Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Example 1 -- Current Partnership Distributions In the following independent situations, determine the partner's recognized gain or loss, the basis of any distributed property, and

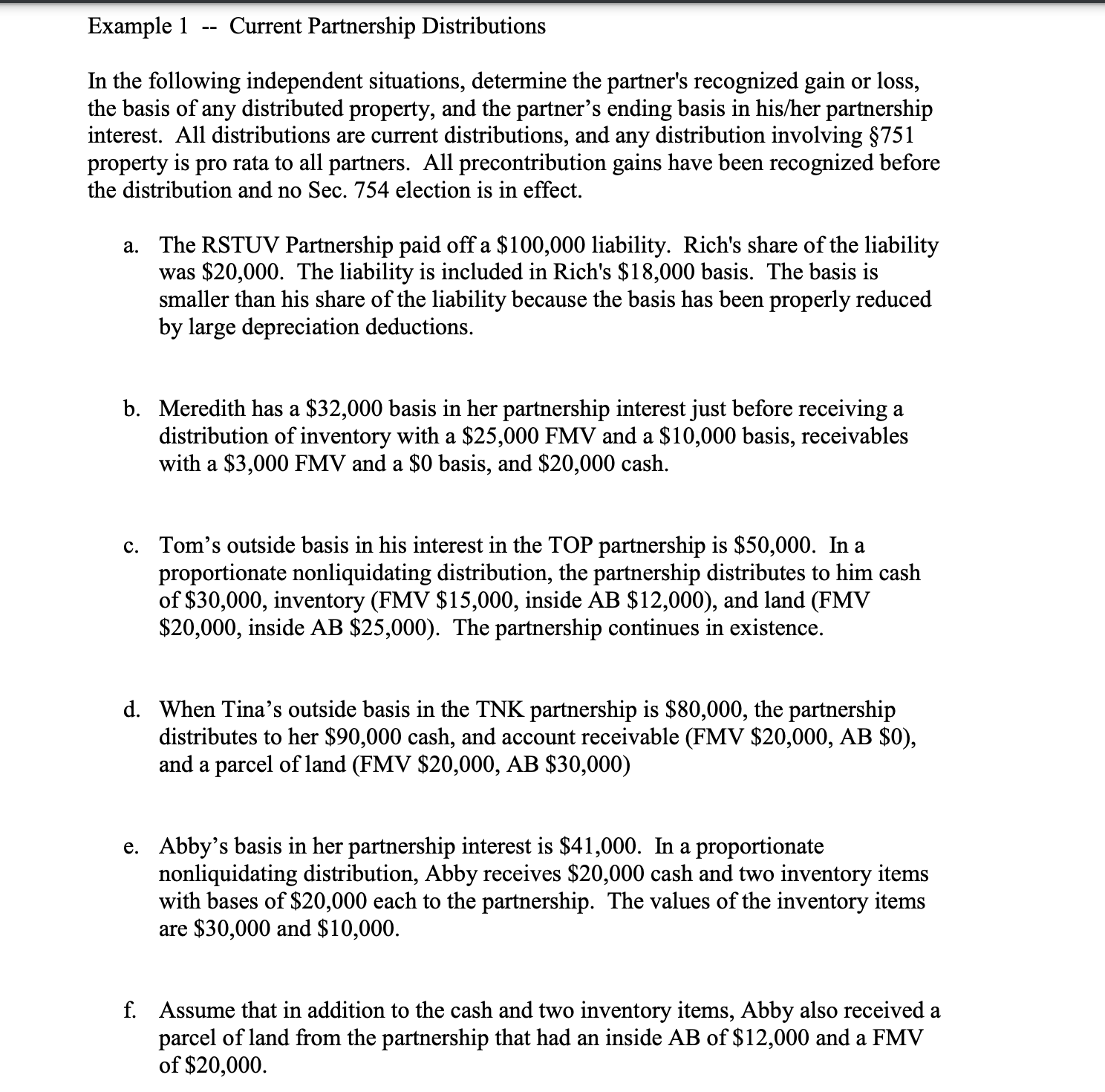

Example 1 -- Current Partnership Distributions In the following independent situations, determine the partner's recognized gain or loss, the basis of any distributed property, and the partner's ending basis in his/her partnership interest. All distributions are current distributions, and any distribution involving 751 property is pro rata to all partners. All precontribution gains have been recognized before the distribution and no Sec. 754 election is in effect. a. The RSTUV Partnership paid off a $100,000 liability. Rich's share of the liability was $20,000. The liability is included in Rich's $18,000 basis. The basis is smaller than his share of the liability because the basis has been properly reduced by large depreciation deductions. b. Meredith has a $32,000 basis in her partnership interest just before receiving a distribution of inventory with a $25,000FMV and a $10,000 basis, receivables with a $3,000FMV and a $0 basis, and $20,000 cash. c. Tom's outside basis in his interest in the TOP partnership is $50,000. In a proportionate nonliquidating distribution, the partnership distributes to him cash of $30,000, inventory (FMV $15,000, inside AB$12,000 ), and land (FMV $20,000, inside AB$25,000 ). The partnership continues in existence. d. When Tina's outside basis in the TNK partnership is $80,000, the partnership distributes to her $90,000 cash, and account receivable (FMV $20,000,AB$0 ), and a parcel of land (FMV $20,000,AB$30,000 ) e. Abby's basis in her partnership interest is $41,000. In a proportionate nonliquidating distribution, Abby receives $20,000 cash and two inventory items with bases of $20,000 each to the partnership. The values of the inventory items are $30,000 and $10,000. f. Assume that in addition to the cash and two inventory items, Abby also received a parcel of land from the partnership that had an inside AB of $12,000 and a FMV of $20,000

Example 1 -- Current Partnership Distributions In the following independent situations, determine the partner's recognized gain or loss, the basis of any distributed property, and the partner's ending basis in his/her partnership interest. All distributions are current distributions, and any distribution involving 751 property is pro rata to all partners. All precontribution gains have been recognized before the distribution and no Sec. 754 election is in effect. a. The RSTUV Partnership paid off a $100,000 liability. Rich's share of the liability was $20,000. The liability is included in Rich's $18,000 basis. The basis is smaller than his share of the liability because the basis has been properly reduced by large depreciation deductions. b. Meredith has a $32,000 basis in her partnership interest just before receiving a distribution of inventory with a $25,000FMV and a $10,000 basis, receivables with a $3,000FMV and a $0 basis, and $20,000 cash. c. Tom's outside basis in his interest in the TOP partnership is $50,000. In a proportionate nonliquidating distribution, the partnership distributes to him cash of $30,000, inventory (FMV $15,000, inside AB$12,000 ), and land (FMV $20,000, inside AB$25,000 ). The partnership continues in existence. d. When Tina's outside basis in the TNK partnership is $80,000, the partnership distributes to her $90,000 cash, and account receivable (FMV $20,000,AB$0 ), and a parcel of land (FMV $20,000,AB$30,000 ) e. Abby's basis in her partnership interest is $41,000. In a proportionate nonliquidating distribution, Abby receives $20,000 cash and two inventory items with bases of $20,000 each to the partnership. The values of the inventory items are $30,000 and $10,000. f. Assume that in addition to the cash and two inventory items, Abby also received a parcel of land from the partnership that had an inside AB of $12,000 and a FMV of $20,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started