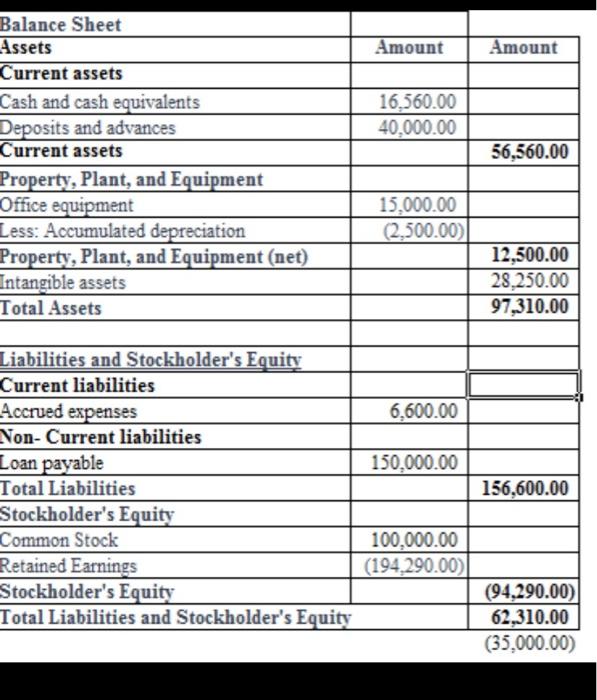

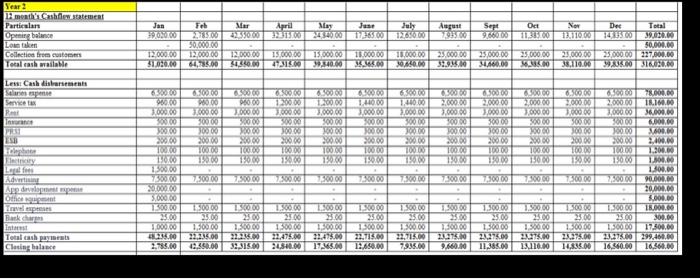

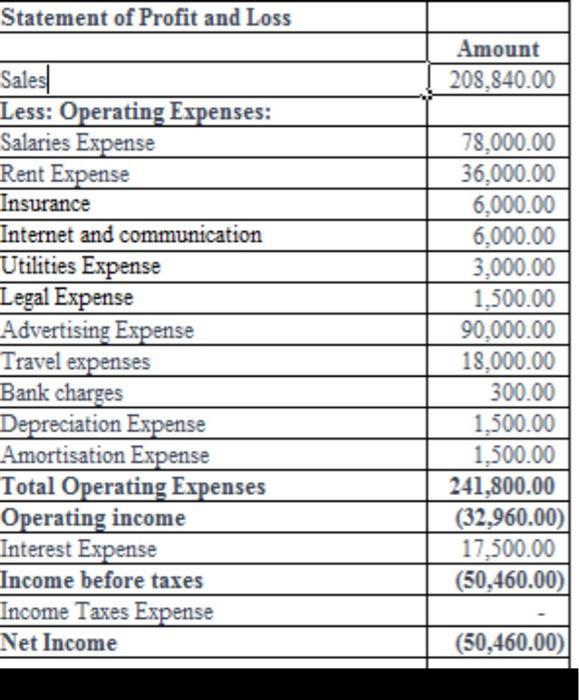

Examine these 2nd year accounts of a start up business. The business is an app that allows people to find accomodation with empty nesters.

Task:

Identify and explain all the possibile ratios. Eg:

Liquidity Ratios, Profitability Ratios, Leverage and Efficiency Ratios by examining the figuers in each of the accounts.

Final:

Conclude by discussing the status of the business.

\begin{tabular}{|l|c|c|} \hline Balance Sheet & & \\ \hline Assets & Amount & Amount \\ \hline Current assets & & \\ \hline Cash and cash equivalents & 16,560.00 & \\ \hline Deposits and advances & 40,000.00 & \\ \hline Current assets & & 56,560.00 \\ \hline Property, Plant, and Equipment & & \\ \hline Office equipment & 15,000.00 & \\ \hline Less: Accumulated depreciation & (2,500.00) & \\ \hline Property, Plant, and Equipment (net) & & 12,500.00 \\ \hline Intangible assets & & 28,250.00 \\ \hline Total Assets & & 97,310.00 \\ \hline Liabilities and Stockholder's Equity & & \\ \hline \hline Current liabilities & & \\ \hline Accrued expenses & & \\ \hline Non- Current liabilities & & \\ \hline Loan payable & 150,000.00 & \\ \hline Total Liabilities & & 156,600.00 \\ \hline Stockholder's Equity & & \\ \hline Rommon Stock & 100,000.00 & \\ \hline Stockholder's Equity & (194,290.00) & \\ \hline Total Liabilities and Stockholder's Equity & & (94,290.00) \\ \hline & & 62,310.00 \\ \hline \end{tabular} Statement of Profit and Loss Amount Sales| Less: Operating Expenses: Salaries Expense Rent Expense Insurance Internet and communication Utilities Expense Legal Expense Advertising Expense Travel expenses Bank charges Depreciation Expense Amortisation Expense Total Operating Expenses Operating income Interest Expense Income before taxes Income Taxes Expense Net Income (50,460.00) \begin{tabular}{|l|c|c|} \hline Balance Sheet & & \\ \hline Assets & Amount & Amount \\ \hline Current assets & & \\ \hline Cash and cash equivalents & 16,560.00 & \\ \hline Deposits and advances & 40,000.00 & \\ \hline Current assets & & 56,560.00 \\ \hline Property, Plant, and Equipment & & \\ \hline Office equipment & 15,000.00 & \\ \hline Less: Accumulated depreciation & (2,500.00) & \\ \hline Property, Plant, and Equipment (net) & & 12,500.00 \\ \hline Intangible assets & & 28,250.00 \\ \hline Total Assets & & 97,310.00 \\ \hline Liabilities and Stockholder's Equity & & \\ \hline \hline Current liabilities & & \\ \hline Accrued expenses & & \\ \hline Non- Current liabilities & & \\ \hline Loan payable & 150,000.00 & \\ \hline Total Liabilities & & 156,600.00 \\ \hline Stockholder's Equity & & \\ \hline Rommon Stock & 100,000.00 & \\ \hline Stockholder's Equity & (194,290.00) & \\ \hline Total Liabilities and Stockholder's Equity & & (94,290.00) \\ \hline & & 62,310.00 \\ \hline \end{tabular} Statement of Profit and Loss Amount Sales| Less: Operating Expenses: Salaries Expense Rent Expense Insurance Internet and communication Utilities Expense Legal Expense Advertising Expense Travel expenses Bank charges Depreciation Expense Amortisation Expense Total Operating Expenses Operating income Interest Expense Income before taxes Income Taxes Expense Net Income (50,460.00)