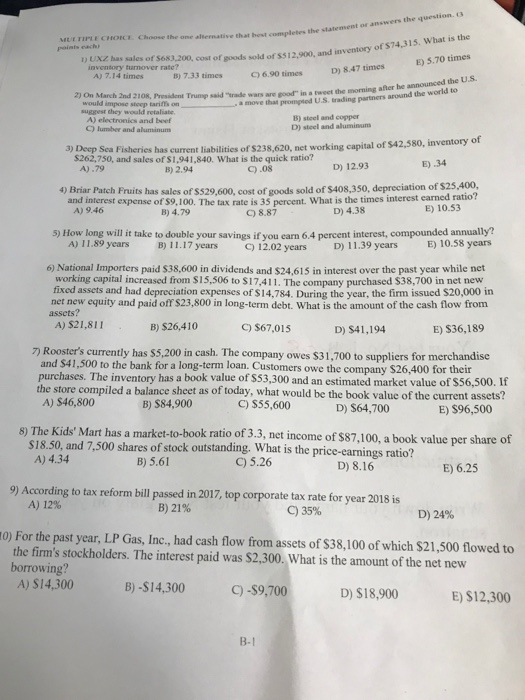

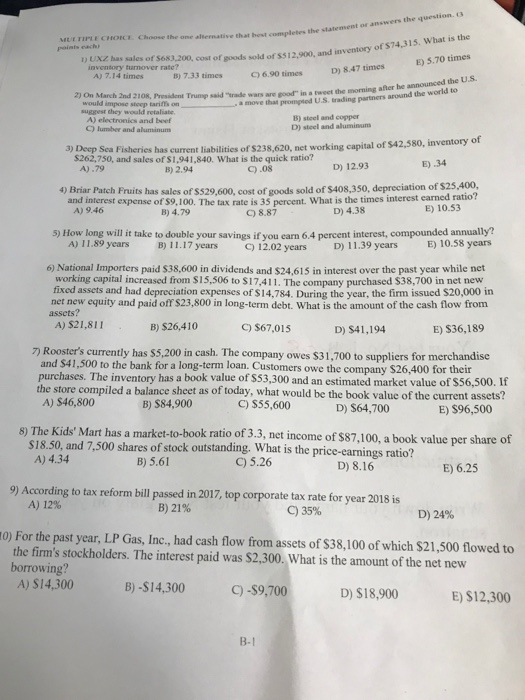

or answers the question. 3 that best completes the statement cost of soods sold of s$12,900, and inventory of $74,315. What is the E) 5.70 times MULTIPLE CHOC. Choose the one alternative D UXZ has sales of $683,200, inventory turnover rate? D) 8.47 times A) 7.14 times B) 7.33 times C) 6.90 times 2) On March 2nd 2108, President Trump said "trade wars are good" in a tweet the would impose steep tarima on- A) electronics and beef C) lumber and aluminum _a move that prem peed UStrading partners arund the world to suggest they would retaliate, B) steel and copper D) steel and aluminum of 3) Deep Sea Fisheries has current liabilitics of $238,620, net working capital of $42,580, inventory $262,750, and sales of $1,941,840. What is the quick ratio? E) 34 A) .79 B) 2.94 C).08 D) 12.93 4) Briar Patch Fruits has sales of $529,600, cost of goods sold of $408,350, depreciation of $25,400 tax rate is 35 percent. What is the times interest earned ratio? D) 4.38 and interest expense of $9,100. The A) 9.46 B) 4.79 E) 10.53 ) 8.87 5) How long will it take to double your savings if you earn 6.4 percent interest, compounded annually? .earsC12.02 years D)11.39 years E 10.58 years 6) National Importers paid $38,600 in dividends and $24,615 in interest over the past year while net working capital increased from S15,506 to $17,411. The company purchased S38,700 in net new net new equity and paid off $23,800 in long-term debt. What is the amount of the cash flow from C) $67,015 fixed assets and had depreciation expenses of $14,784. During the year, the firm issued $20,000 in assets? A) $21,81I B) $26,410 D) $41,194 E) S36,189 7) Rooster's currently has $5,200 in cash. The company owes $31,700 to suppliers for merchandise and $41,500 to the bank for a long-term loan. Customers owe the company $26,400 for their purchases. The inventory has a book value of $53,300 and an estimated market value of S56,500. If the store compiled a balance sheet as of today, what would be the book value of the current assets? A) S46,800 B) $84,900 C) S55,600 D) $64,700 E) S96,500 8) The Kids' Mart has a market-to-book ratio of 3.3, net income of $87,100, a book value per share of $18.50, and 7,500 shares of stock outstanding. What is the price-earnings ratio? A) 4.34 B) 5.61 C) 5.26 E) 6.25 9) According to tax reform bill passed in 2017, top corporate tax rate for year 2018 is A) 12% B) 21% C) 35% D) 24% For the past year, LP Gas, Inc., had cash flow from assets of S38, 100 of which S21.500 flowed to the firm's stockholders. The interest paid was $2,300. What is the amount of the net new borrowing? A) S14,300 B) -$14,300 C)-$9,700 D) $18,900 E) S12,300 B-1